SunTrust 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

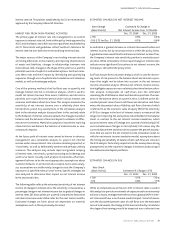

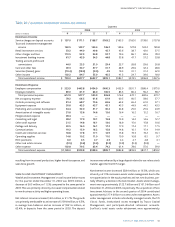

CORPORATE AND INVESTMENT BANKING

CIB’s total income before taxes for the year ended December 31,

2003 was $424.1 million, an increase of $168.0 million, or 65.6%,

compared to 2002. A significant decline in net charge-offs con-

tributed to the increase.

Net interest income increased $16.5 million, or 5.9%.Three Pillars

was consolidated in the third quarter of 2003.This consolidation

had an average loan impact of approximately $1.1 billion compared

to 2002. Growth in deposits and lease balances also contributed to

the increase.

Net charge-offs decreased $126.5 million, or 52.4%, as charge-offs

returned to levels experienced prior to the most recent economic

downturn.

Noninterest income increased $21.0 million, or 4.0%, which was

driven by an increase in fixed income sales, derivatives, and foreign

exchange fees.Also contributing to the overall increase in profitabil-

ity was a $4.0 million, or 1.3%, decline in noninterest expense.

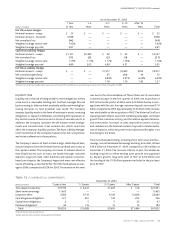

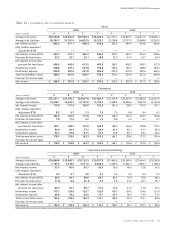

MORTGAGE

Mortgage’s total income before taxes for the year ended December

31, 2003 was $275.3 million, an increase of $103.4 million, or

60.2%, compared to 2002. Higher production and residential port-

folio earnings more than offset increases in mortgage servicing

rights amortization.

Net interest income increased $173.0 million, or 43.3%.The princi-

pal drivers of the higher net interest income were income from

mortgage loans held for sale and income from portfolio loans.

Mortgage loans held for sale increased $3.6 billion, or 83.0%.The

volume increase produced net interest income of $330.2 million, an

increase of $128.9 million, or 64.0%. Additionally, total loans, prin-

cipally residential mortgages, were up $1.1 billion, or 9.4%.

Combined with wider margins, net interest income on loans

increased $35.6 million, or 20.7%.

Net charge-offs increased $0.5 million, or 26.7%. Noninterest

income increased $4.3 million, or 295.2%.The noninterest income

increase was driven by higher production income which was only

partially offset by lower servicing income. Production income of

$151.0 million was up $57.6 million, or 61.6%, principally due to

fees from higher production, increased sales to the secondary mar-

ket and better secondary marketing performance. Mortgage loan

production increased 41.9% to $43.7 billion from $30.8 billion.

Servicing income declined $67.6 million, or 58.9%. The decline

in servicing income was primarily the result of higher mortgage

servicing rights amortization resulting from higher prepayments of

mortgage loans.

Noninterest expense increased $73.3 million, or 32.2%. This

increase was principally driven by higher volume related expense,

such as commissions and costs associated with processing and

closing loans.

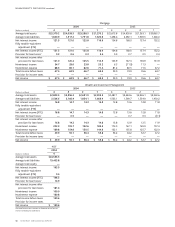

WEALTH AND INVESTMENT MANAGEMENT

Wealth and Investment Management’s total income before taxes

for the year ended December 31, 2003 was $200.2 million, a

decrease of $0.6 million, or 0.3%, compared to 2002.

Net interest income increased $4.9 million, or 10.4%.The growth

was primarily due to an increase of $410.6 million, or 25.8%, in

average loan balances.

Noninterest income increased $34.0 million, or 5.4%, which was

mainly driven by increased retail investment income.The increase in

retail investment income was primarily due to an increase in broker

production, an increase in the number of brokers, and increased rev-

enue generated from Alexander Key.Although average assets under

management increased 4.1% compared to 2002, trust and invest-

ment management income decreased slightly compared to 2002.

As of December 31, 2003, SunTrust’s total assets under advisement

were approximately $180.9 billion, which included $101.0 billion in

assets under management, $21.8 billion in non-managed corporate

trust assets, $35.9 billion in non-managed trust assets, and $22.2

billion in retail brokerage assets.Assets under management include

individually managed assets, the STI Classic Funds, institutional

assets managed by Trusco Capital Management, and participant-

directed retirement accounts.

Noninterest expense increased $38.7 million, or 8.1%. Increased

commissions and incentives from new business activity in SunTrust

Securities and Alexander Key were the main drivers, with increases

in employee benefits expense also contributing.

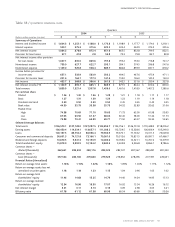

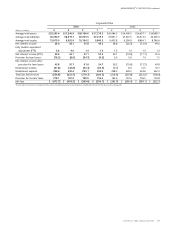

CORPORATE/OTHER

Corporate/Other’s loss before taxes for the year ended December

31, 2003 was a loss of $841.3 million, compared to a loss of $407.4

million for 2002.

Net interest income declined $290.3 million, or 86.5%, in 2003

compared to the prior year. The major reasons for the decline were

lower interest rates compressing the margin earned on liabilities

and capital and lower margin earned on the investment portfolio.

The 2003 provision for loan losses was $38.2 million, or 89.5%, less

than the 2002 provision.The reduction was due to improved credit

quality and the difference between the Company’s consolidated

provision and net charge-offs.

Noninterest income declined $128.0 million, or 79.6%, in 2003

compared to the prior year.The decline was a result of a reduction in

securities gains and higher transfers to the Commercial line of busi-

ness for tax credits generated by Affordable Housing.