SunTrust 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 53

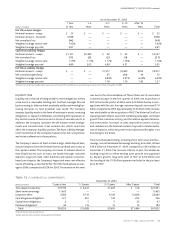

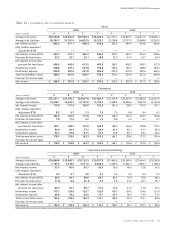

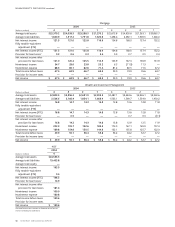

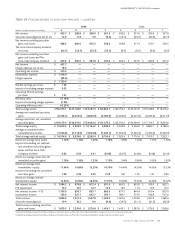

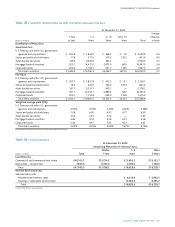

Table 20 / QUARTERLY NONINTEREST INCOME AND EXPENSE

Quarters

2004 2003

(Dollars in millions) 43214321

Noninterest Income

Service charges on deposit accounts $ 197.0 $171.1 $168.7 $163.2 $165.3 $162.0 $158.0 $157.8

Trust and investment management

income 160.5 149.7 140.4 136.2 129.6 127.8 124.2 120.8

Retail investment services 53.2 44.0 49.8 45.7 43.6 38.7 42.0 37.5

Other charges and fees 110.5 92.5 94.8 92.7 79.4 86.1 82.6 78.3

Investment banking income 61.7 45.9 54.3 44.8 53.8 47.7 57.2 33.8

Trading account profits and

commissions 44.0 23.3 31.0 29.4 22.7 26.8 29.6 30.8

Card and other fees 49.3 34.7 37.7 31.7 28.9 29.6 32.4 28.6

Securities (losses) gains (19.4) (18.2) (9.0) 4.9 19.5 31.1 31.2 42.0

Other income 102.2 84.7 55.0 46.5 41.3 24.7 39.6 18.0

Total noninterest income $ 759.0 $627.7 $622.7 $595.1 $584.1 $574.5 $596.8 $547.6

Noninterest Expense

Employee compensation $ 523.9 $445.8 $434.9 $400.3 $432.9 $391.7 $386.4 $375.0

Employee benefits 89.0 81.9 86.0 106.5 83.3 80.4 96.2 98.7

Total personnel expense 612.9 527.7 520.9 506.8 516.2 472.1 482.6 473.7

Net occupancy expense 78.2 66.5 61.6 61.9 60.5 60.5 58.6 57.7

Outside processing and software 81.4 68.7 70.6 65.6 63.2 65.4 61.0 57.1

Equipment expense 50.8 43.3 45.7 45.1 45.5 44.9 44.5 43.5

Marketing and customer development 34.4 32.0 31.7 30.2 24.8 25.0 25.6 24.9

Amortization of intangible assets 31.8 15.6 14.6 15.6 16.4 16.2 15.2 16.7

Merger-related expense 28.4 — — — ————

Consulting and legal 28.2 17.9 19.1 15.8 15.9 14.2 14.6 12.7

Other staff expense 21.5 14.8 16.1 13.6 18.9 15.0 15.8 10.6

Postage and delivery 20.5 16.0 16.1 17.2 17.0 17.4 17.1 17.5

Communications 19.2 15.9 16.2 15.8 14.8 16.1 15.4 14.9

Credit and collection services 18.8 17.8 17.1 12.9 15.8 19.3 19.2 16.1

Operating supplies 14.6 10.2 11.0 11.0 10.9 10.8 8.5 9.7

FDIC premiums 6.0 4.5 4.7 4.3 4.4 4.7 4.8 4.1

Other real estate income (0.5) (0.6) (0.4) (0.3) (0.9) (0.3) (0.8) —

Other expense 102.8 79.5 83.4 74.2 61.4 78.6 55.6 59.0

Total noninterest expense $1,149.0 $929.8 $928.4 $889.7 $884.8 $859.9 $837.7 $818.2

resulting from increased production, higher benefits expense, and

sales force growth.

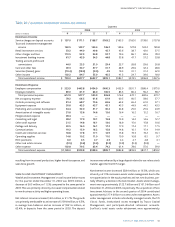

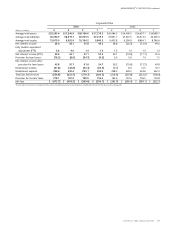

WEALTH AND INVESTMENT MANAGEMENT

Wealth and Investment Management’s total income before taxes

for the quarter ended December 31, 2004 was $49.9 million, a

decrease of $6.3 million, or 11.2%, compared to the same period in

2003.This was primarily driven by increased compensation related

to new business activity and higher operating losses.

Net interest income increased $3.0 million, or 21.7%.The growth

was primarily attributable to an increase of $139.8 million, or 6.5%,

in average loan balances and an increase of $921.6 million, or

62.4%, in deposits from the same period in 2003. The deposit

increase was enhanced by a large deposit related to our role as stock

transfer agent for the NCF merger.

Noninterest income increased $28.4 million, or 16.3%, which was

driven by a 21.5% increase in assets under management due to the

net appreciation in the equity markets and net new business, par-

tially offset by a decline in the bond market. Assets under manage-

ment were approximately $122.7 billion and $101.0 billion as of

December 31, 2004 and 2003, respectively.The acquisition of Seix

Investment Advisors in the second quarter of 2004 contributed

approximately $17.4 billion to assets under management. Assets

under management include individually managed assets, the STI

Classic Funds, institutional assets managed by Trusco Capital

Management, and participant-directed retirement accounts.

SunTrust’s total assets under advisement were approximately