SunTrust 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

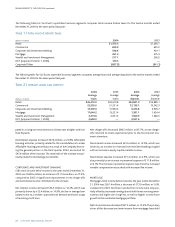

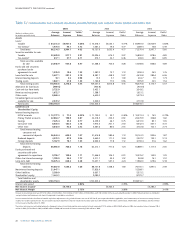

BUSINESS SEGMENTS

Beginning in January 2001, the Company implemented significant

changes to its internal management reporting system to begin to

measure and manage certain business activities by line of business.

For more financial details on business segment disclosures, please

see Note 22 – Business Segment Reporting in the Notes to the

Consolidated Financial Statements.The lines of business which are

the Company’s segments, are defined as follows:

RETAIL

The Retail line of business includes loans, deposits, and other fee-

based services for consumer and private banking clients, as well as

business clients with less than $5 million in sales. Retail serves

clients through an extensive network of traditional and in-store

branches, ATMs, the Internet (suntrust.com) and the telephone

(1-800-SUNTRUST). In addition to serving the retail market, the

Retail line of business serves as an entry point for other lines of busi-

ness.When client needs change and expand, Retail refers clients to

SunTrust’s Wealth and Investment Management, Mortgage and

Commercial lines of business.

COMMERCIAL

The Commercial line of business provides enterprises with a full

array of financial products and services including traditional com-

mercial lending, treasury management, financial risk management,

and corporate bankcard.The primary client segments served by this

line of business include “Commercial” ($5 million to $50 million in

annual revenue),“Middle Market” ($50 million to $250 million in

annual revenue),“Commercial Real Estate” (entities that specialize

in commercial real estate activities), and “Government/Not-for-

Profit” entities. Also included in this segment are specialty groups

that operate both inside and outside of the SunTrust footprint, such

as Affordable Housing (tax credits related to community develop-

ment) and Premium Assignment Corporation (insurance premium

financing).

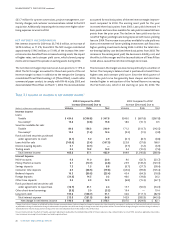

CORPORATE & INVESTMENT BANKING

CIB is comprised of the following businesses: corporate banking,

investment banking, capital markets businesses, commercial leas-

ing, receivables capital management and merchant banking. The

corporate banking strategy is focused on companies with sales in

excess of $250 million and is organized along industry specialty and

geographic lines, providing along with credit, a full array of tradi-

tional bank services, capital markets capabilities, and investment

banking.The investment banking strategy is focused on small- and

mid-cap growth companies and is organized along industry spe-

cialty lines, raising public and private equity, and providing merger

and acquisition advisory services.The debt and equity capital mar-

kets businesses support both the corporate banking and investment

banking relationships, as well as the smaller commercial clients,

who are covered by our Commercial line of business and wealthy

individuals, who are served by our Wealth and Investment

Management line of business. Commercial leasing provides equip-

ment leasing and financing to various entities. Receivables Capital

Management provides traditional factoring services as well as other

value-added receivables management services.

MORTGAGE

The Mortgage line of business offers residential mortgage products

nationally through its retail, broker and correspondent channels.

These products are either sold in the secondary market primarily

with servicing rights retained or held as whole loans in the

Company’s residential loan portfolio.The line of business services

loans for its own residential mortgage portfolio as well as for others.

Additionally, the line of business generates revenue through its tax

service subsidiary (ValuTree Real Estate Services, LLC) and its cap-

tive reinsurance subsidiary (Cherokee Insurance Company).

WEALTH AND INVESTMENT MANAGEMENT

Wealth and Investment Management, the segment formerly known

as Private Client Services, provides a full array of wealth manage-

ment products and professional services to both individual and

institutional clients.Wealth and Investment Management’s primary

segments include brokerage, individual wealth management, and

institutional investment management and administration. SunTrust

Securities, Inc. operates across the Company’s footprint and offers

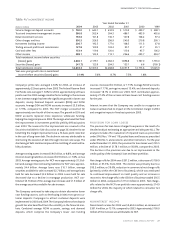

discount/online and full service brokerage services to individual

clients. Alexander Key offers full service brokerage services to afflu-

ent and wealthy clients who generally do not have a pre-existing

relationship with the Company. Alexander Key is currently located

in Atlanta, GA, Nashville, TN, Washington,DC, Jacksonville, FL,

Orlando, FL, and Richmond,VA. Wealth and Investment Manage-

ment also offers professional investment management and trust

services to clients seeking active management of their financial

resources.The ultra high net worth segment of these clients is serv-

iced by Asset Management Advisors (AMA).AMA provides “family

office” services to ultra high net worth clients. Acting in this capac-

ity, AMA investment professionals utilize sophisticated financial

products and wealth management tools to provide a holistic

approach to multi-generational wealth management. AMA is cur-

rently located in Atlanta, GA, Orlando, FL, West Palm Beach, FL,

Miami, FL, St. Petersburg, FL, Washington,DC, Charlotte, NC, and

Greenwich, CT. Institutional investment management and adminis-

tration is comprised of Trusco Capital Management, Inc. (Trusco),

retirement services, endowment and foundation services, corporate

trust, and stock transfer. Retirement services provides administra-

tion and custody services for 401(k) and employee defined benefit

plans. Endowment and foundation services provides administration

and custody services to non-profit organizations, including govern-

ment agencies, colleges and universities, community charities and

foundations, and hospitals. Corporate trust targets issuers of tax-

exempt and corporate debt, and asset-based securities, as well as

corporations and attorneys requiring escrow and custodial services.

Trusco is a registered investment advisor that acts as the invest-