SunTrust 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

ing risk.These three areas of risk are managed on a consolidated

basis under the Company’s enterprise risk management framework.

As part of its risk governance framework, the Company has also

established various risk management-related committees.These

committees are jointly responsible for ensuring adequate risk

measurement and management in their respective areas of

authority.These committees include: Asset/Liability Management

Committee (ALCO), Credit Management Committee, and Opera-

tional Risk Committee. Additionally, the Company has established

an Enterprise Risk Committee (ERC), chaired by the CRO, that is

responsible for supporting the CRO in measuring and managing

the Company’s aggregate risk profile.The ERC consists of various

senior executives throughout the Company and meets on a bi-

monthly basis.

The Board of Directors is wholly responsible for oversight of the

Company’s corporate risk governance process. In 2005, the

Company formed the Risk Committee of the Board, which will assist

the Board of Directors in executing this responsibility.

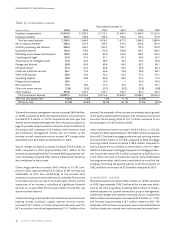

CREDIT RISK MANAGEMENT

Credit risk refers to the potential for economic loss arising from the

failure of SunTrust clients to meet their contractual agreements on

all credit instruments, including on-balance-sheet exposures from

loans and leases, contingent exposures from unfunded commit-

ments, letters of credit, credit derivatives, and counterparty risk

under interest rate and foreign exchange derivative products. As

credit risk is an essential component of many of the products and

services provided by the Company to its clients, the ability to accu-

rately measure and manage credit risk is integral to maintain both

the long-run profitability of its lines of business and capital ade-

quacy of the enterprise.

SunTrust manages and monitors extensions of credit risk through

initial underwriting processes and periodic reviews. SunTrust main-

tains underwriting standards in accordance with credit policies and

procedures; and, Credit Risk Management conducts independent

risk reviews to ensure active compliance with all policies and proce-

dures.Credit Risk Management periodically reviews its lines of busi-

ness to monitor asset quality trends and the appropriateness of

credit policies. In particular, total borrower exposure limits are

established and concentration risk is monitored. SunTrust has made

a major commitment to maintain and enhance comprehensive

credit systems in order to be compliant with business requirements

and evolving regulatory standards.As part of a continuous improve-

ment process, SunTrust Credit Risk Management evaluates poten-

tial enhancements to its risk measurement and management tools,

implementing them as appropriate along with amended credit poli-

cies and procedures.

Borrower/Counterparty (obligor) risk and facility risk are evaluated

using the Company’s risk rating methodology, which has been

implemented in the lines of business representing the largest total

credit exposures. SunTrust uses various risk models in the estima-

tion of expected and unexpected losses.These models incorporate

both internal and external default and loss experience.To the extent

possible, the Company collects internal data to ensure the validity,

reliability, and accuracy of its risk models used in default and loss

estimation.

OPERATIONAL RISK MANAGEMENT

SunTrust is instituting an Operational Risk Management program

which encompasses the use of a structured and disciplined

approach for the identification, assessment, measurement, mitiga-

tion, monitoring, and reporting of operational risk-related events.

This framework includes SunTrust’s policy to maintain a compre-

hensive system of internal controls for each operating unit, line of

business and subsidiary.

The framework being implemented by the Company defines opera-

tional risk as the risk of loss resulting from inadequate or failed

internal processes, people, and systems, or external events.This def-

inition includes compliance (legal) risk, which is the risk of loss from

violations of, or nonconformance with laws, rules, regulations, pre-

scribed practices, or ethical standards.The Company’s definition of

operational risk does not include strategic or reputational risks.

SunTrust believes that effective management of operational risk

plays a major role in both the level and the stability of the prof-

itability of the institution. SunTrust has established a corporate

level Operational Risk Management function, headed by the Chief

Operational Risk Officer,to support the management of operational

risk. The Chief Operational Risk Officer also oversees the

Operational Risk Forum, a monthly meeting of all of SunTrust’s

operational risk managers.

The corporate governance structure includes an Operational Risk

Manager and support staff embedded within each line of business

and corporate function. These risk managers, while reporting

directly to their respective line or function, facilitate communica-

tions with the Company’s corporate risk functions and execute the

requirements of the corporate framework and policy. The

Operational Risk Manager works closely with the corporate

Operational Risk Management function to ensure consistency

and best practices.

MARKET RISK MANAGEMENT

Market risk refers to potential losses arising from changes in interest

rates, foreign exchange rates, equity prices, commodity prices, and

other relevant market rates or prices. Interest rate risk, defined as

the exposure of net interest income and Economic Value of Equity

(EVE) to adverse movements in interest rates, is SunTrust’s primary

market risk, and mainly arises from the structure of the balance

sheet (non-trading activities). SunTrust is also exposed to market

risk in its trading activities, mortgage servicing rights, mortgage

warehouse and pipeline, and equity holdings of The Coca-Cola

Company common stock.The ALCO meets regularly and is respon-

sible for reviewing the interest-rate sensitivity position of the

Company and establishing policies to monitor and limit exposure to