SunTrust 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

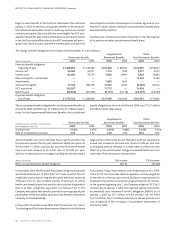

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 83

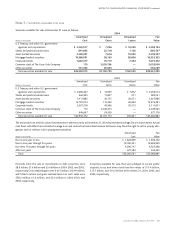

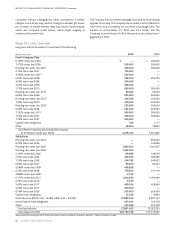

Note 9 / INTANGIBLE ASSETS

Under the provisions of SFAS No. 142, goodwill is tested for impair-

ment on an annual basis and as events or circumstances arise that

would more likely than not reduce fair value of a reporting unit

below its carrying amount. The Company completed its annual

review as of September 30, 2004, and determined there was no

impairment of goodwill as of this date.The changes in the carrying

amount of goodwill by reportable segment for the twelve months

ended December 31, 2004 and 2003 are as follows:

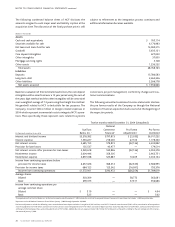

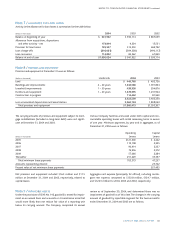

Note 7 / ALLOWANCE FOR LOAN LOSSES

Activity in the allowance for loan losses is summarized in the table below:

(Dollars in thousands) 2004 2003 2002

Balance at beginning of year $ 941,922 $ 930,114 $ 867,059

Allowance from acquisitions, dispositions

and other activity – net 173,844 9,324 15,531

Provision for loan losses 135,537 313,550 469,792

Loan charge-offs (316,081) (394,328) (490,117)

Loan recoveries 114,802 83,262 67,849

Balance at end of year $1,050,024 $ 941,922 $ 930,114

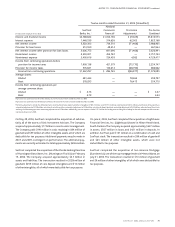

Note 8 / PREMISES AND EQUIPMENT

Premises and equipment at December 31 were as follows:

(Dollars in thousands) Useful Life 2004 2003

Land $ 446,760 $ 402,726

Buildings and improvements 2 – 40 years 1,544,566 1,391,864

Leasehold improvements 1 – 30 years 438,356 294,876

Furniture and equipment 1 – 20 years 1,378,395 1,231,944

Construction in progress 114,462 81,940

3,922,539 3,403,350

Less accumulated depreciation and amortization 2,062,124 1,808,043

Total premises and equipment $1,860,415 $1,595,307

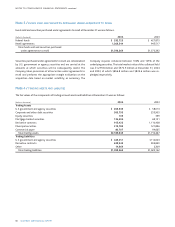

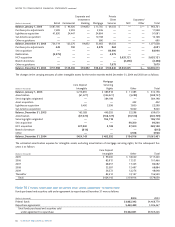

Operating Capital

(Dollars in thousands) Leases Leases

2005 $121,300 $ 2,442

2006 110,108 2,305

2007 90,914 2,337

2008 74,956 2,372

2009 57,066 2,384

Thereafter 251,229 35,397

Total minimum lease payments 705,573 47,237

Amounts representing interest 25,742

Present value of net minimum lease payments $21,495

The carrying amounts of premises and equipment subject to mort-

gage indebtedness (included in long-term debt) were not signifi-

cant at December 31, 2004 and 2003.

Various Company facilities are leased under both capital and non-

cancelable operating leases with initial remaining terms in excess

of one year. Minimum payments, by year and in aggregate, as of

December 31, 2004 were as follows:

Net premises and equipment included $16.3 million and $11.5

million at December 31, 2004 and 2003, respectively, related to

capital leases.

Aggregate rent expense (principally for offices), including contin-

gent rent expense, amounted to $133.8 million, $124.7 million,

and $122.5 million for 2004, 2003 and 2002, respectively.