SunTrust 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 89

In the opinion of management, it is more likely than not that all of

the deferred tax assets will be realized; therefore, a valuation

allowance is not necessary.

SunTrust and its subsidiaries file consolidated income tax returns

where permissible or required. Each subsidiary generally remits cur-

rent taxes to or receives current refunds from the Parent Company

based on what would be required had the subsidiary filed an income

tax return as a separate entity. The Company’s federal and state

income tax returns are subject to review and examination by gov-

ernment authorities. Various examinations are now in progress.

Examinations settled in 2004 resulted in a $14.2 million reduction

in income tax expense. In the opinion of management, any future

adjustments which may result from these examinations should not

have a material adverse effect on the Company’s Consolidated

Financial Statements.

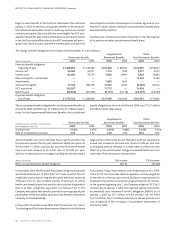

Note 16 / EMPLOYEE BENEFIT PLANS

SunTrust sponsors various incentive plans for eligible employees.

The Management Incentive Plan for key executives provides for

annual cash awards, if any, based on the attainment of Company

profit plan and revenue goals, and the achievement of business unit,

as well as, individual performance objectives.The Performance Unit

Plan (PUP) for key executives provides awards, if any, based on

multi-year earnings performance in relation to earnings goals

established by the Compensation Committee (Committee) of the

Company’s Board of Directors.

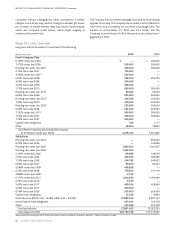

The Company also sponsors an Executive Stock Plan (Stock Plan)

under which the Committee has the authority to grant stock

options, Restricted Stock and Performance based Restricted Stock

(Performance Stock) to key employees of the Company. For the

2004 Stock Plan, the Company has 14 million shares of common

stock reserved for issuance, of which no more than 2.8 million

shares may be issued as Restricted Stock. Options granted are at no

less than the fair market value of a share of stock on the grant date

and may be either tax-qualified incentive stock options or non-

qualified options. Prior to 2002, the Company did not record

expense as a result of the grant or exercise of any of the stock

options. Effective January 1, 2002, the Company adopted prospec-

tively the fair-value recognition approach and began expensing the

cost of stock options.

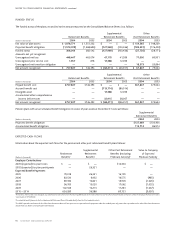

With respect to Performance Stock, shares must be granted,

awarded and vested before participants take full title. After

Performance Stock is granted by the Committee, specified portions

are awarded based on increases in the average market value of

SunTrust common stock from the initial price specified by the

Committee.Awards are distributed on the earliest of (i) fifteen years

after the date shares are awarded to participants; (ii) the participant

attaining age 64; (iii) death or disability of a participant; or (iv) a

change in control of the Company as defined in the Stock Plan.

Dividends are paid on awarded but unvested Performance Stock,

and participants may exercise voting privileges on such shares.

The compensation element for Performance Stock (which is

deferred and shown as a reduction of shareholders’ equity) is equal

to the fair market value of the shares at the date of the award and is

amortized to compensation expense over the period from the

award date to age 64 or the 15th anniversary of the award date

whichever comes first. Approximately 40% of Performance Stock

awarded fully vested on February 10, 2000 and is no longer subject

to the forfeiture condition set forth in the agreements.This early

vested Performance Stock was converted into an equal number of

“Phantom Stock Units” as of that date. Payment of Phantom Stock

Units will be made to participants in shares of SunTrust stock upon

the earlier to occur of (1) the date on which the participant would

have vested in his or her Performance Stock or (2) the date of a

change in control. Dividend equivalents will be paid at the same rate

as the shares of Performance Stock; however, these units will not

carry voting privileges.

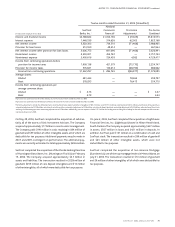

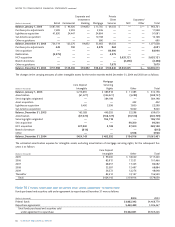

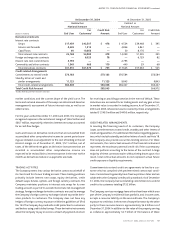

Compensation expense related to the incentive plans for the three years ended December 31 were as follows:

(Dollars in thousands) 2004 2003 2002

401(k) Plan $49,046 $44,090 $43,670

Management Incentive Plan and Performance Unit Plan 55,027 29,849 (5,664)

Performance Stock 8,515 5,475 3,074