SunTrust 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

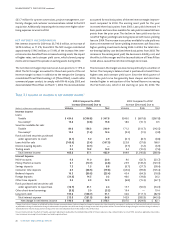

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 23

ment manager for Wealth and Investment Management’s clients

and the STI Classic Funds.

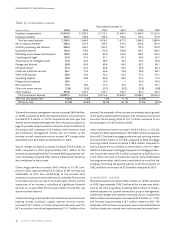

NATIONAL COMMERCE FINANCIAL

The NCF segment represents results of NCF from the October 1,

2004 acquisition date and includes the purchase accounting adjust-

ments and certain merger-related expenses recorded for the acqui-

sition. NCF offers commercial and retail banking, savings and trust

services through its branches located in North Carolina, South

Carolina, Georgia, Tennessee, Mississippi, Arkansas, Virginia, and

West Virginia.The NCF segment includes the assets and liabilities of

the merged entity. The Company expects to fully integrate NCF

among its other lines of business in the first quarter of 2005.

CORPORATE/OTHER

Corporate/Other (Other) includes the investment securities portfo-

lio, long-term debt, capital, derivative instruments, short-term liq-

uidity and funding activities, balance sheet risk management, office

premises, certain support activities not currently allocated to the

aforementioned lines of business and the incremental costs to inte-

grate NCF’s operations (merger expenses).The major components

of Corporate/Other include Enterprise Information Services, which

is the primary data processing and operations group; the Corporate

Real Estate group, which manages the Company’s facilities;

Marketing, which handles advertising, product management and

customer information functions; Bankcard, which handles credit

card issuance and merchant discount relationships; SunTrust

Online, which handles customer phone inquiries and phone sales

and manages the Internet banking function; Human Resources,

which includes the recruiting, training and employee benefit admin-

istration functions; Finance, which includes accounting, budgeting,

planning, tax and treasury. Other functions included in Corporate/

Other are operational risk management, credit risk management,

credit review, audit, internal control, legal and compliance, branch

operations, corporate strategies development, and the executive

management group. Corporate/Other also contains certain ex-

penses that have not been allocated to the primary lines of busi-

ness, eliminations, and the residual offsets derived from

matched-maturity funds transfer pricing, and provision for loan

losses/net charge-offs allocations.

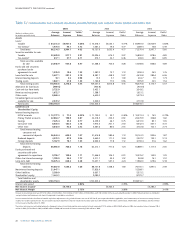

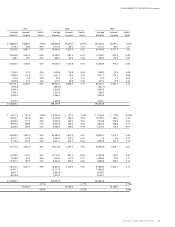

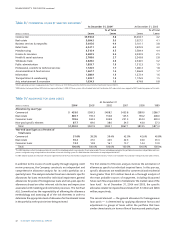

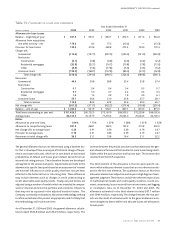

The following analysis details the operating results for each line of

business for the years ended December 31, 2004 and 2003. Prior

periods have been restated to conform to the current period’s pres-

entation. In the discussions, net charge-offs represent the allocated

provision for loan losses for the lines of business.Corporate/Other’s

provision for loan losses represents the difference between consoli-

dated provision for loan losses and the aforementioned allocations.

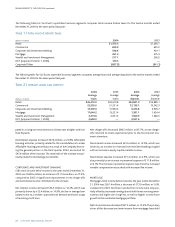

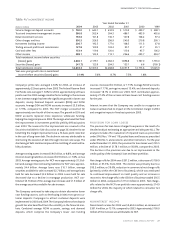

RESULTS OF OPERATIONS — 2004 VS.2003

RETAIL

Retail’s total income before taxes for the year ended December 31,

2004 was $1,375.3 million, an increase of $114.6 million, or 9.1%,

compared to 2003. Higher net interest income, lower net charge-

offs, and higher noninterest income contributed to the year-over-

year increase.

Net interest income increased $109.0 million, or 6.2%. Balance

sheet growth in consumer loans, commercial loans, and lower cost

deposits drove the increase in net interest income. Home equity

lending experienced the strongest growth in the loan category

while demand deposits grew the most in the deposit category.

Average loans increased $2.8 billion, or 11.9%, and average deposits

increased $2.0 billion, or 3.7%.

With improvements in credit quality, net charge-offs decreased

$32.7 million, or 19.1%. Noninterest income increased $56.6 mil-

lion, or 7.4%.The increase was driven by higher service charges on

deposit accounts and an increase in debit card interchange volume.

Noninterest expense increased $83.7 million, or 7.8%.The higher

expense level is primarily attributable to investments in the Retail

distribution network and technology.

COMMERCIAL

Commercial’s total income before taxes for the year ended

December 31, 2004 was $659.9 million, an increase of $24.7 mil-

lion, or 3.9%, compared to 2003. Improvements in net interest

income overcame increased noninterest expense to generate

this growth.

Net interest income increased $54.1 million, or 8.3%.Average loans

increased $1.2 billion, or 5.9%, while average deposits increased

$1.6 billion, or 15.1%. Loan growth was spread across most of the

commercial loan portfolios.The growth in deposits can be attrib-

uted to increased client liquidity.

Even though net charge-offs increased $5.5 million, or 28.3%,

charge-offs remained at historically low levels and overall credit

quality continues to be strong.

Noninterest income increased $43.9 million, or 15.3%, which was

driven by a $48.6 million increase from Affordable Housing activi-

ties, primarily related to the consolidation of certain Affordable

Housing partnerships as a result of the Company becoming the gen-

eral partner in the third quarter of 2003.Additionally, the Company

earned additional Affordable Housing income tax credits, which are

classified on a before tax equivalent basis as noninterest income in

Commercial.This increase was partially offset by declining income

from service charges on deposit accounts and deposit sweep serv-

ices.The decrease in the income from deposit accounts was antici-