MetLife 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

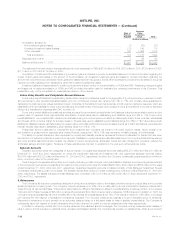

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(ii) requires long-lived assets to be disposed of other than by sale to be considered held and used until disposed; and (iii) retains the basic provisions of

(a) APB 30 regarding the presentation of discontinued operations in the statements of income, (b) SFAS 121 relating to recognition and measurement of

impaired long-lived assets (other than goodwill), and (c) SFAS 121 relating to the measurement of long-lived assets classified as held-for-sale. Adoption

of SFAS 144 did not have a material impact on the Company’s consolidated financial statements other than the presentation as discontinued operations

of net investment income and net investment gains related to operations of real estate on which the Company initiated disposition activities subsequent to

January 1, 2002 and the classification of such real estate as held-for-sale on the consolidated balance sheets. See Note 20.

Effective January 1, 2002, the Company adopted SFAS No. 142. SFAS 142 eliminates the systematic amortization and establishes criteria for

measuring the impairment of goodwill and certain other intangible assets by reporting unit. Amortization of goodwill, prior to the adoption of SFAS 142

was $47 million for the year ended December 31, 2001. Amortization of other intangible assets was not material for the years ended December 31,

2003, 2002 and 2001. The Company completed the required impairment tests of goodwill and indefinite-lived intangible assets in the third quarter of

2002 and recorded a $5 million charge to earnings relating to the impairment of certain goodwill assets as a cumulative effect of a change in accounting.

There was no impairment of identified intangible assets or significant reclassifications between goodwill and other intangible assets at January 1, 2002.

Effective July 1, 2001, the Company adopted SFAS No. 141, Business Combinations (‘‘SFAS 141’’). SFAS 141 requires the purchase method of

accounting for all business combinations and separate recognition of intangible assets apart from goodwill if such intangible assets meet certain criteria.

In accordance with SFAS 141, the elimination of $5 million of negative goodwill was reported in net income in the first quarter of 2002 as a cumulative

effect of a change in accounting.

In July 2001, the U.S. Securities and Exchange Commission (‘‘SEC’’) released Staff Accounting Bulletin (‘‘SAB’’) No. 102, Selected Loan Loss

Allowance and Documentation Issues (‘‘SAB 102’’). SAB 102 summarizes certain of the SEC’s views on the development, documentation and

application of a systematic methodology for determining allowances for loan and lease losses. The application of SAB 102 by the Company did not have

a material impact on the Company’s consolidated financial statements.

Effective April 1, 2001, the Company adopted certain additional accounting and reporting requirements of SFAS No. 140, Accounting for Transfers

and Servicing of Financial Assets and Extinguishments of Liabilities — a Replacement of FASB Statement No. 125, relating to the derecognition of

transferred assets and extinguished liabilities and the reporting of servicing assets and liabilities. The initial adoption of these requirements did not have a

material impact on the Company’s consolidated financial statements.

Effective April 1, 2001, the Company adopted EITF 99-20, Recognition of Interest Income and Impairment on Certain Investments. This pronounce-

ment requires investors in certain asset-backed securities to record changes in their estimated yield on a prospective basis and to apply specific

evaluation methods to these securities for an other-than-temporary decline in value. The initial adoption of EITF 99-20 did not have a material impact on

the Company’s consolidated financial statements.

Effective January 1, 2001, the Company adopted SFAS 133 which established new accounting and reporting standards for derivative instruments,

including certain derivative instruments embedded in other contracts, and for hedging activities. The cumulative effect of the adoption of SFAS 133, as of

January 1, 2001, resulted in a $33 million increase in other comprehensive income, net of income taxes of $18 million, and had no material impact on net

income. The increase to other comprehensive income is attributable to net gains on cash flow-type hedges at transition. Also at transition, the amortized

cost of fixed maturities decreased and other invested assets increased by $22 million, representing the fair value of certain interest rate swaps that were

accounted for prior to SFAS 133 using fair value-type settlement accounting. During the year ended December 31, 2001, $18 million of the pre-tax gain

reported in accumulated other comprehensive income at transition was reclassified into net investment income. The FASB continues to issue additional

guidance relating to the accounting for derivatives under SFAS 133, which may result in further adjustments to the Company’s treatment of derivatives in

subsequent accounting periods.

MetLife, Inc.

F-16