SunTrust 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

ity of Three Pillars’ expected losses.The subordinated note investor

therefore is Three Pillars’ primary beneficiary, and thus the Company

is not required to consolidate Three Pillars. Due to the issuance of

the subordinated note, the Company deconsolidated Three Pillars

effective March 1, 2004. As of December 31, 2004,Three Pillars had

assets and liabilities not included on the Consolidated Balance

Sheet, of approximately $3.4 billion, consisting primarily of secured

loans, marketable asset-backed securities and short-term commer-

cial paper liabilities. As of December 31, 2003, Three Pillars had

assets and liabilities of approximately $3.2 billion which were

included in the Consolidated Balance Sheet.

Activities related to the Three Pillars relationship generated fee rev-

enue for the Company of approximately $24.2 million and $21.3

million for the years ended December 31, 2004 and 2003, respec-

tively.These activities include: client referrals and investment rec-

ommendations to Three Pillars; the issuing of a letter of credit,

which provides partial credit protection to the commercial paper

holders; and providing a majority of the temporary liquidity

arrangements that would provide funding to Three Pillars in the

event it can no longer issue commercial paper or in certain other

circumstances.

As of December 31, 2004, off-balance sheet liquidity commitments

made by the Company to Three Pillars totaled $5.9 billion and other

credit enhancements totaled $548.7 million.These represent the

Company’s maximum exposure to potential loss. The Company

manages the credit risk associated with these commitments by

subjecting them to the Company’s normal credit approval and mon-

itoring processes.

As part of its community reinvestment initiatives, the Company

invests in multi-family affordable housing properties throughout its

footprint as a limited and/or general partner.The Company receives

affordable housing federal and state tax credits for these limited

partner investments. Partnership assets of approximately $884.2

million and $731.8 million in partnerships where SunTrust is only a

limited partner were not included in the Consolidated Balance

Sheet at December 31, 2004 and 2003, respectively.The Company’s

maximum exposure to loss for these partnerships at December 31,

2004 was $198.1 million, consisting of the limited partnership

investments plus unfunded commitments.

SunTrust is the managing general partner of a number of non-regis-

tered investment limited partnerships which have been established

to provide alternative investment strategies for its customers. In

reviewing the partnerships for consolidation, SunTrust determined

that these were voting interest entities and accordingly considered

the consolidation guidance contained in SOP 78-9, “Accounting for

Investments in Real Estate Ventures.” Under the terms of SunTrust’s

non-registered investment limited partnerships, the limited part-

nerships have certain rights, such as those specifically indicated

in SOP 78-9 (including the right to remove the general partner,

or “kick-out rights”). As such, SunTrust, as the general partner, is

precluded from consolidating the limited partnerships under the

provisions of SOP 78-9.

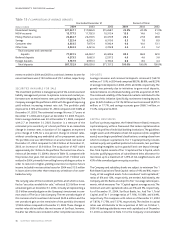

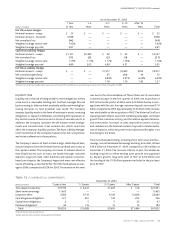

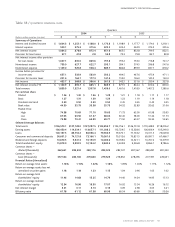

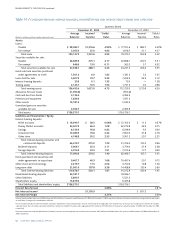

CONTRACTUAL COMMITMENTS

In the normal course of business, the Company enters into certain

contractual obligations. Such obligations include obligations to

make future payments on debt and lease arrangements,contractual

commitments for capital expenditures, and service contracts.Table

16 summarizes the Company’s significant contractual obligations at

December 31, 2004, except for pension and postretirement benefit

plans, included in Note 16 to the Company’s Consolidated Financial

Statements.Additional information with respect to the obligations

presented in the table is included in the Notes to the Consolidated

Financial Statements.

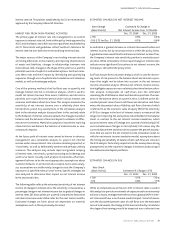

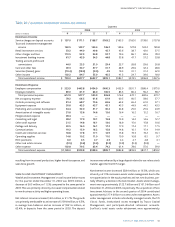

EARNINGS AND BALANCE SHEET ANALYSIS

2003 VS.2002

OVERVIEW

Net income was $1,332.3 million in 2003, up slightly over the

$1,331.8 million earned in 2002. Diluted earnings per share were

$4.73 in 2003 and $4.66 in 2002. In 2002, the Company incurred

$39.8 million, or $0.14 per diluted share, in after-tax merger-related

expenses associated with the acquisition of the Florida banking

franchise of Huntington Bancshares, Inc. (Huntington-Florida).

Net interest income increased $82.1 million to $3,365.3 million in

2003, compared to $3,283.2 million in 2002.The increase was due

to higher volumes in the loan and securities portfolios in 2003, a

decline in mortgage prepayments, and a steepening yield curve in

the latter part of 2003.The net interest margin declined 33 basis

points to 3.08% in 2003 from 3.41% in 2002.The decrease in the

margin was attributed to multiple factors including a shift in the

Company’s balance sheet structure to a slightly asset sensitive posi-

tion in anticipation of rising rates that did not occur, and the larger

decrease in earning asset yields versus the decrease in liability

costs.Also contributing to the decline in the net interest margin was

the consolidation of Three Pillars, the Company’s multi-seller com-

mercial paper conduit, to comply with FIN 46 in the third quarter of

2003.The consolidation had a negative three basis point impact on

the margin.

Net charge-offs were $311.1 million, or 0.41%, of average loans for

2003, compared to $422.3 million, or 0.59%, of average loans for

2002.The Company benefited from a $110.3 million reduction in

commercial net charge-offs.The provision for loan losses decreased

$156.2 million, or 33.3%, from 2002 to 2003 due to credit quality

improvement in 2003.Also impacting the decline was a $45.3 mil-

lion increase to the 2002 provision to bring the acquired

Huntington-Florida loan portfolio into compliance with SunTrust’s

credit standards.