SunTrust 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 77

Note 2 / ACQUISITIONS

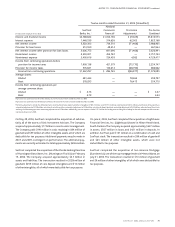

On October 1, 2004, SunTrust acquired 100 percent of the out-

standing common shares of NCF, a Memphis-based financial serv-

ices organization. NCF offered commercial and retail banking,

savings and trust services through its branches located in North

Carolina, South Carolina, Georgia,Tennessee, Mississippi, Arkansas,

Virginia, and West Virginia.The merger enhanced the Company’s

geographic position, as well as expanded the Company’s footprint

to include new areas, specifically Western Tennessee, North

Carolina, South Carolina, Mississippi,Arkansas, and West Virginia.

The acquisition was accounted for under the purchase method of

accounting with the results of operations for NCF included in

SunTrust’s results beginning October 1, 2004. Under the purchase

method of accounting the assets and liabilities of the former NCF

were recorded at their respective fair values as of October 1, 2004.

The consideration for the acquisition was a combination of cash and

stock with a purchase price of approximately $7.4 billion.The total

consideration consists of approximately $1.8 billion in cash and

approximately 76.4 million SunTrust shares.

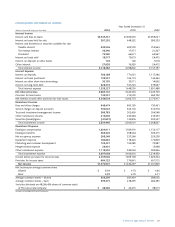

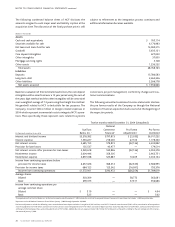

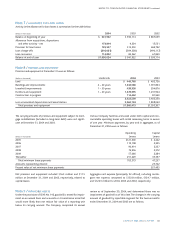

The calculation of the purchase price is as follows:

(Dollars in thousands)

Total SunTrust common

stock issued 76,415,641

Purchase price per

SunTrust common share1$70.41

Value of SunTrust stock issued 5,380,425

Estimated fair value of

employee stock options 137,126

Investment banking fees 38,681

Cash paid 1,800,434

Total purchase price $7,356,666

1The value of the shares of common stock was based on the closing price of SunTrust common

stock on the day before the completion of the merger.

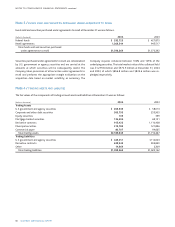

Securities,” are other-than-temporarily impaired and requires cer-

tain disclosures.The Issue was effective for other-than-temporary

impairment evaluations made in reporting periods beginning after

June 15, 2004. However, in September 2004, the evaluation and

accounting guidance contained in paragraphs 10 to 20 of this Issue

was delayed by FSP EITF Issue 03-1-1,“Effective Date of Paragraphs

10–20 of EITF Issue No. 03-1, ‘The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments.’”

The disclosures of the original consensus continued to be effective

in annual financial statements for fiscal years ending after

December 15, 2003 and for investments accounted for under SFAS

115. For all other investments within the scope of the original Issue,

the disclosures continue to be effective in annual financial state-

ments for fiscal years ending after June 15, 2004.

The delay of the effective date for paragraphs 10 through 20 will be

superseded concurrent with the final issuance of proposed FSP EITF

Issue 03-1-a, “Implementation Guidance for the Application of

Paragraph 16 of EITF Issue No. 03-1, ‘The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments.’”

FSP EITF Issue 03-1-a provides implementation guidance for debt

securities that are impaired solely because of interest rate and/or

sector spread increases and analyzed for other-than-temporary

impairment under paragraph 16 of Issue 03-1.The adoption of the

effective provisions of this EITF did not have a material impact on

the Company’s financial position or results of operations. The

required disclosures related to the Company’s other-than-tem-

porarily impaired securities are included in Note 5 to the

Consolidated Financial Statements. The Company is in the process

of assessing the impact the delayed provisions will have on its

financial position and results of operations, when adopted.

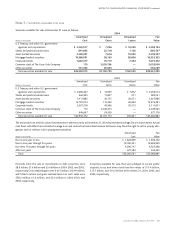

In December 2004, the FASB issued a revision of SFAS No. 123 (SFAS

No. 123(R)), “Accounting for Stock-Based Compensation.” The

revised Statement clarifies and expands SFAS No. 123’s guidance in

several areas, including measuring fair value, classifying an award as

equity or as a liability, and attributing compensation cost to report-

ing periods. The revised statement supercedes Accounting Practice

Bulletin (APB) Opinion No. 25, “Accounting for Stock Issued to

Employees,” and its related implementation guidance. Under the

provisions of SFAS 123(R), the alternative to use Opinion 25’s intrin-

sic value method of accounting that was provided in Statement No.

123, as originally issued, is eliminated, and entities are required to

measure liabilities incurred to employees in share-based payment

transactions at fair value. Effective January 1, 2002, the Company

adopted the fair-value recognition provision of SFAS No. 123,

prospectively, and began expensing the cost of stock options. Under

the provisions of SFAS No. 123(R) SunTrust is permitted to continue

the application of SFAS No. 123 until the reporting period ended

June 30, 2005, at which time the Company will adopt the provisions

of FAS No. 123(R) and expense the remaining unvested awards

issued prior to SunTrust’s adoption of SFAS No.123. The Company

has quantified the effect on net income and earnings per share if the

fair-value based method had been applied on a retrospective basis

in Note 16 to the Consolidated Financial Statements. The adoption

of this Statement is not expected to have a material impact on the

Company’s financial position or results of operations.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of

Nonmonetary Assets – an amendment of APB Opinion No. 29.”

SFAS No. 153 addresses the measurement of nonmonetary

exchanges and eliminates the exception from fair value measure-

ment for nonmonetary exchanges of similar productive assets in

APB No. 29, “Accounting for Nonmonetary Transactions,” and

replaces it with an exception for exchanges that do not have com-

mercial substance. This Statement specifies that a nonmonetary

exchange has commercial substance if the future cash flows of the

entity are expected to change significantly as a result of the

exchange. The Company does not expect the adoption of SFAS No.

153 to have a material impact on the Company’s financial position

or results of operations.