SunTrust 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 85

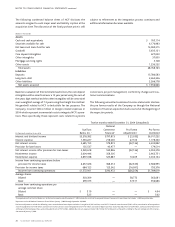

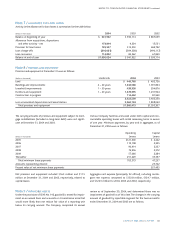

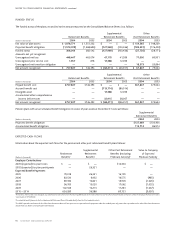

Note 12 / MORTGAGE SERVICING RIGHTS

The following is an analysis of capitalized mortgage servicing rights included in intangible assets in the Consolidated Balance Sheets:

(Dollars in thousands) 2004 2003 2002

Balance at beginning of year $ 449,293 $ 383,918 $ 351,200

Amortization1(168,127) (324,221) (244,625)

Servicing rights originated 196,118 384,198 277,343

Lighthouse acquisition —5,398 —

NCF acquisition 5,108 ——

Balance at end of year $ 482,392 $ 449,293 $ 383,918

1Included $77.4 million, $158.9 million,and $97.2 million for the years ended December 31, 2004, 2003, and 2002, respectively, on loans that have been paid-in-full and loans that have been foreclosed.

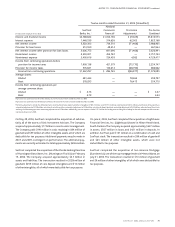

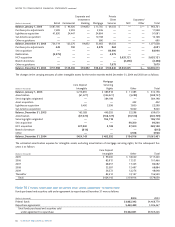

No valuation allowances were required at December 31, 2004, 2003, and 2002 for the Company’s mortgage servicing rights.The Company

retained the servicing rights for all its securitized single-family mortgages. Key economic assumptions used to measure total mortgage serv-

icing rights at December 31, 2004 and 2003 were as follows:

2004 2003

Payment rate 14.9% annual 15.6% annual

Weighted-average life 6.2 years 6.2 years

Discount rate 9.5% 9.7%

Weighted-average coupon 5.9% 6.0%

At December 31, 2004 and 2003, key economic assumptions and the sensitivity of the current fair value on retained servicing rights to imme-

diate 10% and 20% adverse changes in those assumptions follow:

(Dollars in millions) 2004 2003

Fair value of retained servicing rights $631.5 $560.6

Weighted-average life (in years) 6.2 6.2

Prepayment rate (annual rate) 14.9% 15.6%

Decline in fair value of 10% adverse change $ 35.5 $ 31.4

Decline in fair value of 20% adverse change 67.8 59.9

Residual cash flows discount rate (annual rate) 9.5% 9.7%

Decline in fair value of 10% adverse change $ 19.1 $ 17.2

Decline in fair value of 20% adverse change 37.1 33.4

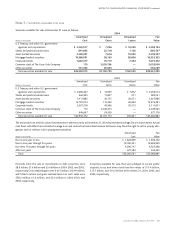

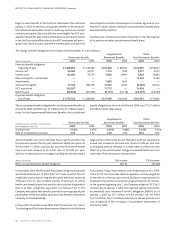

At December 31, 2004, $255 million of unused borrowings under

unsecured lines of credit from non-affiliated banks were available to

the Parent Company to support outstanding commercial paper and

provide for general liquidity needs.The average balances of short-

term borrowings for the year ended December 31, 2004, 2003, and

2002 were $1.7 billion, $2.2 billion, and $0.9 billion, respectively,

while the maximum amounts outstanding at any month-end during

the years ended December 31, 2004, 2003, and 2002 were $4.0 bil-

lion, $4.2 billion, and $1.6 billion, respectively.

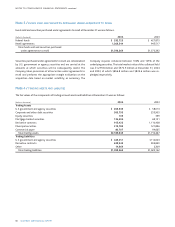

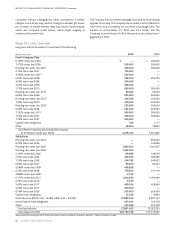

Note 11 / OTHER SHORT-TERM BORROWINGS

Other short-term borrowings at December 31 include:

2004 2003

(Dollars in thousands) Balance Rates Balance Rates

Commercial paper $— —%$3,216,678 1.06% – 1.14%

Federal funds purchased maturing in over one day 810,000 2.13 31,500 0.88 – 0.97

Master notes 534,220 0.87 311,490 0.45

U.S.Treasury demand notes 477,929 2.00 498,979 0.73

Other 240,400 various 2,499 various

Total other short-term borrowings $2,062,549 $4,061,146

These sensitivities are hypothetical and should be used with cau-

tion. As the figures indicate, changes in fair value based on a 10%

variation in assumptions generally cannot be extrapolated because

the relationship of the change in assumption to the change in

fair value may not be linear.Also, the effect of a variation in a partic-

ular assumption on the fair value of the retained servicing right is