SunTrust 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

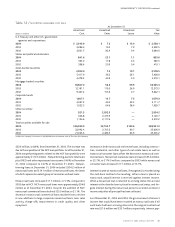

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 25

for sale that was only partially offset by higher income from portfo-

lio loans. Mortgage loans held for sale average balance decreased

$3.2 billion, or 40.1%. Combined with net interest margin compres-

sion, this resulted in a $140.7 million, or 42.6%, decline in net inter-

est income.Total average loans, principally residential mortgages,

increased $4.4 billion, or 33.5%.This resulted in an increase in net

interest income of $61.2 million, or 29.5%. Lower average deposit

balances, due to reduced loan prepayments, also produced a decline

in net interest income of $8.0 million.

Net charge-offs increased $1.2 million, or 48.3%, but remained at a

low level. Noninterest income increased $101.7 million. The

increase in noninterest income was driven by lower amortization of

mortgage servicing rights and higher servicing fee income.

Mortgage servicing rights amortization declined $161.7 million, or

49.1%, due to slower loan prepayments. Servicing fees increased

$30.6 million, or 23.2%, principally due to higher servicing balances.

The servicing portfolio was $77.7 billion at December 31, 2004

compared with $69.0 billion at December 31, 2003.The increase in

servicing income was partially offset by lower loan production

income, which declined $96.5 million, or 63.9%.The decline was

driven by lower production volumes and compressed margins.

Mortgage loan production for 2004 was $30.2 billion, a decline of

$13.5 billion, or 30.8%, from 2003.Additionally,Cherokee Insurance

revenue, the captive reinsurance subsidiary, increased $8.4 million,

or 50.5%.

Noninterest expense increased $26.9 million, or 9.0%. Higher per-

sonnel expense and expenditures related to sales promotions and

growth initiatives were the primary drivers.The higher personnel

expense was principally a result of sales force growth and higher

benefit costs.

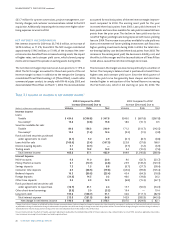

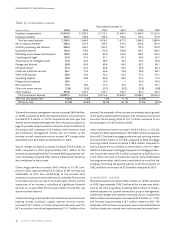

WEALTH AND INVESTMENT MANAGEMENT

Wealth and Investment Management’s total income before taxes

for the year ended December 31, 2004 was $217.1 million, an

increase of $17.0 million, or 8.5%, compared to 2003. Higher bro-

kerage and insurance sales as well as the income generated from

increased assets under management and the Seix acquisition con-

tributed to the increase.

Net interest income increased $8.6 million, or 16.6%.The growth

was due to an increase of $272.4 million, or 13.6%, in average loans

and an increase of $480.4 million, or 32.4%, in average deposits

over the prior year.

Noninterest income increased $111.8 million, or 16.8%. The

increase was driven by growth in trust and investment management

income (due to increased assets under management, estate settle-

ment fees, and distribution fees) as well as higher retail investment

income. In 2004, the Company acquired the majority of the assets

of Seix Investment Advisors, a leading institutional fixed-income

boutique.The Seix acquisition contributed $27.1 million, or 24.2%,

of the increase. Brokerage related income increased $36.7 million

from the same period last year and was driven by higher broker

staffing and productivity levels and increased insurance sales. End-

of-period total assets under advisement were approximately

$212.4 billion, which included $122.7 billion in discretionary bal-

ances, $24.9 billion in non-managed corporate trust assets, $39.3

billion in non-managed trust assets, and $25.5 billion in retail bro-

kerage assets.

Noninterest expense increased $103.8 million, or 20.1%.The Seix

acquisition, increased commissions and incentives from new busi-

ness activity, additional sales personnel, and additional expense

related to the conversion to a new trust accounting system

expected to occur in 2005, all contributed to the increase.

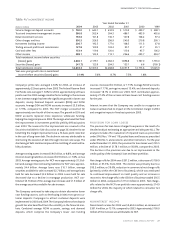

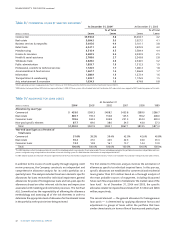

NCF

NCF’s income before taxes for the fourth quarter and year ended

December 31, 2004 was $120.6 million. For the fourth quarter of

2004, average earning assets totaled $21.2 billion and average

deposits and other funding totaled $18.9 billion, resulting in $196.3

million in net interest income. Net interest income also included

$4.3 million of purchase accounting expense, representing amorti-

zation of balance sheet fair value adjustments. Noninterest income

of $100.0 million for the quarter included service charges on

deposit accounts, trust and investment management income,

investment banking income, mortgage income, and other charges

and fees. Noninterest expenses represent personnel costs, occu-

pancy expense, and all other operating expenses. Included in nonin-

terest expense was $15.9 million in purchase accounting

adjustments, primarily related to core deposit intangible amortiza-

tion and $4.7 million for one-time merger expenses.

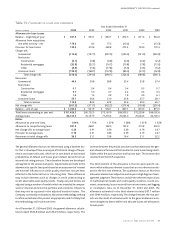

CORPORATE/OTHER

Corporate/Other’s loss before taxes for the year ended December

31, 2004 was $857.5 million, compared to a loss of $841.3 million

for 2003.

Net interest income increased $133.9 million due to balance sheet

management derivative activities and lower matched-maturity

funds transfer pricing allocated to the lines of business.

The loan loss provision declined $68.1 million due to improved

credit quality and the difference between the Company’s consoli-

dated provision and net charge-offs.

Noninterest income declined $180.1 million in 2004 compared to

2003.The primary reason was due to net securities losses of $42.4

million in 2004 versus net securities gains of $121.7 million in 2003.

The net securities losses in 2004 were due to the Company selling

lower-yielding securities in order to reinvest in higher-yielding secu-

rities to improve future income.

Noninterest expense increased $38.1 million, or 4.2%, compared to

2003.The increase was primarily due to merger-related expenses of