MetLife 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

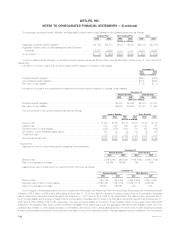

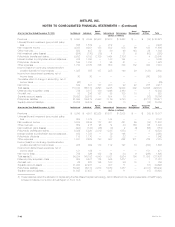

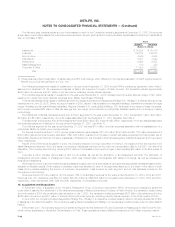

Auto & Asset Corporate

At or for the Year Ended December 31, 2001 Institutional Individual Home International Reinsurance Management & Other Total

(Dollars in millions)

Premiums ********************************************** $7,288 $4,563 $2,755 $846 $1,762 $ — $ (2) $17,212

Universal life and investment-type product policy fees ********* 592 1,260 — 38 — — (1) 1,889

Net investment income *********************************** 3,967 6,165 200 267 390 71 127 11,187

Other revenues ***************************************** 649 495 22 16 42 198 85 1,507

Net investment gains (losses)****************************** (16) 853 (17) (16) (6) 25 (1,402) (579)

Policyholder benefits and claims *************************** 8,924 5,233 2,121 689 1,484 — 3 18,454

Interest credited to policyholder account balances ************ 1,013 1,898 — 51 122 — — 3,084

Policyholder dividends************************************ 259 1,767 — 36 24 — — 2,086

Other expenses ***************************************** 1,746 2,747 800 329 491 252 657 7,022

Income (loss) from continuing operations before provision

(benefit) for income taxes ******************************* 538 1,691 39 46 67 42 (1,853) 570

Income from discontinued operations, net of income taxes ***** 21 36 — — — — 50 107

Net income (loss) *************************************** 382 1,095 41 14 40 27 (1,126) 473

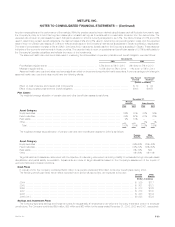

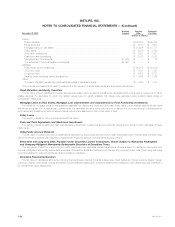

The following table indicates amounts in the current and prior years that have been classified as discontinued operations in accordance with

SFAS 144:

Year ended December 31,

2003 2002 2001

(Dollars in millions)

Net investment income

Institutional ************************************************************************************* $2 $33 $34

Individual*************************************************************************************** 55056

Corporate & Other******************************************************************************* 45 77 79

Total net investment income********************************************************************* $ 52 $160 $169

Net investment gains (losses)

Institutional ************************************************************************************* $ 45 $156 $ —

Individual*************************************************************************************** 43 262 —

Corporate & Other******************************************************************************* 333 164 —

Total net investment gains (losses) *************************************************************** $421 $582 $ —

Interest Expense

Individual*************************************************************************************** $1 $1 $—

Total interest expense ************************************************************************** $1 $1 $—

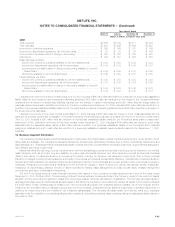

Economic Capital. Beginning in 2003, the Company changed its methodology of allocating capital to its business segments from Risk-Based

Capital (‘‘RBC’’) to Economic Capital. Prior to 2003, the Company’s business segments’ allocated equity was primarily based on RBC, an internally

developed formula based on applying a multiple to the National Association of Insurance Commissioners Statutory Risk-Based Capital and included

certain adjustments in accordance with accounting principles generally accepted in the United States of America (‘‘GAAP’’). Economic Capital is an

internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis upon which capital is deployed.

The Economic Capital model accounts for the unique and specific nature of the risks inherent in MetLife’s businesses. This is in contrast to the

standardized regulatory RBC formula, which is not as refined in its risk calculations with respect to the nuances of the Company’s businesses.

The change in methodology is being applied prospectively. This change has and will continue to impact the level of net investment income and net

income of each of the Company’s business segments. A portion of net investment income is credited to the segments based on the level of allocated

equity. This change in methodology of allocating equity does not impact the Company’s consolidated net investment income or net income.

The following table presents actual and pro forma net investment income with respect to the Company’s segments for the years ended

December 31, 2002 and 2001. The amounts shown as pro forma reflect net investment income that would have been reported in these years had the

Company allocated capital based on Economic Capital rather than on the basis of RBC.

Net Investment Income

For the Years Ended December 31,

2002 2001

Actual Pro forma Actual Pro forma

(Dollars in millions)

Institutional****************************************************************** $ 3,918 $ 3,980 $ 3,967 $ 4,040

Individual ******************************************************************* 6,244 6,155 6,165 6,078

Auto & Home *************************************************************** 177 160 200 184

International ***************************************************************** 461 424 267 251

Reinsurance **************************************************************** 421 382 390 354

Asset Management ********************************************************** 59 71 71 89

Corporate & Other *********************************************************** (19) 89 127 191

Total *************************************************************** $11,261 $11,261 $11,187 $11,187

MetLife, Inc. F-47