MetLife 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

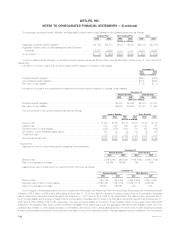

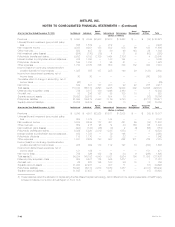

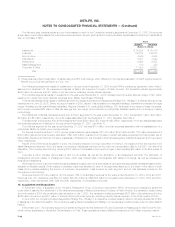

The following table presents actual and pro forma assets for each of the Company’s operating segments at December 31, 2002. The amounts

shown as pro forma reflect assets that would have been reported in the prior year had the Company allocated capital based on Economic Capital rather

than on the basis of RBC.

Assets

Actual(1) Pro forma

(Dollars in millions)

Institutional ************************************************************************************** $ 98,234 $ 98,810

Individual *************************************************************************************** 145,152 144,073

Auto & Home *********************************************************************************** 4,540 4,360

International ************************************************************************************* 8,301 7,990

Reinsurance ************************************************************************************ 9,924 9,672

Asset Management******************************************************************************* 190 320

Corporate & Other ******************************************************************************* 11,085 12,201

Total *********************************************************************************** $277,426 $277,426

(1) These balances reflect the allocation of capital using the RBC methodology, which differs from the original presentation of GAAP equity included in

MetLife, Inc.’s 2002 Annual Report on Form 10-K.

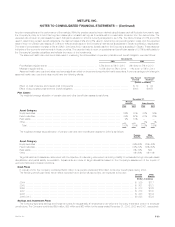

The Reinsurance segment’s results of operations for the year ended December 31, 2003 include RGA’s coinsurance agreement under which it

assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of North America. The transaction added approximately

$246 million of premiums and $11 million of pre-tax income, excluding minority interest expense.

The Individual segment’s results of operations for the year ended December 31, 2003 includes a second quarter after-tax charge of $31 million

resulting from certain improperly deferred expenses at an affiliate, New England Financial.

The International segment’s results of operations include the results of operations of Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), a Mexican life insurer that

was acquired on June 20, 2002. During the second quarter of 2003, as part of its acquisition and integration strategy, International completed the legal

merger of Hidalgo into its original Mexican subsidiary, Seguros Genesis, S.A., forming MetLife Mexico, S.A. As a result of the merger of these companies,

the Company recorded $62 million of after-tax earnings from the merger and a reduction in policyholder liabilities resulting from a change in reserve

methodology.

The Institutional, Individual, Reinsurance and Auto & Home segments for the year ended December 31, 2001 include $287 million, $24 million,

$9 million and $5 million, respectively, of pre-tax losses associated with the September 11, 2001 tragedies. See Note 9.

The Institutional, Individual and Auto & Home segments include $399 million, $97 million and $3 million, respectively, in pre-tax charges associated

with business realignment initiatives for the year ended December 31, 2001. See Note 10.

The Individual segment for the year ended December 31, 2001 includes $118 million of pre-tax expenses associated with the establishment of a

policyholder liability for certain group annuity policies.

For the year ended December 31, 2001, pre-tax gross investment gains (losses) of $1,027 million, $142 million and $(1,172) million (comprised of a

$354 million gain and an intercompany elimination of $(1,526) million), resulting from the sale of certain real estate properties from Metropolitan Life to

Metropolitan Insurance and Annuity Company, a subsidiary of MetLife, Inc., are included in the Individual segment, Institutional segment and Corporate &

Other, respectively.

As part of the GenAmerica acquisition in 2000, the Company acquired Conning Corporation (‘‘Conning’’), the results of which are included in the

Asset Management segment due to the types of products and strategies employed by the entity from its acquisition date to July 2001, the date of its

disposition. The Company sold Conning, receiving $108 million in the transaction and reported a gain of approximately $25 million, in the third quarter of

2001.

Corporate & Other includes various start-up and run-off entities, as well as the elimination of all intersegment amounts. The elimination of

intersegment amounts relates to intersegment loans, which bear interest rates commensurate with related borrowings, as well as intersegment

reinsurance transactions.

Net investment income and net investment gains (losses) are based upon the actual results of each segment’s specifically identifiable asset portfolio

adjusted for allocated capital. Other costs and operating costs were allocated to each of the segments based upon: (i) a review of the nature of such

costs; (ii) time studies analyzing the amount of employee compensation costs incurred by each segment; and (iii) cost estimates included in the

Company’s product pricing.

Revenues derived from any customer did not exceed 10% of consolidated revenues for the years ended December 31, 2003, 2002 and 2001.

Revenues from U.S. operations were $32,312 million, $30,263 million and $29,525 million for the years ended December 31, 2003, 2002 and 2001,

respectively, which represented 90%, 92% and 95%, respectively, of consolidated revenues.

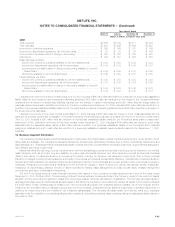

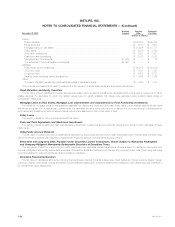

19. Acquisitions and Dispositions

In September 2003, a subsidiary of the Company, Reinsurance Group of America, Incorporated (‘‘RGA’’), announced a coinsurance agreement

under which it assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of North America. The transaction closed during

the fourth quarter of 2003 with an effective date retroactive to July 1, 2003. The transaction added approximately $278 billion of life reinsurance in-force,

$246 million of premium and $11 million of income before income tax expense, excluding minority interest expense, to the fourth quarter of 2003.

In June 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion

in assets as of the date of acquisition. The Company’s existing Mexico subsidiary and Hidalgo now operate as a combined entity under the name MetLife

Mexico.

In November 2001, the Company acquired Compania de Seguros de Vida Santander S.A. and Compania de Reaseguros de Vida Soince Re S.A.,

wholly-owned subsidiaries of Santander Central Hispano in Chile. These acquisitions marked MetLife’s entrance into the Chilean insurance market.

MetLife, Inc.

F-48