SunTrust 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

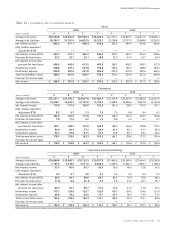

50 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

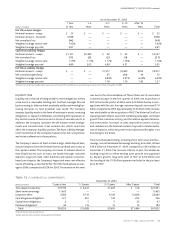

loans increased $2.9 billion, or 11.6%. Average deposits increased

$2.9 billion, or 5.4%.

With improvements in credit quality, charge-offs decreased $14.7

million, or 28.2%. Noninterest income increased $14.6 million, or

7.5%.The change was driven by higher service charges on deposit

accounts and an increase in debit card interchange volume.

Noninterest expense increased $23.9 million, or 8.8%.The higher

expense level is primarily attributable to investments in the retail

distribution network and technology.

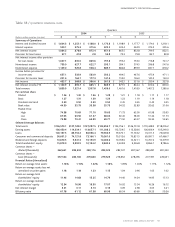

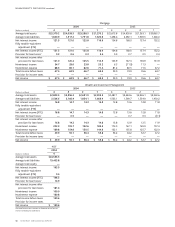

COMMERCIAL

Commercial’s total income before taxes for the quarter ended

December 31, 2004 was $178.3 million, an increase of $16.2 mil-

lion, or 10.0%, compared to the same period in 2003. Higher net

interest income, lower charge-offs, and higher noninterest income

contributed to the increase.

Net interest income increased $15.9 million, or 9.5%.Average loans

increased $1.5 billion, or 6.8%, while average deposits increased

$1.8 billion, or 16.4%. Loan growth was spread across most of the

commercial loan portfolios.The growth in deposits was attributed

to increased client liquidity.

Net charge-offs decreased $7.8 million, or 81.3%, and remained at

historically low levels with overall credit quality remaining strong.

Noninterest income increased $10.4 million, or 12.9%, which was

primarily driven by additional Affordable Housing activities most of

which related to the continued consolidation of newly formed

Affordable Housing partnerships.

Noninterest expense increased $17.9 million, or 23.3%. $10.4 mil-

lion of the increase was due to additional Affordable Housing activi-

ties, most of which related to the continued consolidation of newly

formed Affordable Housing partnerships. The remainder of the

increase was primarily related to technology investments.

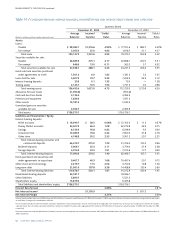

CORPORATE AND INVESTMENT BANKING

CIB’s total income before taxes for the quarter ended December 31,

2004 was $144.4 million, an increase of $15.9 million, or 12.4%,

compared to the same period in 2003. Strong performances in

derivatives, securitizations and syndicated finance offset by a

decline in net interest income contributed to that increase.

Net interest income decreased $20.7 million, or 25.8%. Excluding

the impact of the commercial paper conduit loans being on balance

sheet at the quarter ended December 31, 2003, corporate banking

loans were down approximately $374 million, or 3.9%.The decline

was primarily due to soft corporate loan demand and a reduction in

the usage of revolving credit lines. Net charge-offs decreased $7.8

million, or 118.2%, as net charge-offs returned to levels experi-

enced prior to the most recent economic downturn.

Noninterest income increased $35.2 million, or 25.5%.The increase

was primarily driven by an increase in securitizations, derivatives,

foreign exchange and syndicated finance fee income.The remainder

of the increase was the result of higher merchant banking revenue.

Noninterest expense increased $6.4 million, or 7.7%.The increase

was primarily due to an increase in asset impairment reserves

in SunTrust Equity Partners, which are carried at lower of cost

or market.

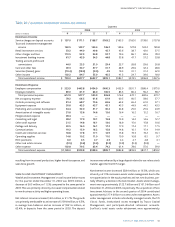

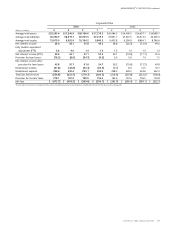

MORTGAGE

Mortgage’s total income before taxes for the quarter ended

December 31, 2004 was $67.4 million, an increase of $8.4 million, or

14.2%, compared to the same period in 2003. Earnings from higher

residential portfolio and servicing balances more than offset

the decline in earnings as a result of fewer loan sales to the

secondary market.

Net interest income decreased $13.5 million, or 10.0%.The primary

driver of this decrease was lower income from mortgage loans held

for sale which was only partially offset by higher income from resi-

dential mortgage loans held for investment and deposits. Mortgage

loans held for sale average balance decreased $1.8 billion, or 27.0%.

Combined with compressed margins, net interest income from

mortgage loans held for sale declined $27.4 million, or 39.7%.Total

average loans, principally residential mortgages held for invest-

ment, increased $4.6 billion, or 31.3%.This increase drove a $12.0

million, or 20.0%, increase in net interest income.Additionally, aver-

age deposit balances were up $91.9 million, or 7.0%, and con-

tributed $1.6 million to net interest income.

Net charge-offs decreased $0.6 million, or 66.7%. Noninterest

income increased $28.4 million, which was driven by both higher

mortgage production and mortgage servicing income. Mortgage

production was $7.9 billion in the quarter, up $1.7 billion, or 26.3%,

from the fourth quarter of 2003.The increase in mortgage produc-

tion income was driven primarily by lower hedge costs, which was

offset by lower net interest income on loans held for sale. Partially

offsetting this increase was a decrease in income from loans sold to

the secondary market. Loans sold to the secondary market were

down $1.1 billion, or 23.3%, from the fourth quarter of 2003.

Servicing income improved $7.8 million due to increased fees

from higher servicing balances and lower mortgage servicing

rights amortization. The servicing portfolio was $77.7 billion at

December 31, 2004 compared with $69.0 billion at December 31,

2003, up 12.6%.

Noninterest expense increased $7.1 million, or 8.7%.The primary

drivers of the increased expense were higher personnel expense and

expenditures related to sales promotion and growth initiatives.

Personnel expense was up due to higher commission expense