MetLife 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

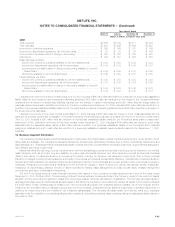

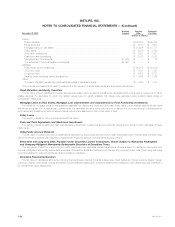

Notional Carrying Estimated

December 31, 2002 Amount Value Fair Value

(Dollars in millions)

Assets:

Fixed maturities********************************************************************** $140,288 $140,288

Equity securities ********************************************************************* $ 1,613 $ 1,613

Mortgage loans on real estate ********************************************************* $ 25,086 $ 27,778

Policy loans************************************************************************* $ 8,580 $ 8,580

Short-term investments *************************************************************** $ 1,921 $ 1,921

Cash and cash equivalents************************************************************ $ 2,323 $ 2,323

Mortgage loan commitments*********************************************************** $ 859 $ — $ 12

Commitments to fund partnership investments ******************************************** $1,667 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 55,285 $ 55,909

Short-term debt ********************************************************************* $ 1,161 $ 1,161

Long-term debt********************************************************************** $ 4,425 $ 4,731

Payable under securities loaned transactions ********************************************* $ 17,862 $ 17,862

Other:

Company-obligated mandatorily redeemable securities of subsidiary trusts********************* $ 1,265 $ 1,337

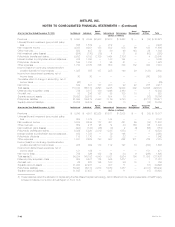

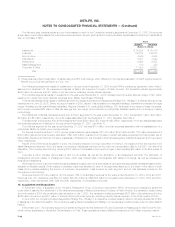

The methods and assumptions used to estimate the fair values of financial instruments are summarized as follows:

Fixed Maturities and Equity Securities

The fair value of fixed maturities and equity securities are based upon quotations published by applicable stock exchanges or received from other

reliable sources. For securities for which the market values were not readily available, fair values were estimated using quoted market prices of

comparable investments.

Mortgage Loans on Real Estate, Mortgage Loan Commitments and Commitments to Fund Partnership Investments

Fair values for mortgage loans on real estate are estimated by discounting expected future cash flows, using current interest rates for similar loans

with similar credit risk. For mortgage loan commitments, the estimated fair value is the net premium or discount of the commitments. Commitments to

fund partnership investments have no stated interest rate and are assumed to have a fair value of zero.

Policy Loans

The carrying values for policy loans approximate fair value.

Cash and Cash Equivalents and Short-term Investments

The carrying values for cash and cash equivalents and short-term investments approximated fair values due to the short-term maturities of these

instruments.

Policyholder Account Balances

The fair value of policyholder account balances is estimated by discounting expected future cash flows based upon interest rates currently being

offered for similar contracts with maturities consistent with those remaining for the agreements being valued.

Short-term and Long-term Debt, Payables Under Securities Loaned Transactions, Shares Subject to Mandatory Redemption

and Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts

The fair values of short-term and long-term debt, payables under securities loaned transactions, shares subject to mandatory redemption and

Company-obligated mandatorily redeemable securities of subsidiary trusts are determined by discounting expected future cash flows using risk rates

currently available for debt with similar terms and remaining maturities.

Derivative Financial Instruments

The fair value of derivative instruments, including financial futures, financial forwards, interest rate, credit default and foreign currency swaps, foreign

currency forwards, caps, floors, options and written covered calls are based upon quotations obtained from dealers or other reliable sources. See Note 3

for derivative fair value disclosures.

MetLife, Inc.

F-50