SunTrust 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 45

processes accorded to loans made by the Company. See Table 17 for

details on unfunded lending commitments.

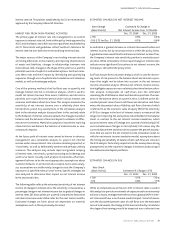

The Company has undertaken certain guarantee obligations in the

ordinary course of business. In following the provisions of FIN 45, as

addressed in Note 1 to the Company’s Consolidated Financial

Statements, the Company must consider guarantees that have any

of the following four characteristics (i) contracts that contingently

require the guarantor to make payments to a guaranteed party

based on changes in an underlying factor that is related to an asset,

a liability, or an equity security of the guaranteed party; (ii) con-

tracts that contingently require the guarantor to make payments to

a guaranteed party based on another entity’s failure to perform

under an obligating agreement; (iii) indemnification agreements

that contingently require the indemnifying party to make pay-

ments to an indemnified party based on changes in an underlying

factor that is related to an asset, a liability, or an equity security of

the indemnified party; and (iv) indirect guarantees of the indebted-

ness of others.

The issuance of these guarantees imposes an obligation to stand

ready to perform, and should certain triggering events occur, it also

imposes an obligation for the Company to make future payments.

Note 18 to the Consolidated Financial Statements includes the

annual required disclosures under FIN 45.

In the normal course of business, the Company utilizes various

derivative and credit-related financial instruments to meet the

needs of customers and to manage the Company’s exposure to

interest rate and other market risks.These financial instruments

involve, to varying degrees, elements of credit and market risk in

excess of the amount recorded on the balance sheet in accordance

with GAAP. SunTrust manages the credit risk of its derivatives by (i)

limiting the total amount of arrangements outstanding by an indi-

vidual counterparty; (ii) monitoring the size and maturity structure

of the portfolio; (iii) obtaining collateral based on management’s

credit assessment of the counterparty; (iv) applying uniform credit

standards maintained for all activities with credit risk; and (v) enter-

ing into transactions with high quality counterparties that are peri-

odically reviewed by the Company’s Credit Committee. The

Company manages the market risk of its derivatives by establishing

and monitoring limits on the types and degree of risk that may be

undertaken. The Company continually measures market risk by

using a value-at-risk methodology. Note 17 to the Consolidated

Financial Statements includes additional information regarding

derivative financial instruments and Table 15 provides further

details with respect to SunTrust’s derivative positions.

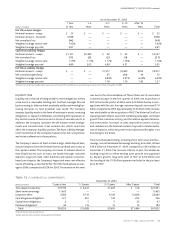

SunTrust assists in providing liquidity to select corporate customers

by directing them to a multi-seller commercial paper conduit,Three

Pillars.Three Pillars provides financing for direct purchases of finan-

cial assets originated and serviced by SunTrust’s corporate cus-

tomers.Three Pillars finances this activity by issuing A-1/P-1 rated

commercial paper.The result is a favorable funding arrangement for

these SunTrust customers.

In January 2003, the FASB issued FIN 46, “Consolidation of Variable

Interest Entities,” which addressed the criteria for the consoli-

dation of off-balance sheet entities similar to Three Pillars. Under

the provisions of FIN 46, SunTrust consolidated Three Pillars as of

July 1, 2003.

In December 2003, the FASB issued a revision to FIN 46 (FIN 46(R))

which replaced the Interpretation issued in January 2003. FIN 46(R)

is effective for reporting periods ending after March 15, 2004. As of

March 31, 2004, the Company adopted all the provisions of FIN

46(R), and the adoption did not have a material impact on the

Company’s financial position or results of operations.

On March 1, 2004, Three Pillars was restructured through the

issuance of a subordinated note to a third party. Under the terms of

the subordinated note, the holder of the note will absorb the major-

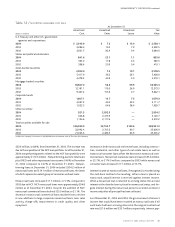

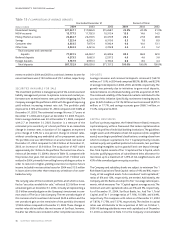

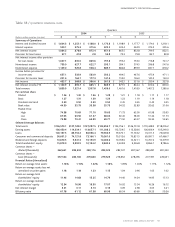

Table 17 / UNFUNDED LENDING COMMITMENTS

(Dollars in millions) At December 31, 2004 At December 31, 2003

Unused lines of credit

Commercial $37,316.5 $36,694.4

Mortgage commitments114,710.5 10,665.8

Home equity lines 12,120.6 7,792.2

Commercial real estate 5,938.5 3,650.0

Commercial paper conduit 5,902.9 —

Commercial credit card 986.6 576.4

Total unused lines of credit $76,975.6 $59,378.8

Letters of credit

Financial standby $10,560.0 $ 9,385.8

Performance standby 416.0 265.8

Commercial 149.1 191.6

Total letters of credit $11,125.1 $ 9,843.2

1Includes $3.8 billion and $2.8 billion in interest rate locks accounted for as derivatives at December 31, 2004 and 2003, respectively.