SunTrust 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

begin to earn benefits in the SunTrust Retirement Plan effective

January 1, 2005. In addition, participants’ benefits in the nonquali-

fied retirement plan will be frozen for both pay and service. Certain

covered participants (but not all) who were eligible for NCF non-

qualified retirement plan will be nominated to earn future benefits

in the SunTrust nonqualified plan.Active NCF employees will partic-

ipate in the SunTrust post retirement welfare plans and have the

same benefits as SunTrust employees of a similar age and service.

Prior NCF retirees will be continued in postretirement benefit plans

administered by SunTrust.

SunTrust uses a measurement date of December 31 for the majority

of its pension and other postretirement benefit plans.

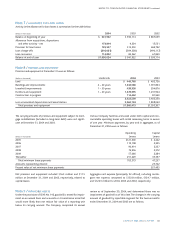

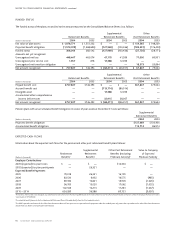

The change in benefit obligations for the years ended December 31 was as follows:

Supplemental Other

Retirement Benefits Retirement Benefits Post Retirement Benefits

(Dollars in thousands) 2004 2003 2004 2003 2004 2003

Projected benefit obligation,

beginning of year $1,268,690 $1,046,260 $100,436 $ 89,305 $176,400 $158,201

Service cost 50,085 43,071 1,713 1,520 2,277 2,515

Interest cost 82,084 74,574 5,082 4,991 9,803 10,823

Plan participants’ contributions ————14,122 9,192

Amendments ——1,883 1,434 ——

Actuarial loss (gain) 77,448 186,775 10,333 6,304 (4,860) 20,012

NCF acquisition 149,297 —11,713 —14,056 —

Benefits paid (56,876) (81,990) (3,191) (3,118) (29,507) (24,343)

Projected benefit obligation,

end of year $1,570,728 $1,268,690 $127,969 $100,436 $182,291 $176,400

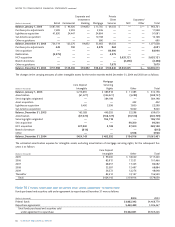

The accumulated benefit obligation for the Retirement Benefits at

the end of 2004 and 2003 was $1.4 billion and $1.1 billion, respec-

tively. For the Supplemental Retirement Benefits, the accumulated

benefit obligation at the end of 2004 and 2003 was $113.7 million

and $86.9 million, respectively.

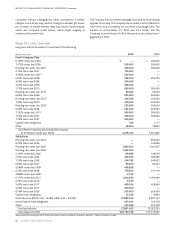

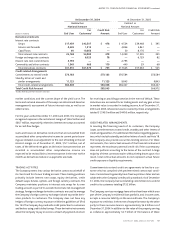

(Dollars in thousands) 1% Increase 1% Decrease

Effect on postretirement benefit obligation $8,733 $(7,706)

Assumed health care cost trend rates have a significant effect on

the amounts reported for the post retirement health care plans.As

of December 31, 2004, SunTrust has assumed that retiree health

care costs will increase at an initial rate of 10.50% per year.

SunTrust’s medical plans are managed carefully and retirees share a

large portion of the medical cost.Therefore, SunTrust expects this

annual cost increase to decrease over time to 5.25% per year. Due

to changing medical inflation, it is important to understand the

effect of a one-percent point change in assumed health care cost

trend rates.These amounts are shown below:

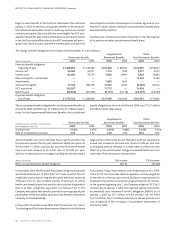

In December 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 (the “Act”) was enacted.The Act

established a prescription drug benefit under Medicare, known as

“Medicare Part D,” and a federal subsidy to sponsors of retiree

health care benefit plans that provide a prescription drug benefit

that is at least actuarially equivalent to Medicare Part D. The

Company anticipates that benefits provided to some groups of plan

participants will be actuarially equivalent and therefore entitle the

Company to a federal subsidy.

In May 2004, the FASB issued FASB Staff Position No. FAS 106-2,

“Accounting and Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act (“FSP

106-2”). FSP 106-2 provides definitive guidance on the recognition

of the effects of the Act and related disclosure requirements for

employers that sponsor prescription drug benefit plans for retirees.

In the quarter beginning July 1, the Company adopted FSP 106-2

retroactively to January 1, 2004.The expected subsidy reduced the

accumulated post retirement benefit obligation (APBO) as of

January 1, 2004 by $9.7 million, and net periodic cost for 2004

by $1.6 million.The $1.6 million reduction in the net periodic cost

was recognized in the Company’s Consolidated Statements of

Income for 2004.

Supplemental Other

(Weighted-average assumptions used to determine Retirement Benefits Retirement Benefits Post Retirement Benefits

benefit obligations, end of year) 2004 2003 2004 2003 2004 2003

Discount rate 5.90% 6.25% 4.59% 4.88% 5.35% 6.25%

Rate of compensation increase 4.00 3.50 4.00 3.50 N/A N/A