SunTrust 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 87

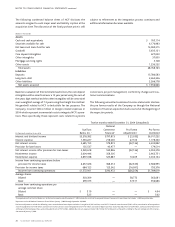

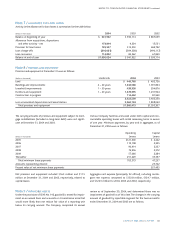

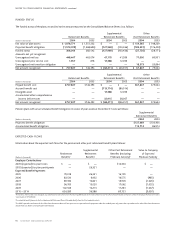

Principal amounts due for the next five years on long-term debt are:

2005 – $3,584.6 million; 2006 – $2,838.7 million; 2007 – $885.4

million; 2008 – $2,979.9 million; and 2009 – $1,134.2 million.

Restrictive provisions of several long-term debt agreements pre-

vent the Company from creating liens on, disposing of, or issuing

(except to related parties) voting stock of subsidiaries. Further,

there are restrictions on mergers, consolidations, certain leases,

sales or transfers of assets, minimum shareholders’equity, and max-

imum borrowings by the Company. As of December 31, 2004, the

Company was in compliance with all covenants and provisions of

long-term debt agreements. Long-term debt of $1,884.0 million

and $1,650.0 million as of December 31, 2004 and 2003, re-

spectively, qualified as Tier 1 capital.As currently defined by federal

bank regulators, long-term debt of $2,404.2 million and $2,380.7

million as of December 31, 2004 and 2003, respectively, qualified as

Tier 2 capital.

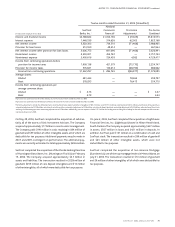

Note 14 / CAPITAL

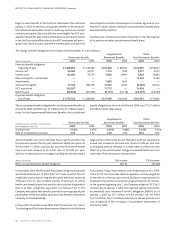

The Company is subject to various regulatory capital requirements

which involve quantitative measures of the Company’s assets,

liabilities, and certain off-balance sheet items. The Company’s

capital requirements and classification are ultimately subject to

qualitative judgments by the regulators about components, risk

weightings, and other factors.The Company and its subsidiary banks

are subject to a minimum Tier 1 capital ratio (Tier 1 capital to risk-

weighted assets) of 4%, total capital ratio (Tier 1 plus Tier 2 to risk-

weighted assets) of 8% and Tier 1 leverage ratio (Tier 1 to average

quarterly assets) of 3%.To be considered a “well capitalized” insti-

tution, the Tier 1 capital ratio, the total capital ratio, and the Tier 1

leverage ratio must equal or exceed 6%, 10%, and 5%, respectively.

Included in Tier 1 capital is $451 million of preferred shares issued

by real estate investment trust subsidiaries. These amounts are

included in other liabilities in the Consolidated Balance Sheets.

Management believes, as of December 31, 2004, that the Company

meets all capital adequacy requirements to which it is subject.

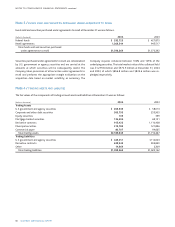

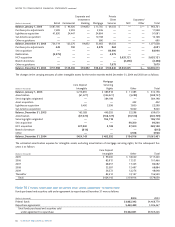

A summary of Tier 1 and Total capital and the Tier 1 leverage ratio

for the Company and its principal subsidiaries as of December 31 is

as follows:

2004 2003

(Dollars in millions) Amount Ratio Amount Ratio

SunTrust Banks, Inc.

Tier 1 capital $ 9,784 7.16% $ 8,930 7.85%

Total capital 14,153 10.36 13,366 11.75

Tier 1 leverage 6.64 7.37

SunTrust Bank

Tier 1 capital 9,162 7.80 8,883 7.92

Total capital 12,539 10.67 12,176 10.85

Tier 1 leverage 7.27 7.35

NBC

Tier 1 capital 1,483 8.84

Total capital 1,766 10.53

Tier 1 leverage 6.80

Substantially all the Company’s retained earnings are undistributed

earnings of the Banks, which are restricted by various regulations

administered by federal and state bank regulatory authorities.

Retained earnings of the Banks available for payment of cash divi-

dends to the Bank Parent Company under these regulations totaled

approximately $544 million at December 31, 2004.

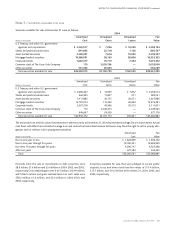

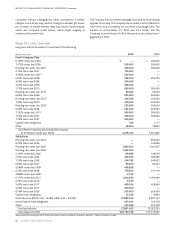

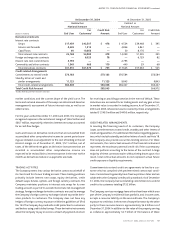

In the calculation of basic and diluted EPS, net income is identical.

Shares of 5.3 million, 2.2 million, and 8.9 million for the years ended

December 31, 2004, 2003, and 2002, respectively, were excluded in

the computation of average shares because they would have been

antidilutive. Below is a reconciliation for the three years ended

December 31, 2004, of the difference between average basic

common shares outstanding and average diluted common shares

outstanding.

(Shares in thousands) 2004 2003 2002

Average common shares – basic 299,375 278,295 282,495

Effect of dilutive securities

Stock options 2,154 1,166 1,681

Performance restricted stock 1,780 1,973 1,876

Average common shares – diluted 303,309 281,434 286,052