SunTrust 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

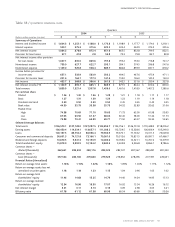

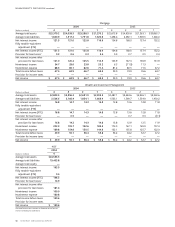

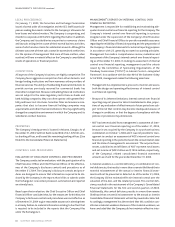

Table 21 / SUMMARY OF LOAN LOSS EXPERIENCE,NONPERFORMING ASSETS AND ACCRUING LOANS

PAST DUE 90 DAYS OR MORE

Quarters

2004 2003

(Dollars in millions) 43214321

Allowance for Loan Losses

Balance – beginning of quarter $ 893.0 $902.2 $937.0 $941.9 $941.4 $ 940.9 $ 931.1 $930.1

Allowance from acquisitions and

other activity – net 173.8 — — — — — 9.3 —

Provision for loan losses 37.1 41.8 2.8 53.8 70.3 79.8 82.7 80.8

Charge-offs (85.8) (78.2) (67.2) (84.8) (90.6) (103.6) (100.3) (99.9)

Recoveries 31.9 27.2 29.6 26.1 20.8 24.3 18.1 20.1

Balance – end of quarter $1,050.0 $893.0 $902.2 $937.0 $941.9 $ 941.4 $ 940.9 $931.1

Ratios

Allowance to quarter-end loans 1.04% 1.06% 1.09% 1.18% 1.17% 1.19% 1.25% 1.26%

Allowance to nonperforming loans 281.3 315.7 299.7 309.7 268.1 217.6 194.8 179.0

Net loan charge-offs to average loans

(annualized) 0.21 0.24 0.19 0.30 0.35 0.40 0.44 0.44

Provision to average loans (annualized) 0.15 0.20 0.01 0.27 0.35 0.41 0.45 0.45

Recoveries to total charge-offs 37.2 34.8 44.1 30.8 23.0 23.5 18.0 20.1

Nonperforming Assets

Nonaccrual loans $ 354.2 $263.2 $282.9 $283.9 $336.5 $ 423.3 $ 480.6 $520.1

Restructured loans 19.1 19.7 18.2 18.7 14.8 9.2 2.5 —

Total nonperforming loans 373.3 282.9 301.1 302.6 351.3 432.5 483.1 520.1

Other real estate owned 28.6 10.9 14.2 18.4 16.5 19.6 20.9 18.0

Other repossessed assets 8.8 10.4 9.1 10.9 10.3 11.7 11.4 10.3

Total nonperforming assets $ 410.7 $304.2 $324.4 $331.9 $378.1 $ 463.8 $ 515.4 $548.4

Ratios

Nonperforming loans to total loans 0.37 0.33 0.36 0.38 0.44 0.55 0.64 0.70

Nonperforming assets to total loans plus

OREO and other repossessed assets 0.40 0.36 0.39 0.42 0.47 0.59 0.68 0.74

Accruing Loans Past Due

90 Days or More $ 214.3 $175.8 $157.1 $173.5 $196.4 $ 228.2 $ 157.1 $165.3

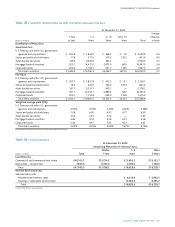

$212.4 billion, which included $24.9 billion in non-managed corpo-

rate trust assets, $39.3 billion in non-managed trust assets, and

$25.5 billion in retail brokerage assets.

Noninterest expense increased $37.7 million, or 28.5%. In addition

to expenses associated with Seix, sales staff additions and increased

incentive expense contributed to the increase.

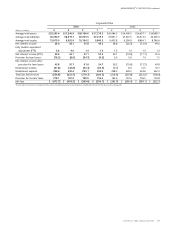

CORPORATE/OTHER

Corporate/Other’s loss before taxes was $254.6 million compared

to a loss of $218.9 million in the fourth quarter of 2003.The fourth

quarter loss was $35.7 million, or 16.3%, larger than the prior year’s

fourth quarter loss.

Net interest income declined $0.5 million, or 1.7%, due to higher

matched-maturity funds transfer pricing allocated to the lines

of business.

The loan loss provision declined $17.1 million, compared to the

fourth quarter of 2003, as a result of improved credit quality and

the difference between the Company’s consolidated provision and

net charge-offs.

Noninterest income was $42.1 million, or 434.0%, worse than the

prior year.The primary driver of the difference was security losses of

$20.2 million in the fourth quarter of 2004 versus security gains of

$18.7 million in the fourth quarter of 2003.The security losses were

primarily from selling lower-yielding securities in order to reinvest

in higher-yielding securities to improve future income.

Noninterest expense was $10.2 million, or 4.3%, higher in 2004

than prior year.The increase was due to merger-related expenses of

$23.7 million for systems conversions, project management,

conformity changes, and customer communications related to the

NCF acquisition.