SunTrust 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 SUNTRUST 2004 ANNUAL REPORT

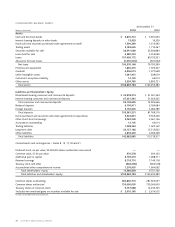

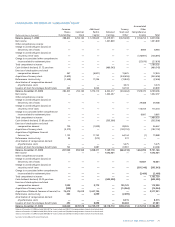

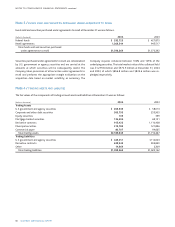

CONSOLIDATED BALANCE SHEETS

At December 31

(Dollars in thousands) 2004 2003

Assets

Cash and due from banks $ 3,876,741 $ 3,931,653

Interest-bearing deposits in other banks 15,929 16,329

Funds sold and securities purchased under agreements to resell 1,596,269 1,373,392

Trading assets 2,183,645 1,710,467

Securities available for sale128,941,080 25,606,884

Loans held for sale 6,580,223 5,552,060

Loans 101,426,172 80,732,321

Allowance for loan losses (1,050,024) (941,922)

Net loans 100,376,148 79,790,399

Premises and equipment 1,860,415 1,595,307

Goodwill 6,806,013 1,077,638

Other intangible assets 1,061,451 639,619

Customers’ acceptance liability 12,105 63,014

Other assets 5,559,765 3,893,721

Total assets $158,869,784 $125,250,483

Liabilities and Shareholders’ Equity

Noninterest-bearing consumer and commercial deposits $ 24,878,314 $ 21,001,324

Interest-bearing consumer and commercial deposits 67,231,381 51,923,322

Total consumer and commercial deposits 92,109,695 72,924,646

Brokered deposits 6,100,911 3,184,084

Foreign deposits 5,150,645 5,080,789

Total deposits 103,361,251 81,189,519

Funds purchased and securities sold under agreements to repurchase 9,342,831 9,505,246

Other short-term borrowings 2,062,549 4,061,146

Acceptances outstanding 12,105 63,014

Trading liabilities 1,098,563 1,020,142

Long-term debt 22,127,166 15,313,922

Other liabilities 4,878,420 4,366,328

Total liabilities 142,882,885 115,519,317

Commitments and contingencies – Notes 8, 13, 17, 18 and 21

Preferred stock, no par value; 50,000,000 shares authorized; none issued ——

Common stock, $1.00 par value 370,578 294,163

Additional paid in capital 6,749,219 1,288,311

Retained earnings 8,118,710 7,149,118

Treasury stock and other (528,558) (664,518)

Accumulated other comprehensive income 1,276,950 1,664,092

Total shareholders’ equity 15,986,899 9,731,166

Total liabilities and shareholders’ equity $158,869,784 $125,250,483

Common shares outstanding 360,840,710 281,923,057

Common shares authorized 750,000,000 750,000,000

Treasury shares of common stock 9,737,688 12,239,700

1Includes net unrealized gains on securities available for sale $ 2,010,165 $ 2,614,512

See notes to Consolidated Financial Statements.