SunTrust 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 47

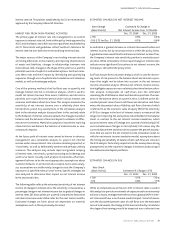

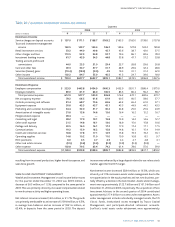

Noninterest income was $2,303.0 million in 2003, compared to

$2,268.8 million in 2002, an increase of $34.2 million, or 1.5%.The

increase was attributed to an improvement in customer-driven fee

income, specifically in the wealth management and capital market

business, and increases in service charges on deposits and other

charges and fees. Retail investment services income increased $25.1

million, or 18.4%, due to an increase in broker production, an

increase in the number of brokers, and increased revenue generated

by Alexander Key.

Combined trading account profits and commissions and investment

banking income, the Company’s capital market revenue sources,

increased $22.2 million, or 7.9%, from 2002 to 2003 as a result of

strong growth in the debt capital markets business. Service charges

on deposits increased $30.2 million, or 4.9%, due to increased

NSF/stop payment volumes, increased pricing and other revenue

enhancement initiatives. Other charges and fees also increased

from 2002 to 2003 as a result of increased letter of credit fees and

insurance revenues. Other noninterest income increased $10.4 mil-

lion, or 9.2%, primarily due to the consolidation of certain

Affordable Housing partnerships, due to the Company becoming the

general partner in the third quarter of 2003.

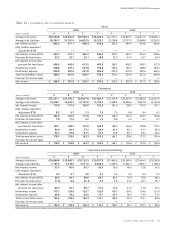

Noninterest expense was $3,400.6 million in 2003, compared to

$3,219.4 million in 2002, an increase of $181.2 million, or 5.6%.

Personnel expenses increased $126.0 million, or 6.9%, primarily due

to increased incentive and pension costs. Commissions and per-

formance-based incentive payments increased as a result of busi-

ness growth, higher production volumes, and higher revenue in the

Wealth and Investment Management, CIB, and Mortgage lines of

business. Marketing and customer development increased $20.3

million, or 25.4%, due to an expanded marketing strategy and sales

focus.Also impacting the increase in noninterest expense was the

consolidation of certain affordable housing partnerships, which

contributed $28.7 million of the increase. In 2002, the Company

incurred $56.2 million of noninterest expense related to the One

Bank initiative, which enhanced customer-based systems in an

effort to improve operating efficiencies.

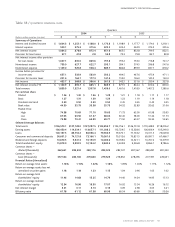

Average earning assets increased $12.9 billion, or 13.4%, from 2002

to 2003, of which $1.3 billion was related to the consolidation of

Three Pillars. Average loans increased $4.9 billion, or 6.8%, from

2002 to 2003.The consolidation of Three Pillars contributed $1.1

billion of the increase.Also contributing to the increase was a signif-

icant rise in residential mortgage loans partially due to the im-

provement in adjustable rate mortgage production in 2003.Average

loans held for sale increased $4.2 billion, or 94.7%, from 2002 to

2003 due to an increase in refinancing activity resulting from the

low rate environment.

Average interest-bearing liabilities increased $9.6 billion, or 12.1%,

from 2002 to 2003. Average consumer and commercial deposits

increased $4.0 billion, or 6.1%, compared to 2002, primarily due to

increases in demand deposits, Money Market, and NOW accounts.

Demand deposits increased $2.6 billion, or 16.8%, and NOW

accounts increased $1.4 billion, or 13.4%, as the Company bene-

fited from initiatives to grow customer deposits and overall volatil-

ity in the financial markets.

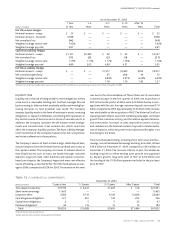

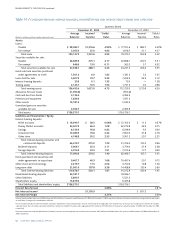

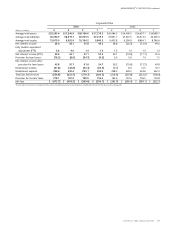

BUSINESS SEGMENTS

The following analysis details the operating results for each line of

business for the years ended December 31, 2003 and 2002.These

periods have been restated to conform to the 2004 presentation.

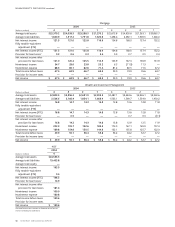

RETAIL

Retail’s total income before taxes for the year ended December 31,

2003 was $1,260.7 million, an increase of $106.6 million, or 9.2%,

compared to 2002. Net interest income increased $87.1 million, or

5.2%. Net charge-offs increased $5.8 million, or 3.5%. The net

charge-offs increase was due to increased net charge-offs in the

indirect lending category.

Noninterest income increased $30.4 million, or 4.2%, which was

driven primarily by growth in service charges on deposit accounts.

Noninterest expense increased $5.1 million, or 0.5%.

COMMERCIAL

Commercial’s total income before taxes for the year ended

December 31, 2003 was $635.2 million, an increase of $147.7 mil-

lion, or 30.3%, compared to 2002. Improvement in net interest

income driven by balance sheet growth and noninterest income

contributed to that increase.

Net interest income increased $90.9 million, or 16.2%. Average

loans increased $2.0 billion, or 10.4%, while average deposits

increased $1.8 billion, or 20.9%.

Net charge-offs increased $1.4 million, or 7.5%, from 2002. Net

charge-offs remained at historically low levels and overall credit

quality continued to be strong.

Noninterest income increased $72.6 million, or 33.7%, which was

driven by a $61.7 million increase from Affordable Housing activi-

ties. In the third quarter of 2003, the Company became the general

partner in certain Affordable Housing partnerships, which resulted

in the consolidation of these partnerships. In addition, the Company

continued to earn additional income tax credits from its investment

in these partnerships, which in 2003 began being classified on a

before tax equivalent basis as noninterest income in Commercial.

Commercial’s prior year results were not able to be restated to

reflect the impact of the tax credits.

Noninterest expense increased $14.4 million, or 5.3%. Affordable

Housing activities, primarily related to the consolidation of certain

Affordable Housing partnerships due to the Company becoming

the general partner in the third quarter of 2003, accounted for $7.6

million of the increase.