SunTrust 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

lines, factoring receivables, credit card receivables, nonaccrual and

restructured loans, direct financing leases, and leveraged leases.

Interest income on all types of loans is accrued based upon the out-

standing principal amounts, except those classified as nonaccrual

loans. Interest accrual is discontinued when it appears that future

collection of principal or interest according to the contractual terms

may be doubtful. Interest income on nonaccrual loans is recognized

on a cash basis if there is no longer doubt of future collection of

principal. Loans classified as nonaccrual, except for smaller balance

homogeneous loans, which include consumer and residential loans,

meet the criteria to be considered impaired loans.The Company

classifies a loan as nonaccrual with the occurrence of one of the fol-

lowing events: (i) interest or principal has been in default 90 days or

more, unless the loan is well-secured and in the process of collec-

tion; (ii) collection of recorded interest or principal is not antici-

pated; or (iii) income for the loan is recognized on a cash basis due

to the deterioration in the financial condition of the debtor.

Consumer and residential mortgage loans are typically placed on

nonaccrual when payments have been in default for 90 and 125

days or more, respectively. When borrowers demonstrate over an

extended period the ability to repay a loan in accordance with the

contractual terms of a loan classified as nonaccrual, the loan is

returned to accrual status.(See Allowance for Loan Losses section of

this Note for further discussion of impaired loans.)

Fees and incremental direct costs associated with the loan origina-

tion and pricing process, as well as premiums and discounts, are

deferred and amortized as level yield adjustments over the respec-

tive loan terms. Fees received for providing loan commitments and

letter of credit facilities that result in loans are deferred and then

recognized over the term of the loan as an adjustment of the yield.

Fees on commitments and letters of credit that are not expected to

be funded are amortized into noninterest income using the

straight-line method over the commitment period.

ALLOWANCE FOR LOAN AND LEASE LOSSES

The Company’s allowance for loan and lease losses is that amount

considered adequate to absorb probable losses in the portfolio

based on management’s evaluations of the size and current risk

characteristics of the loan portfolio. Such evaluations consider prior

loss experience, the risk rating distribution of the portfolios, the

impact of current internal and external influences on credit loss and

the levels of nonperforming loans. Specific allowances for loan

losses are established for large impaired loans on an individual basis

as required per SFAS Nos. 114 and 118 and large impaired leases

based on the criteria set forth in SFAS No. 5. The specific allowance

established for these loans and leases is based on a thorough analy-

sis of the most probable source of repayment, including the present

value of the loan’s expected future cash flow, the loan’s estimated

market value, or the estimated fair value of the underlying collat-

eral.General allowances are established for loans and leases that

can be grouped into pools based on similar characteristics as

described in SFAS No. 5. In this process, general allowance factors

are based on an analysis of historical charge-off experience and

expected losses given default derived from the Company’s internal

risk rating process. These factors are developed and applied to the

portfolio in terms of line of business and loan type. Adjustments are

also made to the allowance for the pools after an assessment of

internal and external influences on credit quality that have not yet

been reflected in the historical loss or risk rating data. Non-pool-

specific allowances relate to inherent losses that are not otherwise

evaluated in the first two elements.The qualitative factors associ-

ated with the non-pool-specific allowances are subjective and

require a high degree of management judgement. These factors

include the inherent imprecisions in mathematical models and

credit quality statistics, recent economic uncertainty, losses

incurred from recent events, and lagging or incomplete data.

PREMISES AND EQUIPMENT

Premises and equipment are carried at cost less accumulated depre-

ciation and amortization. Depreciation has been calculated prima-

rily using the straight-line method over the assets’ estimated useful

lives. Certain leases are capitalized as assets for financial reporting

purposes. Such capitalized assets are amortized, using the straight-

line method, over the terms of the leases. Maintenance and repairs

are charged to expense and improvements are capitalized.

GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill represents the excess of purchase price over the fair value

of identifiable net assets of acquired companies. Under the provi-

sions of SFAS No. 142, “Goodwill and Other Intangible Assets,”

goodwill is not subject to amortization. Rather it is subject to

impairment testing on an annual basis, or more often if events or

circumstances indicate that there may be impairment.

Identified intangible assets that have a finite life are amortized over

their useful lives and evaluated for impairment whenever events or

changes in circumstances indicate the carrying amount of the

assets may not be recoverable.

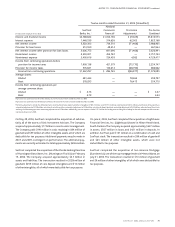

MORTGAGE SERVICING RIGHTS

The Company recognizes as assets the rights to service mortgage

loans for others whether the servicing rights are acquired through

purchase or loan origination. Purchased MSRs are capitalized at

cost. The carrying value of MSRs is maintained on the balance sheet

in intangible assets. For loans originated and sold where the servic-

ing rights have been retained, the Company allocates the cost of the

loan and the servicing rights based on their relative fair market val-

ues at the time of sale of the underlying mortgage loan. Fair value is

determined through a review of valuation assumptions that are

supported by market and economic data collected from various

outside sources. There are two components to the amortization

expense that the Company records on MSRs. First, the Company

amortizes fully the remaining balance of all MSRs for loans paid in

full in recognition of the termination of future cash flow streams,

and second, normal amortization on the surviving MSRs is recorded

based on the current market cash flows as estimated by future net

servicing income. The current market cash flows are calculated and

updated monthly by applying market-driven assumptions, such as

interest rate and prepayment speed assumptions.