MetLife 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

tions to counterparties in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third party lawsuits. These

obligations are often subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of law, such as

applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is subject to a contractual

limitation ranging from $1 million to $800 million, while in other cases such limitations are not specified or applicable. Since certain of these obligations are

not subject to limitations, the Company does not believe that it is possible to determine the maximum potential amount due under these guarantees in the

future.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies other of its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to limitation

with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount due under these

indemnities in the future.

The fair value of such indemnities, guarantees and commitments entered into was insignificant. The Company’s recorded liability at December 31,

2003 and 2002 for indemnities, guarantees and commitments provided to third parties prior to January 1, 2003 was insignificant.

The Company writes credit default swap obligations requiring payment of principal due in exchange for the reference credit obligation, depending on

the nature or occurrence of specified credit events for the referenced entities. In the event of a specified credit event, the Company’s maximum amount at

risk, assuming the value of the referenced credits become worthless, is $489 million at December 31, 2003. The credit default swaps expire at various

times during the next four years.

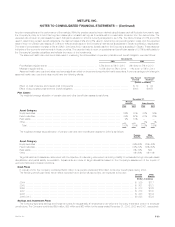

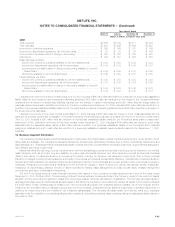

13. Employee Benefit Plans

Pension Benefit and Other Benefit Plans

The Company is both the sponsor and administrator of defined benefit pension plans covering eligible employees and sales representatives of the

Company. Retirement benefits are based upon years of credited service and final average or career average earnings history.

The Company also provides certain postemployment benefits and certain postretirement health care and life insurance benefits for retired employees

through insurance contracts. Substantially all of the Company’s employees may, in accordance with the plans applicable to the postretirement benefits,

become eligible for these benefits if they attain retirement age, with sufficient service, while working for the Company.

The Company uses a December 31 measurement date for all of its pension and postretirement benefit plans.

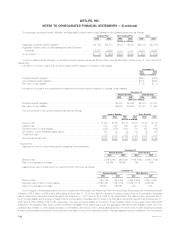

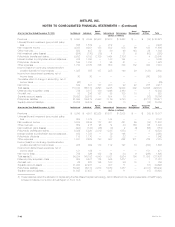

Obligations, Funded Status and Net Periodic Benefit Costs

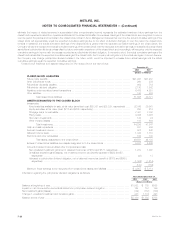

December 31,

Pension Benefits Other Benefits

2003 2002 2003 2002

(Dollars in millions)

Change in projected benefit obligation:

Projected benefit obligation at beginning of year ****************************************** $4,785 $4,426 $1,878 $1,669

Service cost********************************************************************** 123 105 38 36

Interest cost********************************************************************** 314 308 122 123

Acquisitions and divestitures ******************************************************** (1) (73) — —

Actuarial losses ******************************************************************* 352 312 167 342

Curtailments and terminations ******************************************************* (7) (3) (4) (2)

Change in benefits **************************************************************** (2) — (1) (168)

Benefits paid ********************************************************************* (292) (290) (122) (122)

Projected benefit obligation at end of year *********************************************** 5,272 4,785 2,078 1,878

Change in plan assets:

Contract value of plan assets at beginning of year **************************************** 4,053 4,161 965 1,169

Actual return on plan assets ******************************************************** 634 (179) 112 (92)

Acquisitions and divestitures ******************************************************** (1) (67) — —

Employer and participant contributions ************************************************ 337 428 46 10

Benefits paid ********************************************************************* (292) (290) (122) (122)

Contract value of plan assets at end of year ********************************************* 4,731 4,053 1,001 965

Under funded ********************************************************************** (541) (732) (1,077) (913)

Unrecognized net asset at transition**************************************************** 3———

Unrecognized net actuarial losses****************************************************** 1,451 1,507 364 262

Unrecognized prior service cost ******************************************************* 82 101 (184) (208)

Prepaid (accrued) benefit cost********************************************************* $ 995 $ 876 $ (897) $ (859)

Qualified plan prepaid pension cost **************************************************** $1,325 $1,171

Non-qualified plan accrued pension cost ************************************************ (474) (341)

Unamortized prior service cost ******************************************************** 14 —

Accumulated other comprehensive loss************************************************* 130 46

Prepaid benefit cost ***************************************************************** $ 995 $ 876

MetLife, Inc. F-37