SunTrust 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST 2004 ANNUAL REPORT 71

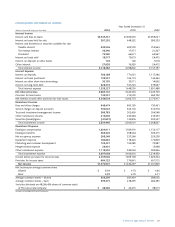

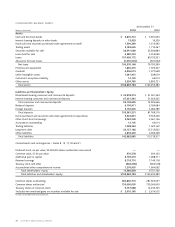

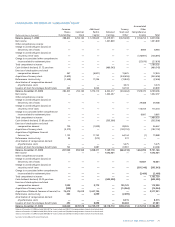

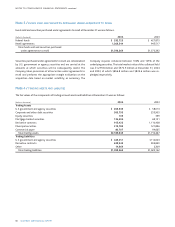

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’EQUITY

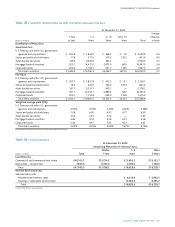

Accumulated

Common Additional Treasury Other

Shares Common Paid in Retained Stock and Comprehensive

(Dollars and shares in thousands) Outstanding Stock Capital Earnings Other1Income Total

Balance, January 1, 2002 288,602 $294,163 $ 1,259,609 $ 5,479,951 $ (329,408) $ 1,655,253 $ 8,359,568

Net income — — — 1,331,809 — — 1,331,809

Other comprehensive income:

Change in unrealized gains (losses) on

derivatives, net of taxes — — — — — 8,984 8,984

Change in unrealized gains (losses) on

securities, net of taxes — — — — — (126,891) (126,891)

Change in accumulated other comprehensive

income related to retirement plans — — — — — (27,876) (27,876)

Total comprehensive income — — — — — — 1,186,026

Cash dividends declared, $1.72 per share — — — (489,543) — — (489,543)

Exercise of stock options and stock

compensation element 367 — (6,801) — 19,625 — 12,824

Acquisition of treasury stock (5,659) — — — (340,656) — (340,656)

Performance stock activity (1,448) — 17,236 — (19,842) — (2,606)

Amortization of compensation element

of performance stock — — — — 3,074 — 3,074

Issuance of stock for employee benefit plans 643 — 6,066 — 34,743 — 40,809

Balance, December 31, 2002 282,505 294,163 1,276,110 6,322,217 (632,464) 1,509,470 8,769,496

Net income — — — 1,332,297 — — 1,332,297

Other comprehensive income:

Change in unrealized gains (losses) on

derivatives, net of taxes — — — — — 29,488 29,488

Change in unrealized gains (losses) on

securities, net of taxes — — — — — 115,254 115,254

Change in accumulated other comprehensive

income related to retirement plans — — — — — 9,881 9,881

Total comprehensive income — — — — — — 1,486,920

Cash dividends declared, $1.80 per share — — — (505,396) — — (505,396)

Exercise of stock options and stock

compensation element 700 — (1,859) — 38,526 — 36,667

Acquisition of treasury stock (3,275) — — — (182,152) — (182,152)

Acquisition of Lighthouse Financial

Services, Inc. 1,152 — 11,745 — 64,144 (1) 75,888

Performance stock activity 99 — (572) — 572 — —

Amortization of compensation element

of performance stock — — — — 5,475 — 5,475

Issuance of stock for employee benefit plans 742 — 2,887 — 41,381 — 44,268

Balance, December 31, 2003 281,923 294,163 1,288,311 7,149,118 (664,518) 1,664,092 9,731,166

Net income — — — 1,572,901 — — 1,572,901

Other comprehensive income:

Change in unrealized gains (losses) on

derivatives, net of taxes — — — — — 10,661 10,661

Change in unrealized gains (losses) on

securities, net of taxes — — — — — (395,343) (395,343)

Change in accumulated other comprehensive

income related to retirement plans — — — — — (2,460) (2,460)

Total comprehensive income — — — — — — 1,185,759

Cash dividends declared, $2.00 per share — — — (603,309) — — (603,309)

Exercise of stock options and stock

compensation element 1,905 — 8,775 — 105,125 — 113,900

Acquisition of treasury stock (200) — — — (14,064) — (14,064)

Acquisition of National Commerce Financial, Inc. 76,415 76,415 5,441,136 — — — 5,517,551

Performance stock activity 302 — 2,099 — (2,099) — —

Amortization of compensation element

of performance stock — — — — 8,515 — 8,515

Issuance of stock for employee benefit plans 495 — 8,898 — 38,483 — 47,381

Balance, December 31, 2004 360,840 $370,578 $6,749,219 $8,118,710 $(528,558) $1,276,950 $15,986,899

1Balance at December 31, 2004 included $492,047 for treasury stock and $36,511 for compensation element of restricted stock.

Balance at December 31, 2003 included $634,878 for treasury stock and $29,640 for compensation element of restricted stock.

Balance at December 31, 2002 included $603,602 for treasury stock and $28,862 for compensation element of restricted stock.

See notes to Consolidated Financial Statements.