SunTrust 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

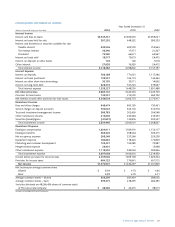

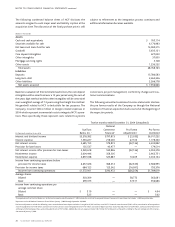

(Dollars in thousands)

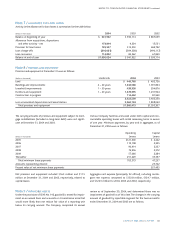

Assets

Cash and cash equivalents $ 765,114

Securities available for sale 6,176,983

Net loans and loans held for sale 14,585,315

Goodwill 5,635,121

Core deposit intangibles 327,000

Other intangibles 37,000

Mortgage servicing rights 5,108

Other assets 1,236,522

Total assets 28,768,163

Liabilities

Deposits 15,780,583

Long-term debt 3,364,336

Other liabilities 2,266,578

Net assets acquired $ 7,356,666

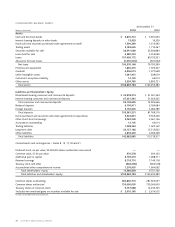

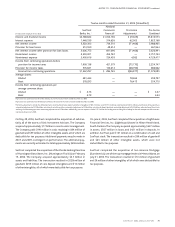

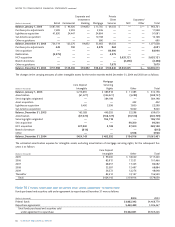

Twelve months ended December 31, 2004 (Unaudited)

National

SunTrust Commerce Pro Forma Pro Forma

(In thousands except per share data) Banks, Inc.1Financial2Adjustments3Combined

Interest and dividend income $5,218,382 $797,873 $ (5,033) $6,011,222

Interest expense 1,533,227 218,000 27,103 1,778,330

Net interest income 3,685,155 579,873 (32,136) 4,232,892

Provision for loan losses 135,537 43,977 — 179,514

Net interest income after provision for loan losses 3,549,618 535,896 (32,136) 4,053,378

Noninterest income 2,604,446 358,305 — 2,962,751

Noninterest expense 3,897,038 525,887 10,209 4,433,134

Income from continuing operations before

provision for income taxes 2,257,026 368,314 (42,345) 2,582,995

Provision for income taxes 684,125 125,342 (16,091) 793,376

Income from continuing operations $1,572,901 $242,972 $(26,254) $1,789,619

Average shares:

Diluted 303,309 — 58,772 362,081

Basic 299,375 — 57,311 356,686

Income from continuing operations per

average common share:

Diluted $ 5.19 — — $ 4.94

Basic 5.25 — — 5.02

1The reported results of SunTrust Banks, Inc. for the twelve months ended December 31, 2004 include the results of the acquired National Commerce Financial from the October 1, 2004 acquisition date.

2Represents results of National Commerce Financial from January 1,2004 through September 30, 2004.

3Pro forma adjustments include the following items: amortization of core deposit and other intangibles of $49.3 million, net of NCF’s historical amortization of $39.1 million, amortization of loan purchase

accounting adjustment of $7.0 million, accretion of securities purchase accounting adjustment of $1.9 million, accretion of deposit purchase accounting adjustment of $3.9 million, and acccretion of short-term

and long-term borrowings purchase accounting adjustments of $5.7 million.Additionally, interest expense includes $36.7 million for funding costs as though the funding for the cash component of the transac-

tion occurred January 1, 2004.

The following condensed balance sheet of NCF discloses the

amounts assigned to each major asset and liability caption at the

acquisition date.The allocation of the final purchase price is still

subject to refinement as the integration process continues and

additional information becomes available.

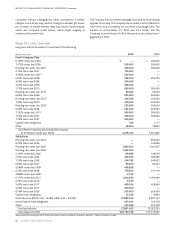

Based on a valuation of their estimated useful lives,the core deposit

intangibles will be amortized over a 10 year period using the sum of

the years digit method and the other intangibles will be amortized

over a weighted average of 7.3 years using the straight line method.

No goodwill related to NCF is deductible for tax purposes. The

Company incurred $28.4 million in merger-related expenses in

2004 which represent incremental costs to integrate NCF’s opera-

tions. More specifically, these represent costs related to systems

conversions, project management, conformity changes and cus-

tomer communications.

The following unaudited condensed income statements disclose

the pro forma results of the Company as though the National

Commerce Financial acquisition had occurred at the beginning of

the respective periods.