MetLife 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

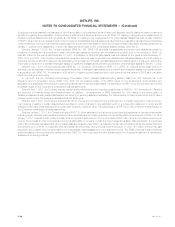

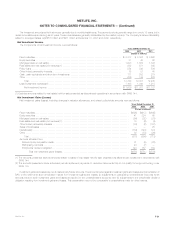

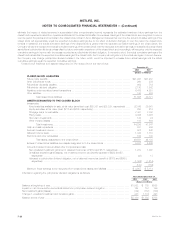

The following is a reconciliation of the notional amounts by derivative type and strategy at December 31, 2003 and 2002:

December 31, 2002 Terminations/ December 31, 2003

Notional Amount Additions Maturities Notional Amount

(Dollars in millions)

BY DERIVATIVE TYPE

Financial futures *************************************************** $ 4 $ 2,208 $ 864 $ 1,348

Interest rate swaps************************************************* 3,866 8,063 1,985 9,944

Floors************************************************************ 325 — — 325

Caps ************************************************************ 8,040 3,000 1,695 9,345

Financial forwards************************************************** 1,945 1,310 1,945 1,310

Foreign currency swaps ******************************************** 2,371 2,534 195 4,710

Options ********************************************************** 6,472 — 407 6,065

Foreign currency forwards******************************************* 54 663 22 695

Written covered calls *********************************************** — 1,178 1,178 —

Credit default swaps *********************************************** 376 284 45 615

Total contractual commitments *********************************** $23,453 $19,240 $8,336 $34,357

BY DERIVATIVE STRATEGY

Liability hedging *************************************************** $ 8,954 $ 5,386 $1,952 $12,388

Invested asset hedging ********************************************* 5,411 7,295 1,823 10,883

Portfolio hedging*************************************************** 9,028 2,443 4,539 6,932

Firm commitments and forecasted transactions ************************* 60 3,589 22 3,627

Hedging net investments in foreign operations ************************** — 527 — 527

Total contractual commitments *********************************** $23,453 $19,240 $8,336 $34,357

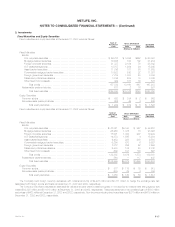

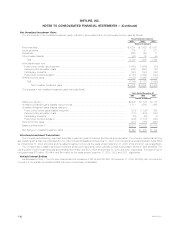

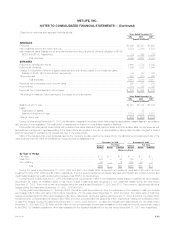

The following table presents the notional amounts of derivative financial instruments by maturity at December 31, 2003:

Remaining Life

After One After Five

One Year Year Through Years Through After Ten

or Less Five Years Ten Years Years Total

(Dollars in millions)

Financial futures **************************************************** $ 1,348 $ — $ — $ — $ 1,348

Interest rate swaps ************************************************** 242 6,343 1,693 1,666 9,944

Floors ************************************************************* — — 325 — 325

Caps ************************************************************* 3,150 6,195 — — 9,345

Financial forwards *************************************************** 1,310 — — — 1,310

Foreign currency swaps********************************************** 327 1,676 2,271 436 4,710

Options *********************************************************** 4,163 1,901 — 1 6,065

Foreign currency forwards ******************************************** 695 — — — 695

Written covered calls ************************************************ —— — ——

Credit default swaps************************************************* 189 426 — — 615

Total contractual commitments ************************************ $11,424 $16,541 $4,289 $2,103 $34,357

The following table presents the notional amounts and fair values of derivatives by type of hedge designation at December 31, 2003 and 2002:

2003 2002

Fair Value Fair Value

Notional Notional

Amount Assets Liabilities Amount Assets Liabilities

(Dollars in millions)

BY TYPE OF HEDGE

Fair value ************************************************************ $ 4,027 $ 27 $297 $ 420 $ — $ 64

Cash flow *********************************************************** 13,173 59 449 3,520 69 73

Foreign operations 527 — 10 — — —

Non qualifying ******************************************************** 16,630 170 142 19,513 239 183

Total ******************************************************** $34,357 $256 $898 $23,453 $308 $320

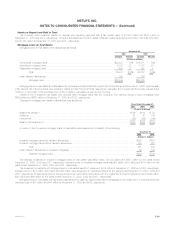

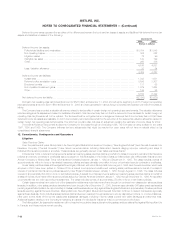

The Company recognized net investment expense of $63 million and net investment income of $9 million and $9 million, from the periodic

settlement of interest rate caps and interest rate, foreign currency and credit default swaps that qualify as accounting hedges under SFAS No. 133, as

amended, for the years ended December 31, 2003, 2002 and 2001, respectively.

During the years ended December 31, 2003 and 2002, the Company recognized $191 million and $30 million, respectively, in net investment

losses related to qualifying fair value hedging instruments. Accordingly, $159 million and $34 million of net unrealized gains on fair value hedged

investments were recognized in net investment gains and losses during the years ended December 31, 2003 and 2002, respectively. There were no

MetLife, Inc.

F-24