MetLife 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

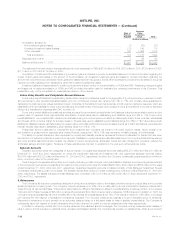

As previously reported, the SEC is conducting a formal investigation of New England Securities Corporation (‘‘NES’’), an indirect subsidiary of New

England Life Insurance Company (‘‘NELICO’’), in response to NES informing the SEC that certain systems and controls relating to one NES advisory

program were not operating effectively. NES is cooperating fully with the SEC.

Prior to filing the Company’s June 30, 2003 Form 10-Q, MetLife announced a $31 million after-tax charge resulting from certain improperly deferred

expenses at an affiliate, New England Financial. MetLife notified the SEC about the nature of this charge prior to its announcement. The SEC is pursuing a

formal investigation of the matter and MetLife is fully cooperating with the investigation.

The American Dental Association and two individual providers have sued MetLife, Mutual of Omaha and Cigna in a purported class action lawsuit

brought in a Florida federal district court. The plaintiffs purport to represent a nationwide class of in-network providers who allege that their claims are

being wrongfully reduced by downcoding, bundling, and the improper use and programming of software. The complaint alleges federal racketeering and

various state law theories of liability. MetLife is vigorously defending the case and a motion to dismiss has been filed.

A purported class action in which a policyholder seeks to represent a class of owners of participating life insurance policies is pending in state court

in New York. Plaintiff asserts that Metropolitan Life breached her policy in the manner in which it allocated investment income across lines of business

during a period ending with the 2000 demutualization. In August 2003, an appellate court affirmed the dismissal of fraud claims in this action. MetLife is

vigorously defending the case.

Regulatory bodies have contacted the Company and have requested information relating to market timing and late trading of mutual funds and

variable insurance products. The Company believes that these inquiries are similar to those made to many financial services companies as part of an

industry-wide investigation by various regulatory agencies into the practices, policies and procedures relating to trading in mutual fund shares. State

Street Research Investment Services, one of the Company’s indirect broker/dealer subsidiaries, has entered into a settlement with the National

Association of Securities Dealers (‘‘NASD’’) resolving all outstanding issues relating to its investigation. The SEC has commenced an investigation with

respect to market timing and late trading in a limited number of privately-placed variable insurance contracts that were sold through General American.

The Company is in the process of responding and is fully cooperating with regard to these information requests and investigations. The Company at the

present time is not aware of any systemic problems with respect to such matters that may have a material adverse effect on the Company’s consolidated

financial position.

Various litigation, claims and assessments against the Company, in addition to those discussed above and those otherwise provided for in the

Company’s consolidated financial statements, have arisen in the course of the Company’s business, including, but not limited to, in connection with its

activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other federal and state

authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and other laws and

regulations.

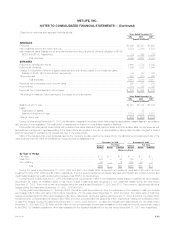

Summary

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses, except as noted above in connection with specific matters. In some of the matters referred to above, very large and/or indeterminate

amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that an adverse outcome in certain

cases could have a material adverse effect upon the Company’s consolidated financial position, based on information currently known by the Company’s

management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the

large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome

in certain matters could, from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly

or annual periods.

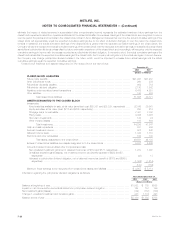

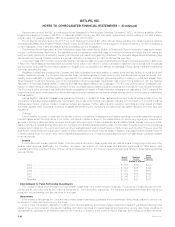

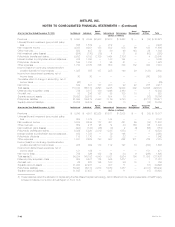

Leases

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants is contingent upon the level of the

tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, data

processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments relating to these lease agreements

were as follows:

Gross

Rental Sublease Rental

Income Income Payments

(Dollars in millions)

2004 *************************************************************************** $ 567 $16 $210

2005 *************************************************************************** $ 522 $15 $192

2006 *************************************************************************** $ 481 $14 $168

2007 *************************************************************************** $ 432 $12 $145

2008 *************************************************************************** $ 366 $10 $113

Thereafter *********************************************************************** $1,955 $13 $717

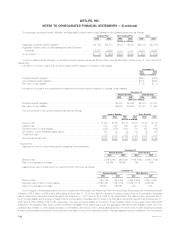

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,380 million and $1,667 million at December 31, 2003 and 2002, respectively. The Company anticipates that these amounts will be

invested in the partnerships over the next three to five years.

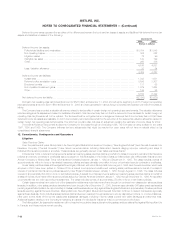

Guarantees

In the course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties pursuant to which it may

be required to make payments now or in the future.

In the context of acquisition, disposition, investment and other transactions, the Company has provided indemnities and guarantees, including those

related to tax, environmental and other specific liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of

representations, warranties or covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifica-

MetLife, Inc.

F-36