SunTrust 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

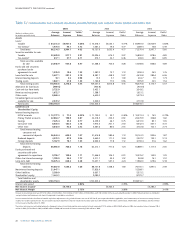

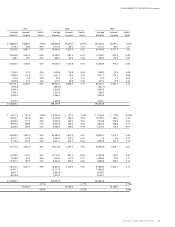

MANAGEMENT’S DISCUSSION

SUNTRUST 2004 ANNUAL REPORT 19

This narrative will assist readers in their analysis of the accompany-

ing consolidated financial statements and supplemental financial

information. It should be read in conjunction with the Consolidated

Financial Statements and Notes on pages 66 through 107.

Effective October 1, 2004, National Commerce Financial Corporation

(NCF) merged with SunTrust (“SunTrust” or “Company”).The re-

sults of operations for NCF were included with SunTrust’s results

beginning October 1, 2004. Prior periods do not reflect the impact

of the merger.

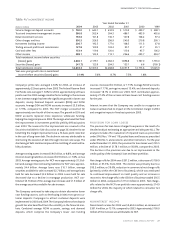

In Management’s Discussion, net interest income, net interest mar-

gin and the efficiency ratio are presented on a fully taxable-equiva-

lent (FTE) basis, which is adjusted for the tax-favored status of

income from certain loans and investments.The Company believes

this measure to be the preferred industry measurement of net inter-

est income and provides relevant comparison between taxable and

non-taxable amounts.The Company also presents operating diluted

earnings per share and operating efficiency ratio that exclude

merger charges related to the NCF acquisition. The Company

believes the exclusion of the merger charges, which represent incre-

mental costs to integrate NCF’s operations, is more reflective of

normalized operations.The Company provides reconcilements on

pages 58 through 59 for all non-GAAP measures. Certain reclassifi-

cations have been made to prior year financial statements and

related information to conform them to the 2004 presentation.

SunTrust has made, and may continue to make, various forward-

looking statements with respect to financial and business matters.

The following discussion contains forward-looking statements that

involve inherent risks and uncertainties. Actual results may differ

materially from those contained in these forward-looking state-

ments. For additional information regarding forward-looking state-

ments, see “A Warning About Forward-Looking Information” on page

63 of this Annual Report. In addition, the preparation of the financial

statements, upon which this Management’s Discussion is based,

requires management to make estimates which impact these finan-

cial statements. Included in the Notes to the Consolidated Financial

Statements, which start on page 73, are the most significant

accounting policies used in the preparation of these statements as

required by generally accepted accounting principles (GAAP).These

Notes should be read in conjunction with the reader’s review of

SunTrust’s financial statements and results of operations.

INTRODUCTION

SunTrust operates primarily within Florida, Georgia, Maryland,

North Carolina, South Carolina,Tennessee,Virginia,West Virginia,

and the District of Columbia.The acquisition of NCF on October 1,

2004 strengthened the Company’s existing footprint, as well as

expanded the footprint into new geographic areas, which provide

new opportunities in high-growth markets.

Within the geographic footprint, SunTrust strategically operates

under six business segments.These business segments are: Retail,

Commercial, Corporate and Investment Banking (CIB),Wealth and

Investment Management (formerly known as Private Client

Services), Mortgage and NCF. For a complete description of each

line of business, please see pages 22 through 23.

One of the Company’s top priorities for 2004 was the successful

integration of NCF.The Company’s continuing objective is to make

the integration of the two companies seamless to both clients and

employees.The focus of the integration process is on revenue gen-

eration, client and employee retention and satisfaction, and the

achievement of the financial goals established for the acquisition.

The Company identified approximately 1,800 merger milestones as

a way of monitoring the integration process. As of year-end, the

Company remains on track with over 40% of these milestones hav-

ing been completed. Included in the key accomplishments was the

integration of NCF’s organizational structure, business lines, and

support functions, the creation of an employee-experience team

comprised of both NCF and historical SunTrust employees to

address employee communications, retention, and morale, the

placement of talented NCF managers into positions of authority

and the transition of 3,200 NCF revenue producers to equivalent

positions at SunTrust. One of the main focuses of the integration

has been on NCF client retention, which the Company is able to

track and measure through a four-step program.The four key com-

ponents of the program are: client impact assessment, communica-

tion to clients, retention implementation, and measurement and

monitoring.The Company will continue to monitor client retention

rates throughout 2005 as major system conversions, including

client account and branch conversions, are completed.

The Company currently anticipates pretax expense savings of

approximately $125 million to be recognized by the end of 2006.

Approximately 60% of the cost savings are expected to be realized

in 2005.The savings will be achieved through the consolidation and

elimination of duplicate functions, procurement savings and branch

closings.The merger is also expected to spark additional revenue

generation through synchronized pricing and the introduction of

SunTrust products to NCF clients. The Company estimates total

one-time expenses to be approximately $125 million. Of the

expected one-time expenses, $28.4 million were recorded in 2004,

with the remaining $96.6 million expected to be incurred in 2005.

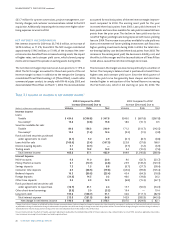

For the Company, 2004 was an exciting year due not only to the

opportunities created by the acquisition of NCF, but also due to the

strong financial results. Earnings per diluted share increased 9.7%

from 2003 to $5.19. On an operating basis, which excludes merger-

related expenses, earnings per diluted share increased 11.0% from

2003 to $5.25. Net income for the year was $1,572.9 million, an

increase of $240.6 million, or 18.1%, over the prior year. SunTrust

reported positive trends throughout the year, including accelerating

revenue growth generated by solid performance by each of the lines

of business, strong credit quality, and emerging strength in net

interest margin.