SunTrust 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 75

Impairment for MSRs is determined based on the fair value of the

rights, stratified according to interest rate and type of related loan.

Impairment, if any, is recognized through a valuation allowance

with a corresponding charge recorded in the income statement.

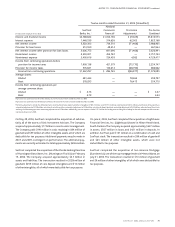

LOAN SALES AND SECURITIZATIONS

The Company sells residential mortgages and other loans and has

securitized mortgage loans. Retained interests in securitized assets,

including debt securities, are recorded as securities available for sale

at their allocated carrying amounts based on the relative fair value

of assets sold and retained. Retained interests are subsequently

carried at fair value, which is generally estimated based on the pres-

ent value of expected cash flows, calculated using management’s

best estimates of key assumptions, including credit losses, loan

repayment speeds and discount rates commensurate with the risks

involved. Gains or losses on sales as well as servicing fees are

recorded in noninterest income.

INCOME TAXES

The provision for income taxes is based on income and expense

reported for financial statement purposes after adjustment for per-

manent differences such as tax-exempt income. Deferred income

tax assets and liabilities result from differences between assets and

liabilities measured for financial reporting purposes and for income

tax return purposes. These assets and liabilities are measured using

the enacted tax rates and laws that are currently in effect.

Subsequent changes in the tax laws will require adjustment to these

assets and liabilities with the cumulative effect included in the cur-

rent year’s income tax provision. Recognition of deferred tax assets

is based on management’s belief that it is more likely than not that

the tax benefit associated with certain temporary differences and

tax credits will be realized. A valuation allowance would be

recorded for the amount of the deferred tax item for which it is

more likely than not that realization will not occur. The Company

periodically evaluates the merits and risks of its income tax posi-

tions based on current legislative, judicial, and regulatory guidance.

Based on this evaluation, changes are recorded as appropriate.

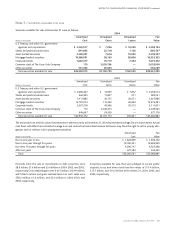

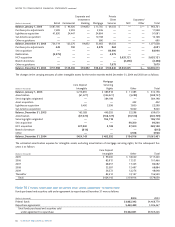

EARNINGS PER SHARE

Basic earnings per share are based on the weighted-average number

of common shares outstanding during each period. Diluted earn-

ings per share are based on the weighted-average number of com-

mon shares outstanding during each period, plus common shares

calculated for stock options and performance restricted stock out-

standing using the treasury stock method.

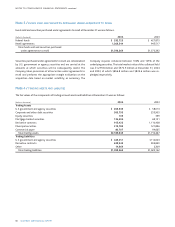

CASH FLOWS

For purposes of reporting cash flows, cash and cash equivalents

include only cash and due from banks, interest-bearing deposits in

other banks and funds sold and securities purchased under agree-

ments to resell with an original maturity of three months or less.

DERIVATIVE FINANCIAL INSTRUMENTS

It is the policy of the Company to record all derivative financial

instruments at fair value in the financial statements. The Company

uses derivative instruments to hedge interest rate exposure by

modifying the characteristics of the related balance sheet instru-

ments. Derivatives that do not qualify as hedges,and those transac-

tions for which the Company has elected not to adopt hedge

accounting, are carried at their current market value on the balance

sheet and changes in their fair value are recorded as trading income

in the current period.

Under the provisions of SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” and SFAS No. 149,“Amend-

ment of Statement 133 on Derivative Instruments and Hedging

Activities,” on the date that a derivative contract is entered into,the

Company prepares written hedge documentation, identifying the

risk management objective, and designating the derivative as (1) a

hedge of the fair value of a recognized asset or liability or of an

unrecognized firm commitment (fair value hedge); (2) a hedge of a

forecasted transaction or of the variability of cash flows to be

received or paid related to a recognized asset or liability (cash flow

hedge); (3) a foreign currency fair value or cash flow hedge (foreign

currency hedge); or (4) held for trading (trading instruments). All

transactions designated as accounting hedges must first be deemed

effective using the correlation method. Additionally, transactions

which do not qualify for the shortcut method of hedge accounting

are reviewed quarterly for ongoing effectiveness. Transactions

which are not deemed effective are removed from accounting

hedge classification.

Changes in the fair value of a derivative that is highly effective, and

that has been designated and qualifies as a fair value hedge, along

with the loss or gain on the hedged asset or liability that is attribut-

able to the hedged risk (including losses or gains on firm commit-

ments), are recorded in current period earnings. Changes in the fair

value of a derivative that is highly effective, and that is designated

and qualifies as a cash flow hedge, are recorded in other compre-

hensive income, with any ineffective portion recorded in current

period earnings.Cash flow hedges of forecasted transactions, which

are no longer deemed likely to occur, are reclassified out of other

comprehensive income and into current period interest income or

expense related to the originally hedged item. Changes in the fair

value of derivative trading instruments are reported in current

period earnings. For additional information on the Company’s deriv-

ative activities, refer to Note 17 to the Consolidated Financial

Statements.

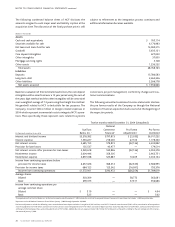

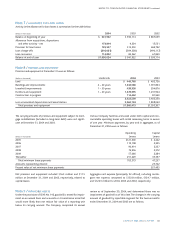

STOCK-BASED COMPENSATION

The Company sponsors stock option plans under which incentive

and nonqualified stock options may be granted periodically to cer-

tain employees. The Company’s stock options typically have an

exercise price equal to the fair value of the stock on the date of the

grant and typically vest over three years.The Company accounts for

all awards granted after January 1, 2002 under the fair-value recog-

nition provisions of SFAS No. 123, “Accounting for Stock-Based

Compensation.” The required disclosures related to the Company’s