MetLife 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The Company enters into written covered calls to generate additional investment income on the underlying assets it holds. These derivatives are not

designated as hedges. The Company records the premiums received over the life of the contract and changes in fair value of such options as net

investment gains and losses.

Cash and Cash Equivalents

The Company considers all investments purchased with an original maturity of three months or less to be cash equivalents.

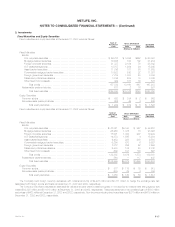

Property, Equipment, Leasehold Improvements and Computer Software

Property, equipment and leasehold improvements, which are included in other assets, are stated at cost, less accumulated depreciation and

amortization. Depreciation is determined using either the straight-line or sum-of-the-years-digits method over the estimated useful lives of the assets. The

estimated life for company occupied real estate property is generally 40 years. Estimated lives range from five to ten years for leasehold improvements

and three to five years for all other property and equipment. Accumulated depreciation and amortization of property, equipment and leasehold

improvements was $527 million and $428 million at December 31, 2003 and 2002, respectively. Related depreciation and amortization expense was

$119 million, $85 million and $99 million for the years ended December 31, 2003, 2002 and 2001, respectively.

Computer software, which is included in other assets, is stated at cost, less accumulated amortization. Purchased software costs, as well as internal

and external costs incurred to develop internal-use computer software during the application development stage, are capitalized. Such costs are

amortized generally over a three-year period using the straight-line method. Accumulated amortization of capitalized software was $432 million and

$317 million at December 31, 2003 and 2002, respectively. Related amortization expense was $150 million, $155 million and $110 million for the years

ended December 31, 2003, 2002 and 2001, respectively.

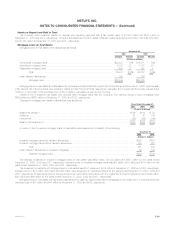

Deferred Policy Acquisition Costs

The costs of acquiring new and renewal insurance business that vary with, and are primarily related to, the production of that business are deferred.

Such costs, which consist principally of commissions, agency and policy issue expenses, are amortized with interest over the expected life of the

contract for participating traditional life, universal life and investment-type products. Generally, DAC is amortized in proportion to the present value of

estimated gross margins or profits from investment, mortality, expense margins and surrender charges. Interest rates are based on rates in effect at the

inception or acquisition of the contracts.

Actual gross margins or profits can vary from management’s estimates resulting in increases or decreases in the rate of amortization. Management

utilizes the reversion to the mean assumption, a standard industry practice, in its determination of the amortization of DAC. This practice assumes that the

expectation for long-term equity investment appreciation is not changed by minor short-term market fluctuations, but that it does change when large

interim deviations have occurred. Management periodically updates these estimates and evaluates the recoverability of DAC. When appropriate,

management revises its assumptions of the estimated gross margins or profits of these contracts, and the cumulative amortization is reestimated and

adjusted by a cumulative charge or credit to current operations.

DAC for non-participating traditional life, non-medical health and annuity policies with life contingencies is amortized in proportion to anticipated

premiums. Assumptions as to anticipated premiums are made at the date of policy issuance or acquisition and are consistently applied during the lives of

the contracts. Deviations from estimated experience are included in operations when they occur. For these contracts, the amortization period is typically

the estimated life of the policy.

Policy acquisition costs related to internally replaced contracts are expensed at the date of replacement.

DAC for property and casualty insurance contracts, which is primarily comprised of commissions and certain underwriting expenses, are deferred

and amortized on a pro rata basis over the applicable contract term or reinsurance treaty.

VOBA, included as part of DAC, represents the present value of future profits generated from existing insurance contracts in-force at the date of

acquisition and is amortized over the expected policy or contract duration in relation to the estimated gross profits or premiums from such policies and

contracts.

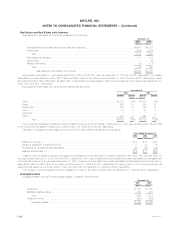

Goodwill

The excess of cost over the fair value of net assets acquired (‘‘goodwill’’) is included in other assets. On January 1, 2002, the Company adopted the

provisions of SFAS No. 142, Goodwill and Other Intangible Assets, (‘‘SFAS 142’’). In accordance with SFAS 142, goodwill is not amortized but is tested

for impairment at least annually to determine whether a writedown of the cost of the asset is required. Impairments are recognized in operating results

when the carrying amount of goodwill exceeds its implied fair value. Prior to the adoption of SFAS 142, goodwill was amortized on a straight-line basis

over a period ranging from ten to 30 years and impairments were recognized in operating results when permanent diminution in value was deemed to

have occurred.

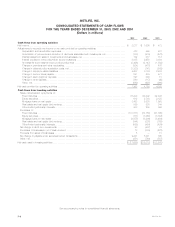

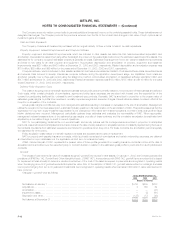

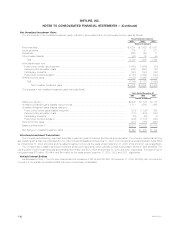

Changes in goodwill were as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Net balance at January 1 ************************************************************************ $ 750 $609 $703

Acquisitions************************************************************************************ 3 166 54

Amortization************************************************************************************ — — (47)

Impairment Losses ****************************************************************************** — (8) (61)

Disposition and other **************************************************************************** (125) (17) (40)

Net balance at December 31 ********************************************************************* $ 628 $750 $609

MetLife, Inc.

F-12