SunTrust 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

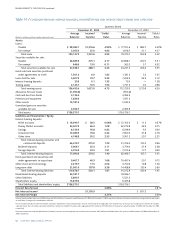

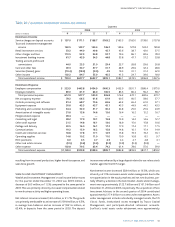

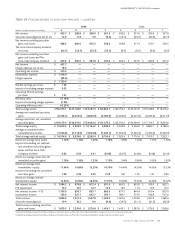

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 49

Noninterest expense in 2003 was $53.7 million, or 6.2%, lower than

the prior year.The primary driver of the expense decrease was lower

allocations of support expense to the lines of business.

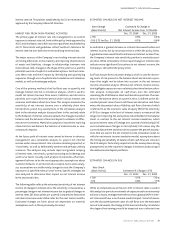

FOURTH QUARTER RESULTS

OVERVIEW

SunTrust reported $455.7 million, or $1.26 per diluted share, of net

income for the fourth quarter of 2004 compared with $342.5 mil-

lion, or $1.21 per diluted share, for the fourth quarter of 2003.After

tax merger-related expenses of $18.5 million related to the

Company’s acquisition of NCF on October 1, 2004 were incurred in

the fourth quarter of 2004. Excluding these merger expenses, oper-

ating net income for the fourth quarter of 2004 was $474.2 million

and operating diluted earnings per share was $1.31.

Fully-taxable net interest income increased $223.4 million, or

25.5%, and the net interest margin increased 12 basis points from

the fourth quarter of 2003 to the fourth quarter of 2004. The

increase in net interest income was attributed to the NCF acquisi-

tion, higher balance sheet volumes, the steepening of the yield

curve, and a larger increase in the earning asset yield versus the

increase in liability cost.The addition of NCF contributed approxi-

mately $196.3 million to the increase in net interest income and

nine basis points of the improvement in net interest margin.Total

average earning assets increased $23.7 billion, or 21.0%, from the

fourth quarter of 2003 to the fourth quarter of 2004.

Approximately $21.2 billion of the increase was attributed to the

acquisition of NCF.The Company consolidated Three Pillars, a multi

seller commercial paper conduit, in the third quarter of 2003 to

comply with FIN 46 and deconsolidated Three Pillars in the first

quarter of 2004.The deconsolidation contributed six basis points to

the increase in the net interest margin.

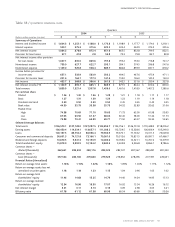

The provision for loan losses for the fourth quarter of 2004 was

$37.1 million, a decrease of $33.2 million,or 47.2%, from the fourth

quarter of 2003. Net charge-offs declined $15.9 million, or 22.8%,

from the fourth quarter of 2003 to the fourth quarter of 2004 due

to improved credit quality and a strengthening economy.

Commercial net charge-offs declined $10.6 million, or 51.3%, from

the fourth quarter of 2004 compared to the fourth quarter of 2003.

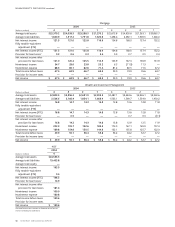

Noninterest income was $759.0 million in the fourth quarter of

2004, an increase of $174.9 million, or 29.9%, compared to the

fourth quarter of 2003.The increase was primarily attributable to

the NCF acquisition, which contributed approximately $100.0

million of the increase. Positively impacting noninterest income

were increases in trust and investment management income, com-

bined trading account profits and commissions and investment

banking income, and service charges on deposits.Trust and invest-

ment management income increased $30.9 million, or 23.8%, from

the fourth quarter of 2003 to the fourth quarter of 2004 due prima-

rily to the acquisitions of Seix Investment Advisors, Inc. and NCF

in 2004. Approximately $10.9 million of the increase was related

to the acquisition of NCF and $11.4 million was related to the

acquisition of Seix.

Combined trading account profits and commissions and investment

banking income, SunTrust’s capital market revenue sources,

increased $29.2 million, or 38.2%, from the fourth quarter of 2003

to the fourth quarter of 2004 due to the acquisition of NCF and

strong growth in debt capital markets. Service charges on deposit

accounts increased $31.7 million, or 19.2%, from the fourth quarter

of 2003 to the fourth quarter of 2004 primarily as a result of the

NCF acquisition, which contributed approximately $32.1 million to

the increase.

Noninterest expense in the fourth quarter of 2004 was $1,149.0

million, an increase of $264.2 million, or 29.9%, from the fourth

quarter of 2003. Approximately $184.5 million of the increase was

attributed to the acquisition of NCF. Personnel expense, the largest

component of noninterest expense, grew $96.7 million, or 18.7%,

from the fourth quarter of 2003 to the fourth quarter of 2004.

Approximately $78.7 million of the increase was attributable to the

NCF acquisition. The remainder of the increase was primarily

related to an increase in historical SunTrust headcount and higher

incentive payments.The efficiency ratio for the fourth quarter of

2004 was 61.78% compared to 60.54% for the fourth quarter of

2003. On an operating basis, which excludes merger-related

expenses, the efficiency ratio was 60.25% for the fourth quarter

of 2004.

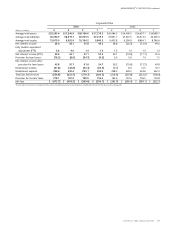

Provision for income taxes was $201.4 million for the fourth quarter

of 2004 compared to $152.0 million in the same period of 2003.The

provision represents an effective tax rate of 30.6% for the fourth

quarter of 2004, compared to 30.7% for the fourth quarter of 2003.

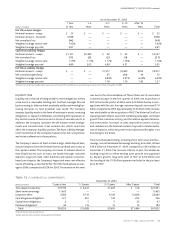

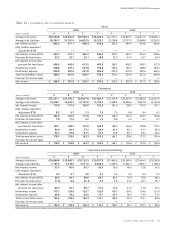

BUSINESS SEGMENTS

The following analysis details the operating results for each line of

business for the quarters ended December 31, 2004 and 2003.The

prior period has been restated to conform to the current period’s

presentation.The fourth quarter analysis for the NCF segment is on

page 25.The 2004 annual analysis and fourth quarter analysis for

NCF are the same due to the October 1, 2004, acquisition date.

RETAIL

Retail’s total income before taxes for the quarter ended December

31, 2004 was $368.0 million, an increase of $48.4 million, or 15.1%,

compared to the same period in 2003. Higher net interest income,

lower charge-offs, and higher noninterest income contributed to

the increase.

Net interest income increased $43.0 million, or 9.5%. Balance sheet

growth in consumer loans, commercial loans, and deposits drove

the increase in net interest income. Home equity lending showed

the strongest growth in the loan category while demand deposits

showed the strongest growth in the deposit category. Average