SunTrust 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 93

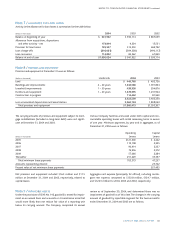

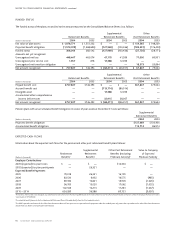

The change in plan assets for the years ended December 31 was as follows:

Other

Retirement Benefits Post Retirement Benefits

(Dollars in thousands) 2004 2003 2004 2003

Fair value of plan assets, beginning of year $1,551,232 $1,025,873 $148,229 $140,669

Actual return on plan assets 188,790 307,349 7,283 17,740

NCF acquisition 165,625 ———

Employer contributions 30,000 300,000 14,438 4,971

Plan participants’ contributions ——14,122 9,192

Benefits paid (56,876) (81,990) (29,507) (24,343)

Fair value of plan assets, end of year $1,878,771 $1,551,232 $154,565 $148,229

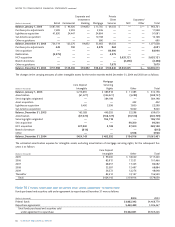

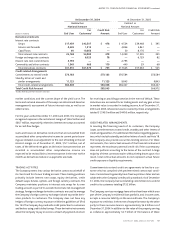

Target Percentage of Plan

Allocation Assets at December 31

Asset Category 20051200412003

Equity securities 58%–88% 78% 74%

Debt securities 20–25 18 23

Real estate —1—

Cash equivalents 0–5 3 3

Total 100% 100%

1The target allocation is for the SunTrust plan only and the percentage of plan assets include both SunTrust and NCF plan assets.

Employer contributions and benefits paid in the above table include

only those amounts contributed directly to pay participants’ plan

benefits or added to plan assets in 2004 and 2003, respectively.

Note that the other Supplemental Retirement Plans are not funded

through plan assets.

The asset allocation for SunTrust’s Retirement Plan at the end of

2004 and 2003, and the target allocation for 2005, by asset cate-

gory, follows.The expected long-term rate of return on these plan

assets was 8.50% in 2004 and 8.75% in 2003.

Equity securities include SunTrust common stock in the amounts of

$17.3 million, or 0.9% of total plan assets and $4.2 million, 0.3% of

total plan assets at the end of 2004 and 2003, respectively.

The SunTrust benefit plan committee establishes investment poli-

cies and strategies and regularly monitors the performance of the

funds.The Company’s investment strategy with respect to pension

assets is to invest the assets in accordance with ERISA and fiduciary

standards. The long-term primary objectives for the Retirement

Plan are to 1) provide for a reasonable amount of long-term growth

of capital, without undue exposure to risk; and protect the assets

from erosion of purchasing power, and 2) provide investment

results that meet or exceed the Retirement Plan’s actuarially

assumed long-term rate of return.

The NCF benefit plan committee established the target allocation

for the NCF Retirement Plan for 2004.The SunTrust benefits plan

committee will establish a target allocation for the NCF plan assets

of $176 million consistent with that of the SunTrust Retirement

Plan.

The asset allocation for the other post retirement benefit plans at

the end of 2004 and 2003, and target allocation for 2005, by asset

category, are as follows:

Target Percentage of Plan

Allocation Assets at December 31

Asset Category 20053200432003

Equity securities135–50% 45% 50%

Debt securities 50–65 42 49

Other2—13 1

Total 100% 100%

1Equity securities do not include SunTrust common stock for the Post Retirement Welfare Plans.

2A contribution was made on December 31, 2004 and invested in a short-term investment.

3The target allocation is for the SunTrust plan only and the percentage of plan assets include both SunTrust and NCF plan assets.

The Company’s investment strategy with respect to other Post Retirement Benefits is to create a stream of investment return sufficient to

provide for current and future liabilities at a reasonable level of risk.