MetLife 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

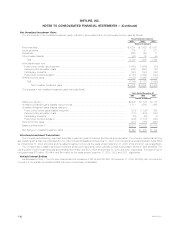

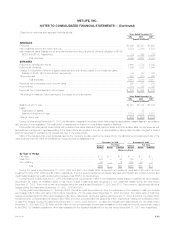

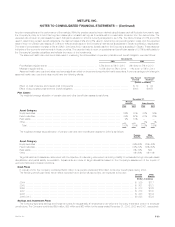

Deferred income taxes represent the tax effect of the differences between the book and tax bases of assets and liabilities. Net deferred income tax

assets and liabilities consisted of the following:

December 31,

2003 2002

(Dollars in millions)

Deferred income tax assets:

Policyholder liabilities and receivables **************************************************************** $ 3,704 $ 3,845

Net operating losses ****************************************************************************** 352 322

Litigation related ********************************************************************************** 72 99

Intangible tax asset ******************************************************************************* 120 199

Other******************************************************************************************* 268 386

4,516 4,851

Less: Valuation allowance************************************************************************** 32 84

4,484 4,767

Deferred income tax liabilities:

Investments ************************************************************************************* 1,343 1,681

Deferred policy acquisition costs ******************************************************************** 3,595 3,307

Employee benefits ******************************************************************************** 131 55

Net unrealized investment gains********************************************************************* 1,679 1,264

Other******************************************************************************************* 135 85

6,883 6,392

Net deferred income tax liability *********************************************************************** $(2,399) $(1,625)

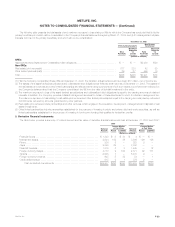

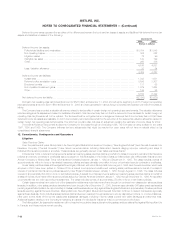

Domestic net operating loss carryforwards amount to $828 million at December 31, 2003 and will expire beginning in 2013. Foreign net operating

loss carryforwards amount to $241 million at December 31, 2003 and were generated in various foreign countries with expiration periods of five years to

infinity.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating loss carryforwards. The valuation allowance

reflects management’s assessment, based on available information, that it is more likely than not that the deferred income tax asset for certain foreign net

operating loss carryforwards will not be realized. The tax benefit will be recognized when management believes that it is more likely than not that these

deferred income tax assets are realizable. In 2003, the Company recorded a tax benefit for the reduction of the deferred tax valuation allowance related to

certain foreign net operating loss carryforwards. The 2003 tax provision also includes an adjustment revising the estimate of income taxes for 2002.

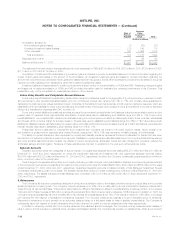

The Internal Revenue Service has audited the Company for the years through and including 1996. The Company is being audited for the years

1997, 1998 and 1999. The Company believes that any adjustments that might be required for open years will not have a material effect on its

consolidated financial statements.

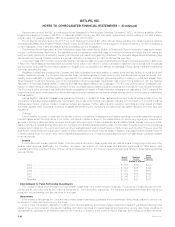

12. Commitments, Contingencies and Guarantees

Litigation

Sales Practices Claims

Over the past several years, Metropolitan Life, New England Mutual Life Insurance Company (‘‘New England Mutual’’) and General American Life

Insurance Company (‘‘General American’’) have faced numerous claims, including class action lawsuits, alleging improper marketing and sales of

individual life insurance policies or annuities. These lawsuits are generally referred to as ‘‘sales practices claims.’’

In December 1999, a federal court approved a settlement resolving sales practices claims on behalf of a class of owners of permanent life insurance

policies and annuity contracts or certificates issued pursuant to individual sales in the United States by Metropolitan Life, Metropolitan Insurance and

Annuity Company or Metropolitan Tower Life Insurance Company between January 1, 1982 and December 31, 1997. The class includes owners of

approximately six million in-force or terminated insurance policies and approximately one million in-force or terminated annuity contracts or certificates.

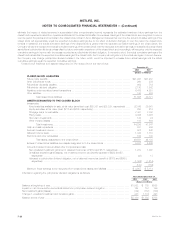

Similar sales practices class actions against New England Mutual, with which Metropolitan Life merged in 1996, and General American, which was

acquired in 2000, have been settled. In October 2000, a federal court approved a settlement resolving sales practices claims on behalf of a class of

owners of permanent life insurance policies issued by New England Mutual between January 1, 1983 through August 31, 1996. The class includes

owners of approximately 600,000 in-force or terminated policies. A federal court has approved a settlement resolving sales practices claims on behalf of

a class of owners of permanent life insurance policies issued by General American between January 1, 1982 through December 31, 1996. An appellate

court has affirmed the order approving the settlement. The class includes owners of approximately 250,000 in-force or terminated policies.

Certain class members have opted out of the class action settlements noted above and have brought or continued non-class action sales practices

lawsuits. In addition, other sales practices lawsuits have been brought. As of December 31, 2003, there are approximately 366 sales practices lawsuits

pending against Metropolitan Life, approximately 40 sales practices lawsuits pending against New England Mutual and approximately 25 sales practices

lawsuits pending against General American. Metropolitan Life, New England Mutual and General American continue to defend themselves vigorously

against these lawsuits. Some individual sales practices claims have been resolved through settlement, won by dispositive motions, or, in a few instances,

have gone to trial. Most of the current cases seek substantial damages, including in some cases punitive and treble damages and attorneys’ fees.

Additional litigation relating to the Company’s marketing and sales of individual life insurance may be commenced in the future.

The Metropolitan Life class action settlement did not resolve two putative class actions involving sales practices claims filed against Metropolitan Life

in Canada, and these actions remain pending.

MetLife, Inc.

F-32