SunTrust 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 43

LIQUIDITY RISK

Liquidity risk is the risk of being unable to meet obligations as they

come due at a reasonable funding cost. SunTrust manages this risk

by structuring its balance sheet prudently and by maintaining bor-

rowing resources to fund potential cash needs. The Company

assesses liquidity needs in the form of increases in assets, maturing

obligations, or deposit withdrawals, considering both operations in

the normal course of business and in times of unusual events. In

addition, the Company considers the off-balance sheet arrange-

ments and commitments it has entered into, which could also

affect the Company’s liquidity position.The Asset Liability Manage-

ment Committee of the Company measures this risk, sets policies,

and reviews adherence to those policies.

The Company’s sources of funds include a large, stable deposit base,

secured advances from the Federal Home Loan Bank and access to

the capital markets.The Company structures its balance sheet so

that illiquid assets, such as loans, are funded through customer

deposits, long-term debt, other liabilities and capital. Customer-

based core deposits, the Company’s largest and most cost-effective

source of funding, accounted for 66.1% of the funding base on aver-

age for 2004, compared to 65.2% for 2003.The increase in this ratio

was due to the deconsolidation of Three Pillars and its associated

commercial paper in the first quarter of 2004, the acquisition of

NCF in the fourth quarter of 2004, and a $3.2 billion decline in aver-

age loans held for sale. Average customer deposits increased $7.6

billion compared to 2003.Approximately $3.5 billion of the increase

was attributable to the acquisition of NCF. The historical SunTrust

deposit growth reflects successful marketing campaigns, continued

growth from customer activity, and the relative appeal of alterna-

tive investments. Increases in rates, improved economic activity

and confidence in the financial markets may lead to disintermedia-

tion of deposits, which may need to be replaced with higher cost

borrowings in the future.

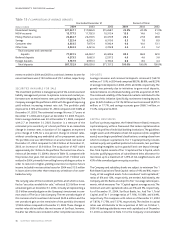

Total net wholesale funding, including short-term unsecured bor-

rowings, secured wholesale borrowings and long-term debt, totaled

$43.6 billion at December 31, 2004, compared to $39.0 billion at

December 31, 2003. The increase reflects, in part, the wholesale

funding required to offset earning asset growth not supported

by deposit growth, long-term debt of NCF of $2.8 billion and

the funding of the $1.8 billion payment included in the purchase

price for NCF.

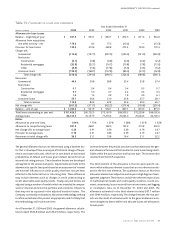

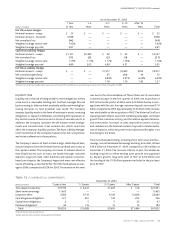

As of December 31, 2003

1 Year 1–2 2–5 5–10 After 10

(Dollars in millions) or Less Years Years Years Years Total

Fair Value Asset Hedges

Notional amount – swaps $ 25 $ — $ — $ — $ — $ 25

Notional amount – forwards13,938 — — — — 3,938

Net unrealized loss (44) — — — — (44)

Weighted average receive rate11.92% — — — — 1.92%

Weighted average pay rate 4.97 — — — — 4.97

Cash Flow Liability Hedges

Notional amount – swaps $1,101 $2,389 $ 22 $ 45 $ — $3,557

Net unrealized loss (15) (6) (2) (4) — (27)

Weighted average receive rate11.15% 1.17% 1.17% 1.16% — 1.16%

Weighted average pay rate14.89 2.02 4.38 4.51 — 2.95

Fair Value Liability Hedges

Notional amount – swaps $ — $ — $1,317 $3,650 $950 $5,917

Net unrealized gain (loss) — — 65 (34) 44 75

Weighted average receive rate1— — 4.84% 3.91% 6.23% 4.49%

Weighted average pay rate1— — 1.18 1.16 1.42 1.21

1All interest rate swaps have variable pay or receive rates with resets of three months or less, and are the pay or receive rates in effect at December 31, 2003.

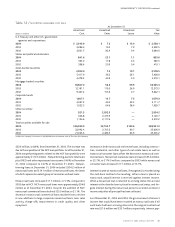

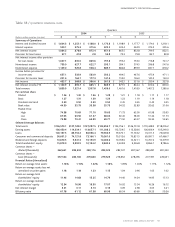

Table 16 / CONTRACTUAL COMMITMENTS

December 31, 2004

(Dollars in millions) 1 year or less 1–3 years 3–5 years After 5 years Total

Time deposit maturities1$19,199 $ 6,247 $1,429 $ 516 $27,391

Short-term borrowings111,405 — — — 11,405

Long-term debt13,583 3,719 4,109 10,669 22,080

Operating lease obligations 121 201 132 252 706

Capital lease obligations 2 5 5 35 47

Purchase obligations240 116 15 12 183

Total $34,350 $10,288 $5,690 $11,484 $61,812

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.