SunTrust 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

pated in a rising rate environment as clients earn a higher credit on

their deposits.

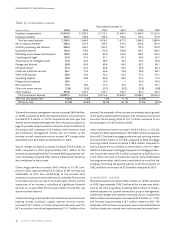

Noninterest expense increased $67.8 million, or 23.8%. Affordable

Housing activities, primarily related to the consolidation of certain

Affordable Housing partnerships as a result of the Company becom-

ing the general partner in the third quarter 2003, accounted for

$45.9 million of the increase.The remainder of the increase was pri-

marily related to technology investments.

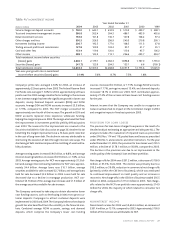

CORPORATE AND INVESTMENT BANKING

CIB’s total income before taxes for the year ended December 31,

2004 was $538.6 million, an increase of $114.6 million, or 27.0%,

compared to 2003.A significant improvement in net charge-offs

and noninterest income contributed to the increase.

Net interest income decreased $36.3 million, or 12.2%, which was

primarily driven by a $2.4 billion, or 14.9%, decline in average loan

balances due to a weaker corporate loan demand and lower usage

of revolving credit lines.

Net charge-offs decreased $98.5 million, or 85.7%, as net charge-

offs returned to levels experienced prior to the most recent eco-

nomic downturn.

Noninterest income increased $67.6 million, or 12.3%, which was

driven by an increase in revenues from merchant banking coupled

with an increase in equity capital markets revenue.

Noninterest expense increased $15.2 million, or 4.9%, which was

due primarily to an increase in personnel expense of $11.8 million,

or 6.1%.The increase in personnel expense was driven by increased

variable compensation associated with increased fee income.

MORTGAGE

Mortgage’s total income before taxes for the year ended December

31, 2004 was $261.4 million, a decrease of $13.9 million, or 5.0%,

compared to 2003. Declines in production income were only par-

tially offset by increased earnings due to both lower servicing amor-

tization and higher servicing fees, as well as higher income from

growth in the residential mortgage portfolio.

Net interest income decreased $87.5 million, or 15.3%.The primary

driver of this decrease was lower income from mortgage loans held

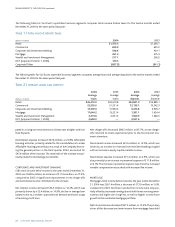

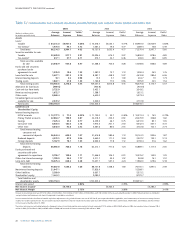

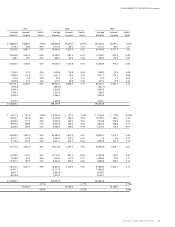

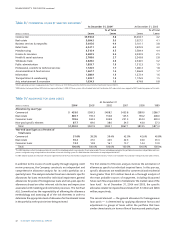

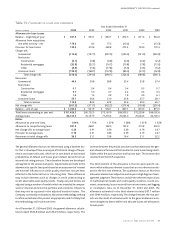

The following table for SunTrust’s reportable business segments compares total income before taxes for the twelve months ended

December 31, 2004 to the same period last year:

TABLE 1 / TOTAL INCOME BEFORE TAXES

(Dollars in millions) 2004 2003

Retail $1,375.3 $1,260.7

Commercial 659.9 635.2

Corporate and Investment Banking 538.6 424.1

Mortgage 261.4 275.3

Wealth and Investment Management 217.1 200.2

NCF (acquired October 1, 2004) 120.5 —

Corporate/Other (857.5) (841.3)

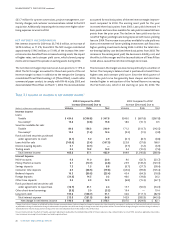

The following table for SunTrust’s reportable business segments compares average loans and average deposits for the twelve months ended

December 31, 2004 to the same period last year:

TABLE 2 / AVERAGE LOANS AND DEPOSITS

2004 2003 2004 2003

Average Average Average Average

(Dollars in millions) loans loans deposits deposits

Retail $26,419.0 $23,619.8 $54,841.0 $52,889.1

Commercial 22,500.0 21,251.4 12,139.1 10,542.3

Corporate and Investment Banking 13,539.0 15,906.4 3,233.8 2,909.7

Mortgage 17,644.2 13,221.4 1,381.1 1,634.4

Wealth and Investment Management 2,273.6 2,001.2 1,960.9 1,480.5

NCF (acquired October 1, 2004) 3,659.0 —3,941.6 —