SunTrust 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

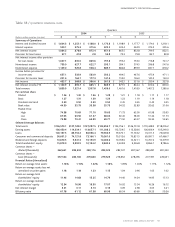

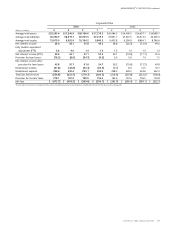

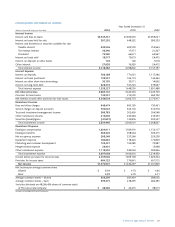

Table 26 / FUNDS PURCHASED AND SECURITIES SOLD UNDER AGREEMENTS TO REPURCHASE1

Maximum

Outstanding

At December 31 Daily Average at Any

(Dollars in millions) Balance Rate Balance Rate Month-End

2004 $ 9,342.8 1.85% $ 9,796.7 1.11% $11,079.4

2003 9,505.2 0.72 11,666.9 0.91 15,089.8

2002 10,402.5 1.01 10,376.2 1.35 12,701.9

1Consists of federal funds purchased and securities sold under agreements to repurchase that mature overnight or at a fixed maturity generally not exceeding three months. Rates on overnight funds reflect cur-

rent market rates. Rates on fixed maturity borrowings are set at the time of borrowings.

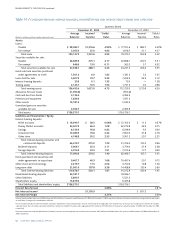

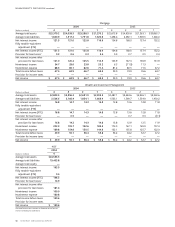

Table 25 / SHARE REPURCHASES IN 2004

Number of shares Maximum number of

Total number Average purchased as part of shares that may yet be

of shares price paid publicly announced purchased under the

purchased1per share plans or programs plans or programs2

January 1-31 — $ — — 6,227,796

February 1-29 — — — 6,227,796

March 1-31 200,000 70.32 200,000 6,027,796

April 1-30 — — — 6,027,796

May 1-31 — — — 6,027,796

June 1-30 — — — 6,027,796

July 1-31 — — — 6,027,796

August 1-31 — — — 6,027,796

September 1-30 — — — 6,027,796

October 1-31 143367.81 — 6,027,796

November 1-30 8,268372.05 — 6,027,796

December 1-31 3,924372.77 — 6,027,796

Total 212,335 $70.43 200,000

1In addition to these repurchases, participants may exercise SunTrust stock options by surrendering shares of SunTrust common stock the participants already own as payment of the option exercise price. Shares

so surrendered by participants in SunTrust’s employee stock option plans are repurchased pursuant to the terms of the applicable stock option plan and not pursuant to publicly announced share repurchase pro-

grams. For the year ended December 31, 2004, the following shares of SunTrust common stock were surrendered by participants in SunTrust’s employee stock option plans: January 2004 - 10,697 shares at an

average price per share of $71.54; February 2004 - 8,311 shares at an average price per share of $73.11;March 2004 - 3,230 shares at an average price per share of $71.25;April 2004 - no shares; May 2004 - 1,573

shares at an average price per share of $63.34; June 2004 - 2,354 shares at an average price per share of $64.76; July 2004 - 3,710 shares at an average price per share of $65.36;August 2004 - 3,340 shares at an

average price per share of $67.32; September 2004 - 619 shares at an average price per share of $68.56; October 2004 - 10,253 shares at an average price per share of $68.15; November 2004 - 25,413 shares at

an average price per share of $71.77; December 2004 - 25,093 shares at an average price per share of $72.94.

2On November 12, 2002, the Board of Directors authorized the purchase of 10 million shares of SunTrust common stock in addition to 2,796 shares which were available for repurchase from a June 13, 2001

authorization.There is no expiration date for this authorization.The Company has not determined to terminate the program and no programs expired during the period covered by the table.

3Represent shares purchased in the open market using funds allocated as cash consideration in connection with the NCF acquisition.The purchases were made to satisfy valid elections by NCF shareholders to

acquire SunTrust common stock that were not originally honored as a result of SunTrust error.

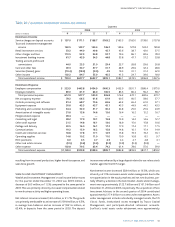

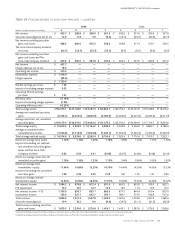

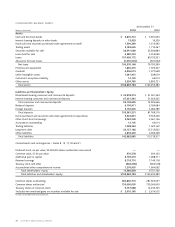

Table 27 / MATURITY OF CONSUMER TIME AND OTHER TIME DEPOSITS IN AMOUNTS OF $100,000 OR MORE

At December 31, 2004

(Dollars in millions) Consumer Brokered Foreign Other Total

Months to Maturity

3 or less $1,761.0 $2,063.1 $5,150.6 $ 85.7 $ 9,060.4

Over 3 through 6 870.7 1,448.7 — 48.0 2,367.4

Over 6 through 12 1,387.2 776.9 — 10.0 2,174.1

Over 12 2,336.8 1,812.2 — — 4,149.0

Total $6,355.7 $6,100.9 $5,150.6 $143.7 $17,750.9