SunTrust 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

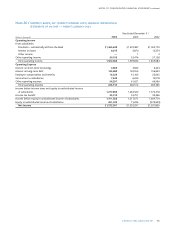

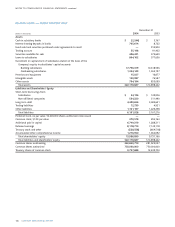

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 101

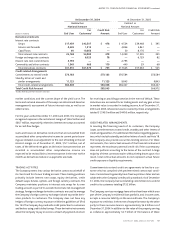

• Mortgage servicing rights are valued through a review of valua-

tion assumptions that are supported by market and economic

data collected from various sources.

• Deposit liabilities with no defined maturity such as demand

deposits, NOW/money market accounts, and savings accounts

have a fair value equal to the amount payable on demand at the

reporting date, i.e., their carrying amounts. Fair values for certifi-

cates of deposit are estimated using a discounted cash flow cal-

culation that applies current interest rates to a schedule of

aggregated expected maturities. The intangible value of long-

term relationships with depositors is not taken into account in

estimating fair values.

• Fair values for long-term debt are based on quoted market prices

for similar instruments or estimated using discounted cash flow

analysis and the Company’s current incremental borrowing rates

for similar types of instruments.

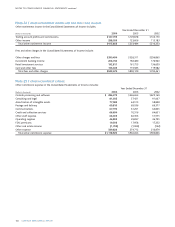

Note 21 / CONTINGENCIES

On January 11, 2005, the Securities and Exchange Commission

issued a formal order of investigation and the SEC Staff issued sub-

poenas seeking documents related to the Company’s allowance for

loan losses and related matters.The Company is cooperating, and

intends to cooperate with the SEC regarding this matter.In addition,

the Company and its subsidiaries are parties to numerous claims

and lawsuits arising in the course of their normal business activities,

some of which involve claims for substantial amounts. The

Company’s experience has shown that the damages alleged by

plaintiffs or claimants are grossly overstated, often unsubstantiated

by legal theory, and bear no relation to the ultimate award that a

court might grant. In addition, valid legal defenses, such as statutes

of limitations, frequently result in judicial findings of no liability by

the Company. Because of these factors, we cannot provide a mean-

ingful estimate of the range of reasonably possible outcomes of

claims in the aggregate or by individual claim. However, it is the

opinion of management that liabilities arising from these claims in

excess of the amounts currently accrued, if any, will not have a

material impact to the Company’s financial condition or results

of operations.

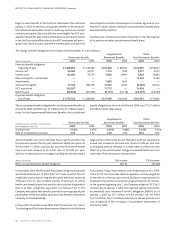

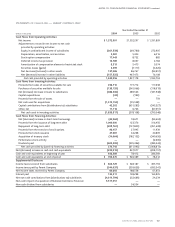

Note 22 / BUSINESS SEGMENT REPORTING

The Company uses a line of business management structure to

measure business activities.The Company has six functional lines of

business: Retail, Commercial, Corporate and Investment Banking

(CIB), Mortgage,Wealth and Investment Management, and NCF. In

addition, the Company reports Corporate/Other which includes the

investment securities portfolio, long-term debt, capital, short-term

liquidity and funding activities, balance sheet risk management

including derivative hedging activities, office premises and certain

support activities not currently allocated to the aforementioned

lines of business. Any transactions between the separate lines of

business not already eliminated in the results of the functional lines

of business are also reflected in Corporate/Other. Finally, the provi-

sion for income taxes is also reported in Corporate/Other.

The Retail line of business includes loans, deposits, and other fee-

based services for consumer and private banking clients, as well as

business clients with less than $5 million in revenues.Clients are

serviced through an extensive network of traditional and in-store

branches,ATMs, the Internet and the telephone.The Commercial

line of business provides clients with a full array of financial solu-

tions including traditional commercial lending, treasury manage-

ment, financial risk management products and corporate bankcard

services.This line of business primarily serves business customers

between $5 million and $250 million in annual revenues in addition

to entities specializing in commercial real estate activities. CIB is

comprised of the following businesses: corporate banking, invest-

ment banking, capital markets businesses, commercial leasing,

receivables capital management, and merchant banking.The corpo-

rate banking strategy is focused on companies with revenues in

excess of $250 million and is organized along industry specialty and

geographic lines.The Mortgage line of business offers residential

mortgage products nationally through its retail, broker, and corre-

spondent channels.Wealth and Investment Management provides a

full array of wealth management products and professional services

to both individual and institutional clients.Wealth and Investment

Management’s primary divisions include brokerage, individual

wealth management, insurance product sales, and institutional

investment management and administration.

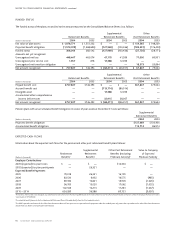

The Company continues to augment its internal management

reporting system. Future enhancements of items reported for each

line of business segment are expected to include: assets, liabilities

and attributed economic capital; matched maturity funds transfer

priced net interest income, net of net credit losses; direct noninter-

est income; internal credit transfers between lines of business for

supportive business services; and fully allocated expenses. The

internal management reporting system and the business segment

disclosures for each line of business do not currently include attrib-

uted economic capital, nor fully allocated expenses. During 2004,

certain product-related expenses incurred within production sup-

port areas of the Company that had previously been allocated to

the line of business segments, are no longer distributed to the line of

business segments. These expenses are reported in Corporate/

Other and prior periods have been reclassified. This change was

made in anticipation of finalizing the methodology for full cost allo-

cations, one of the primary future enhancements to the Company’s

internal management reporting system. The implementation of

these enhancements to the internal management reporting system

is expected to materially affect the net income disclosed for each

segment with no impact on consolidated amounts.Whenever sig-

nificant changes to management report methodologies take place,

the impact of these changes is quantified and prior period informa-

tion is reclassified wherever practicable.The Company will reflect

these reclassified changes immediately in the current period and in

year-to-date historical comparisons, and will provide updated

historical quarterly and annual schedules in the 2004 Annual Report

on Form 10-K.