SunTrust 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

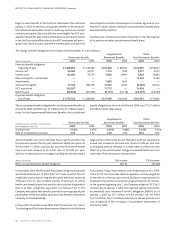

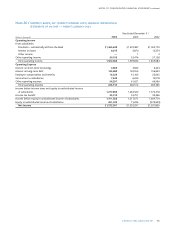

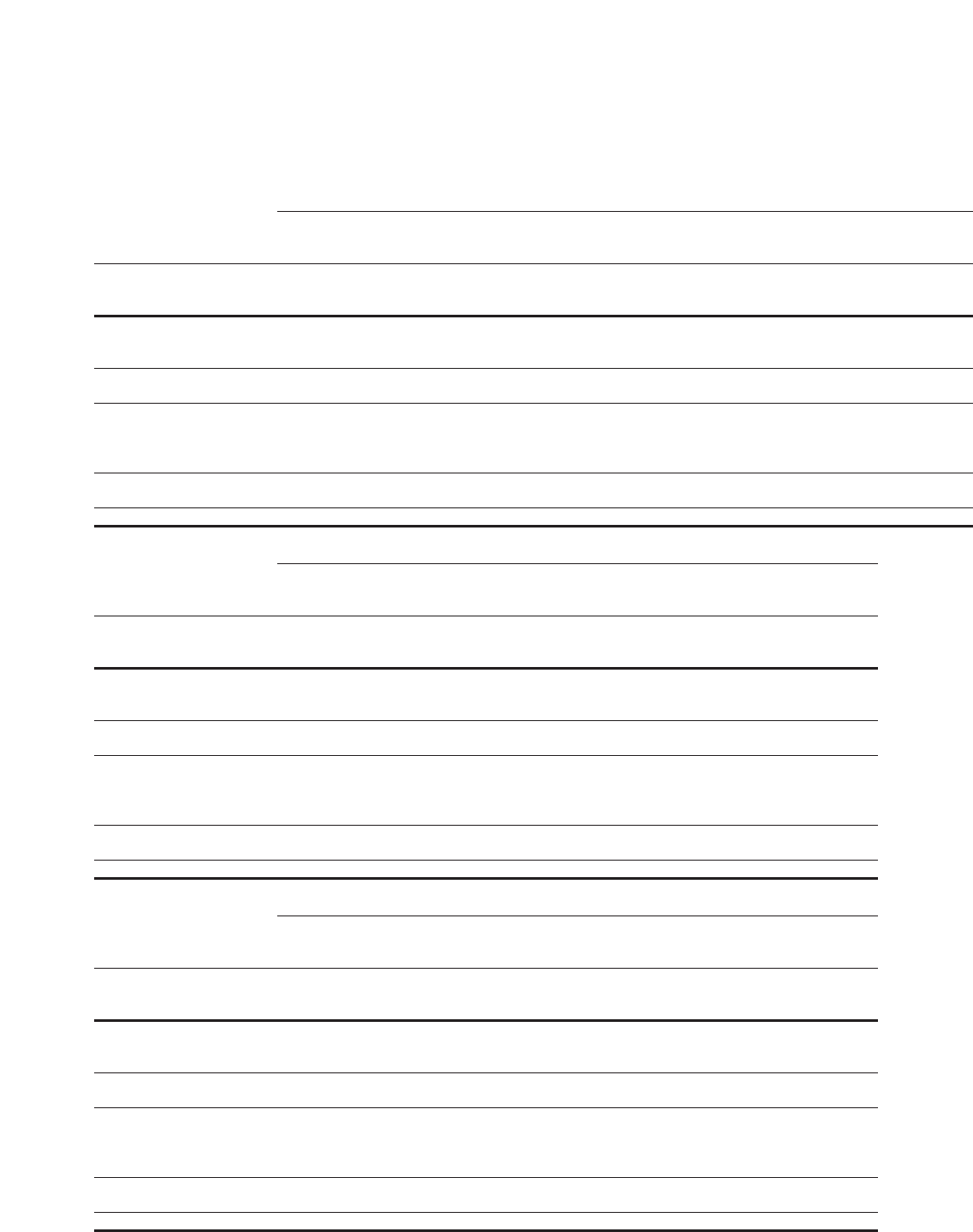

The tables below disclose selected financial information for SunTrust’s reportable business segments for the twelve months ended

December 31, 2004, 2003, and 2002.

Twelve Months Ended December 31, 2004

Corporate & Wealth and

Investment Investment Corporate/

(Dollars in thousands) Retail Commercial Banking Mortgage Management NCF Other Consolidated

Average total assets $29,467,302 $24,653,432 $19,281,182 $23,505,768 $2,686,121 $6,171,907 $27,988,581 $133,754,293

Average total liabilities 54,942,949 12,482,582 7,526,233 1,547,700 2,049,187 4,877,970 38,858,190 122,284,811

Average total equity — — — — — — 11,469,482 11,469,482

Net interest income $ 1,855,157 $ 674,904 $ 244,392 $ 485,020 $ 60,629 $ 195,966 $ 169,087 $ 3,685,155

Fully taxable-equivalent

adjustment (FTE) 78 31,538 16,236 — 8 353 10,185 58,398

Net interest income (FTE)11,855,235 706,442 260,628 485,020 60,637 196,319 179,272 3,743,553

Provision for loan losses2138,520 25,017 16,497 3,676 531 14,900 (63,604) 135,537

Net interest income after

provision for loan losses 1,716,715 681,425 244,131 481,344 60,106 181,419 242,876 3,608,016

Noninterest income 817,618 331,695 618,640 107,424 776,428 99,986 (147,345) 2,604,446

Noninterest expense 1,159,048 353,176 324,128 327,361 619,415 160,845 953,065 3,897,038

Total contribution before taxes 1,375,285 659,944 538,643 261,407 217,119 120,560 (857,534) 2,315,424

Provision for income taxes3— — — — — — 742,523 742,523

Net income $ 1,375,285 $ 659,944 $ 538,643 $ 261,407 $ 217,119 $ 120,560 $ (1,600,057) $ 1,572,901

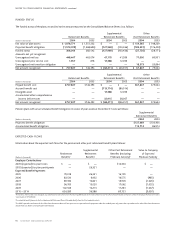

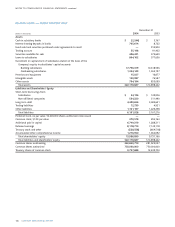

Twelve Months Ended December 31, 2003

Corporate & Wealth and

Investment Investment Corporate/

(Dollars in thousands) Retail Commercial Banking Mortgage Management Other Consolidated

Average total assets $26,623,936 $23,257,092 $22,386,296 $22,509,803 $2,301,156 $25,247,078 $122,325,361

Average total liabilities 53,036,587 10,754,043 9,081,569 1,800,908 1,529,679 37,039,549 113,242,335

Average total equity — — — — — 9,083,026 9,083,026

Net interest income $ 1,746,158 $ 625,979 $ 283,538 $ 572,501 $ 51,982 $ 40,145 $ 3,320,303

Fully taxable-equivalent

adjustment (FTE) 71 26,316 13,369 — 11 5,247 45,014

Net interest income (FTE)11,746,229 652,295 296,907 572,501 51,993 45,392 3,365,317

Provision for loan losses2171,185 19,494 114,965 2,479 928 4,499 313,550

Net interest income after

provision for loan losses 1,575,044 632,801 181,942 570,022 51,065 40,893 3,051,767

Noninterest income 761,068 287,795 551,029 5,698 664,677 32,734 2,303,001

Noninterest expense 1,075,396 285,361 308,896 300,460 515,575 914,928 3,400,616

Total contribution before taxes 1,260,716 635,235 424,075 275,260 200,167 (841,301) 1,954,152

Provision for income taxes3— — — — — 621,855 621,855

Net income $ 1,260,716 $ 635,235 $ 424,075 $ 275,260 $ 200,167 $ (1,463,156) $ 1,332,297

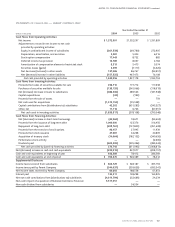

Twelve Months Ended December 31, 2002

Corporate & Wealth and

Investment Investment Corporate/

(Dollars in thousands) Retail Commercial Banking Mortgage Management Other Consolidated

Average total assets $24,321,753 $20,977,234 $21,686,361 $18,692,058 $1,861,801 $20,976,889 $108,516,096

Average total liabilities 51,679,943 8,817,108 6,364,551 1,265,271 1,562,074 30,101,442 99,790,389

Average total equity — — — — — 8,725,707 8,725,707

Net interest income $ 1,658,939 $ 538,800 $ 269,334 $ 399,536 $ 47,064 $ 330,036 $ 3,243,709

Fully taxable-equivalent

adjustment (FTE) 187 22,582 11,050 — 17 5,686 39,522

Net interest income (FTE)11,659,126 561,382 280,384 399,536 47,081 335,722 3,283,231

Provision for loan losses2165,381 18,131 241,483 1,957 140 42,700 469,792

Net interest income after

provision for loan losses 1,493,745 543,251 38,901 397,579 46,941 293,022 2,813,439

Noninterest income 730,640 215,209 530,037 1,442 630,721 160,778 2,268,827

Noninterest expense 1,070,289 270,931 312,872 227,208 476,921 861,199 3,219,420

Total contribution before taxes 1,154,096 487,529 256,066 171,813 200,741 (407,399) 1,862,846

Provision for income taxes3— — — — — 531,037 531,037

Net income $ 1,154,096 $ 487,529 $ 256,066 $ 171,813 $ 200,741 $ (938,436) $ 1,331,809

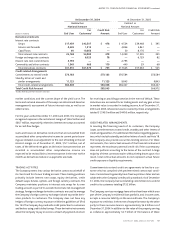

1Net interest income is fully taxable equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

2Provision for loan losses includes an allocation to the lines of business reflecting net credit losses.

3Includes regular income tax provision and taxable-equivalent income adjustment reversal of $58.4 million, $45.0 million, and $39.5 million for the twelve months ended December 31,

2004, 2003 and 2002 respectively.