MetLife 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

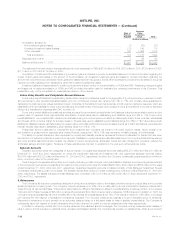

was significantly higher than those received in the prior year quarter, resulting in more new claims being received by Metropolitan Life in 2002 than in

2001. Factors considered also included expected trends in filing cases, the dates of initial exposure of plaintiffs to asbestos, the likely percentage of total

asbestos claims which included Metropolitan Life as a defendant and experience in claims settlement negotiations.

Metropolitan Life also considered views derived from actuarial calculations it made in the fourth quarter of 2002. These calculations were made

using, among other things, then current information regarding Metropolitan Life’s claims and settlement experience, information available in public reports,

as well as a study regarding the possible future incidence of mesothelioma. Based on all of the above information, including greater than expected claims

experience in 2000, 2001 and 2002, Metropolitan Life expected to receive more claims in the future than it had previously expected. Previously,

Metropolitan Life’s liability reflected that the increase in asbestos-related claims was a result of an acceleration in the reporting of such claims; the liability

now reflects that such an increase is also the result of an increase in the total number of asbestos-related claims expected to be received by Metropolitan

Life. Accordingly, Metropolitan Life increased its recorded liability for asbestos-related claims by $402 million from approximately $820 million to

$1,225 million at December 31, 2002. This total recorded asbestos-related liability (after the self-insured retention) is within the coverage of the excess

insurance policies discussed below. The aforementioned analysis was updated through December 31, 2003.

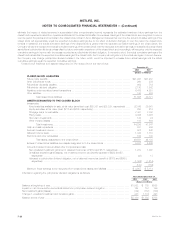

During 1998, Metropolitan Life paid $878 million in premiums for excess insurance policies for asbestos-related claims. The excess insurance

policies for asbestos-related claims provide for recovery of losses up to $1,500 million, which is in excess of a $400 million self-insured retention. The

asbestos-related policies are also subject to annual and per-claim sublimits. Amounts are recoverable under the policies annually with respect to claims

paid during the prior calendar year. Although amounts paid by Metropolitan Life in any given year that may be recoverable in the next calendar year under

the policies will be reflected as a reduction in the Company’s operating cash flows for the year in which they are paid, management believes that the

payments will not have a material adverse effect on the Company’s liquidity.

Each asbestos-related policy contains an experience fund and a reference fund that provides for payments to Metropolitan Life at the commutation

date if the reference fund is greater than zero at commutation or pro rata reductions from time to time in the loss reimbursements to Metropolitan Life if the

cumulative return on the reference fund is less than the return specified in the experience fund. The return in the reference fund is tied to performance of

the Standard & Poor’s 500 Index and the Lehman Brothers Aggregate Bond Index. A claim was made under the excess insurance policies in 2003 for

the amounts paid with respect to asbestos litigation in excess of the retention. Based on performance of the reference fund, at December 31, 2002, the

loss reimbursements to Metropolitan Life in 2003 and the recoverable with respect to later periods was $42 million less than the amount of the recorded

losses. Such foregone loss reimbursements may be recovered upon commutation depending upon future performance of the reference fund. The

foregone loss reimbursements were estimated to be $9 million with respect to 2002 claims and estimated to be $42 million in the aggregate.

The $402 million increase in the recorded liability for asbestos claims less the foregone loss reimbursement adjustment of $42 million ($27 million,

net of income tax) resulted in an increase in the recoverable of $360 million. At December 31, 2002, a portion ($136 million) of the $360 million

recoverable was recognized in income while the remainder ($224 million) was recorded as a deferred gain which is expected to be recognized in income

in the future over the estimated settlement period of the excess insurance policies. The $402 million increase in the recorded liability, less the portion of

the recoverable recognized in income, resulted in a net expense of $266 million ($169 million, net of income tax). The $360 million recoverable may

change depending on the future performance of the Standard & Poor’s 500 Index and the Lehman Brothers Aggregate Bond Index.

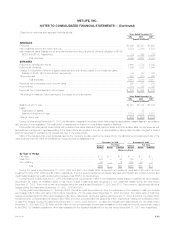

As a result of the excess insurance policies, $1,237 million is recorded as a recoverable at December 31, 2002 ($224 million of which is recorded

as a deferred gain as mentioned above); the amount includes recoveries for amounts paid in 2002. If at some point in the future, the Company believes

the liability for probable and estimable losses for asbestos-related claims should be increased, an expense would be recorded and the insurance

recoverable would be adjusted subject to the terms, conditions and limits of the excess insurance policies. Portions of the change in the insurance

recoverable would be recorded as a deferred gain and amortized into income over the estimated remaining settlement period of the insurance policies.

In 2003, Metropolitan Life also has been named as a defendant in a small number of silicosis, welding and mixed dust cases. The cases are

pending in Mississippi, Texas, Ohio, Pennsylvania, West Virginia, Louisiana, Kentucky, Georgia, Alabama, Illinois and Arkansas. The Company intends to

defend itself vigorously against these cases.

Property and Casualty Actions

A purported class action has been filed against Metropolitan Property and Casualty Insurance Company’s subsidiary, Metropolitan Casualty

Insurance Company, in Florida alleging breach of contract and unfair trade practices with respect to allowing the use of parts not made by the original

manufacturer to repair damaged automobiles. Discovery is ongoing and a motion for class certification is pending. Two purported nationwide class

actions have been filed against Metropolitan Property and Casualty Insurance Company in Illinois. One suit claims breach of contract and fraud due to the

alleged underpayment of medical claims arising from the use of a purportedly biased provider fee pricing system. A motion for class certification has been

filed and discovery is ongoing. The second suit claims breach of contract and fraud arising from the alleged use of preferred provider organizations to

reduce medical provider fees covered by the medical claims portion of the insurance policy. A motion to dismiss has been filed. A purported class action

has been filed against Metropolitan Property and Casualty Insurance Company in Montana. This suit alleges breach of contract and bad faith for not

aggregating medical payment and uninsured coverages provided in connection with the several vehicles identified in insureds’ motor vehicle policies.

Metropolitan Property and Casualty Insurance Company is vigorously defending itself against this lawsuit. Certain plaintiffs’ lawyers have alleged that the

use of certain automated databases to provide total loss vehicle valuation methods was improper. Metropolitan Property and Casualty Insurance

Company, along with a number of other insurers, has tentatively agreed in January 2004 to resolve this issue in a class action format. The amount to be

paid in resolution of this matter will not be material to Metropolitan Property and Casualty Insurance Company.

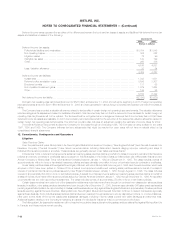

Demutualization Actions

Several lawsuits were brought in 2000 challenging the fairness of Metropolitan Life’s plan of reorganization, as amended (the ‘‘plan’’) and the

adequacy and accuracy of Metropolitan Life’s disclosure to policyholders regarding the plan. These actions name as defendants some or all of

Metropolitan Life, the Holding Company, the individual directors, the New York Superintendent of Insurance (the ‘‘Superintendent’’) and the underwriters

for MetLife, Inc.’s initial public offering, Goldman Sachs & Company and Credit Suisse First Boston. Five purported class actions pending in the New York

state court in New York County were consolidated within the commercial part. In addition, there remained a separate purported class action in New York

state court in New York County. On February 21, 2003, the defendants’ motions to dismiss both the consolidated action and separate action were

granted; leave to replead as a proceeding under Article 78 of New York’s Civil Practice Law and Rules has been granted in the separate action. Plaintiffs

MetLife, Inc.

F-34