SunTrust 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

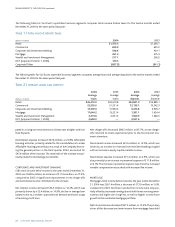

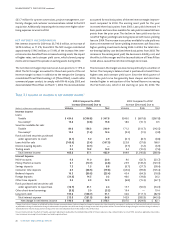

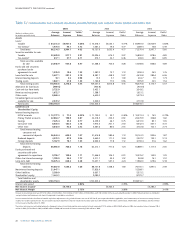

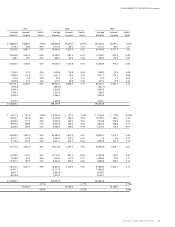

Net interest income for 2004 was $3.7 billion, an increase of 11.2%

compared to 2003.Approximately $196.3 million, or 51.9%, of the

increase was attributed to NCF. Historical SunTrust net interest

income showed improvement as a result of healthy loan growth and

margin improvement. The Company also benefited from a slow-

down in mortgage prepayments as a result of a steepening yield

curve, which began in the latter part of 2003 and continued

throughout 2004.The Company experienced a gradual increase in

the net interest margin throughout the year as the earning asset

yield increased, while total interest-bearing liability rates declined.

The acquisition of NCF also contributed to the increase due to the

higher yield on NCF’s earning assets. In 2005, the margin is expected

to remain relatively flat. The Company remains well positioned

should interest rates continue to rise in 2005.

Credit quality continued to improve in 2004. As credit quality

improved, the associated credit costs also declined due to both the

improving operating environment and the Company’s conservative

lending practices.The provision for loan losses declined $178.1 mil-

lion, or 56.8%, and net charge-offs declined $109.9 million, or

35.3%, from 2003 levels. Nonperforming assets increased $32.6

million, or 8.6%, in 2004 as a result of the NCF acquisition, however,

nonperforming assets as a percentage of total loans declined seven

basis points from December 31, 2003. The Company does not

expect credit quality to considerably change in the coming year.

Noninterest income increased $301.4 million, or 13.1%, compared

to 2003. Approximately $100.0 million, or 33.2%, of the increase

was due to NCF. The Retail, Commercial, CIB, and Wealth and

Investment Management lines of business reported revenue growth

in 2004 as a result of successful implementation of revenue initia-

tives, favorable market conditions, and an intense sales focus.

Customer driven fee income was a key factor in revenue growth in

2004.The Company reported strong results in the wealth manage-

ment business as a result of an increase in assets under manage-

ment, good sales momentum, and consistent levels of customer

retention. Equity capital markets improved over the prior year.

Service charges on deposits and other charges and fees increased

significantly due to the NCF acquisition, increased NSF/stop pay-

ment volumes, higher insurance revenues, and letter of credit fees.

As previously mentioned, SunTrust anticipates generating addi-

tional revenue from NCF customers in the coming year with a syn-

chronized pricing strategy and the introduction of a broad array of

SunTrust products, such as wealth management products.

Noninterest expense increased $496.4 million, or 14.6%, compared

to 2003. Approximately $184.5 million, or 37.2%, of the increase

was due to NCF.The largest component of noninterest expense was

personnel expense, which increased 11.5%. Approximately a third

of the increase in personnel expense was due to the acquisition of

NCF, with the remaining increase due primarily to increased head-

count, normal merit raises, and increased incentive costs related to

higher revenue. From a historical SunTrust perspective, noninterest

expense remained relatively flat in the last three quarters of 2004

as a result of the Company’s focus on expense control.As previously

discussed, the Company anticipates recording approximately $97

million in one-time merger charges in 2005. However, the Company

also expects to realize cost savings of approximately $76 million in

2005 and future periods.

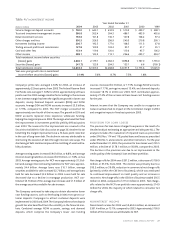

Loan production grew steadily throughout the year as average loans

for the year increased $10.1 billion, or 13.2%, from 2003.

Approximately $3.7 billion, or 36.3%, of the increase was due to

NCF. Residential mortgages increased due to the continued success

of adjustable rate mortgage production.The home equity lending

business strengthened as a result of better products, sales focus, and

cross-selling efforts. On the downside, the demand for large corpo-

rate lending continued to be sluggish throughout 2004. The

Company plans to capitalize on opportunities within the NCF foot-

print by pursuing smaller corporate and commercial customers.

Average consumer and commercial deposits grew $7.6 billion, or

11.0%, in 2004. Approximately $3.5 billion, or 46.1%, of the

increase was due to NCF.The makeup of deposits has been shifting

to lower cost deposits, which are comprised of demand deposits,

NOW accounts, and savings.The shift can be attributed to initia-

tives to grow customer deposits and customers being slightly indif-

ferent to interest bearing and noninterest bearing deposits in the

low rate environment.

The following discussions will provide further insight on the 2004

performance of SunTrust.

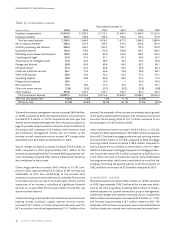

CRITICAL ACCOUNTING POLICIES

The Company’s significant accounting policies are described in

detail in Note 1 to the Consolidated Financial Statements and are

integral to understanding Management’s Discussion of results of

operations and financial condition. Management has identified cer-

tain accounting policies as being critical because they require man-

agement’s judgment to ascertain the valuations of assets, liabilities,

commitments and contingencies. A variety of factors could affect

the ultimate value that is obtained either when earning income, rec-

ognizing an expense, recovering an asset, or reducing a liability. The

Company has established detailed policies and control procedures

that are intended to ensure these critical accounting estimates are

well controlled and applied consistently from period to period. In

addition, the policies and procedures are intended to ensure that

the process for changing methodologies occurs in an appropriate

manner. However, in the fourth quarter of 2004 the Company

identified a material weakness in internal controls related to estab-

lishing the Allowance for Loan and Lease Losses (ALLL).The Controls

and Procedures section on pages 64 through 65 provides further

discussion surrounding this internal control weakness.The follow-

ing is a description of the Company’s current accounting policies

that are considered to involve significant management valuation

judgments.