SunTrust 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

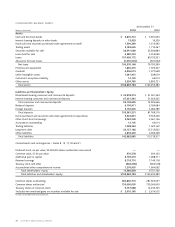

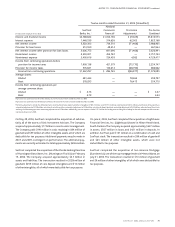

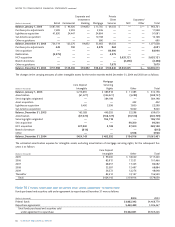

Note 3 / FUNDS SOLD AND SECURITIES PURCHASED UNDER AGREEMENTS TO RESELL

Funds sold and securities purchased under agreements to resell at December 31 were as follows:

(Dollars in thousands) 2004 2003

Federal funds $ 332,725 $ 427,875

Resell agreements 1,263,544 945,517

Total funds sold and securities purchased

under agreements to resell $1,596,269 $1,373,392

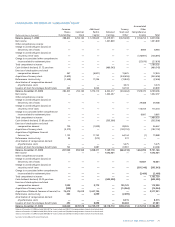

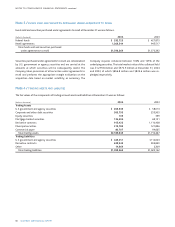

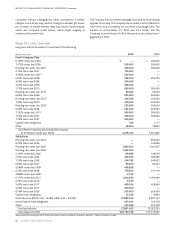

Note 4 / TRADING ASSETS AND LIABILITIES

The fair values of the components of trading account assets and liabilities at December 31 were as follows:

(Dollars in thousands) 2004 2003

Trading Assets

U.S. government and agency securities $ 265,339 $ 58,013

Corporate and other debt securities 565,795 255,905

Equity securities 105 399

Mortgage-backed securities 136,494 69,151

Derivative contracts 915,422 1,110,438

Municipal securities 219,783 121,896

Commercial paper 80,707 94,665

Total trading assets $2,183,645 $1,710,467

Trading Liabilities

U.S. government and agency securities $ 445,251 $114,003

Derivative contracts 638,943 903,830

Other 14,369 2,309

Total trading liabilities $1,098,563 $1,020,142

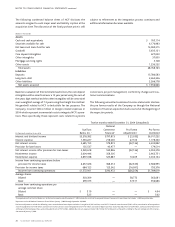

Securities purchased under agreements to resell are collateralized

by U.S. government or agency securities and are carried at the

amounts at which securities will be subsequently resold. The

Company takes possession of all securities under agreements to

resell and performs the appropriate margin evaluation on the

acquisition date based on market volatility, as necessary. The

Company requires collateral between 100% and 105% of the

underlying securities.The total market value of the collateral held

was $1,279.8 million and $970.5 million at December 31, 2004

and 2003, of which $856.8 million and $832.6 million was re-

pledged, respectively.