MetLife 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

will have statutory earnings to support payment of dividends to the Holding Company in an amount sufficient to fund its cash requirements and pay cash

dividends or that the Superintendent will not disapprove any dividends that Metropolitan Life must submit for the Superintendent’s consideration. In

addition, the Holding Company receives dividends from its other subsidiaries. The Holding Company’s other insurance subsidiaries are also subject to

similar restrictions on the payment of dividends to their respective parent companies.

The dividend limitation is based on statutory financial results. Statutory accounting practices, as prescribed by insurance regulators of various states

in which the Company conducts business, differ in certain respects from accounting principles used in financial statements prepared in conformity with

GAAP. The significant differences relate to the treatment of DAC, certain deferred income taxes, required investment reserves, reserve calculation

assumptions, goodwill and surplus notes.

As of December 31, 2003, the maximum amount of the dividend which may be paid to the Holding Company by Metropolitan Life, Metropolitan

Property and Casualty Insurance Company and Metropolitan Insurance and Annuity Company in 2004, without prior regulatory approval, is $798 million,

$200 million and $185 million, respectively.

Liquid Assets. An integral part of the Holding Company’s liquidity management is the amount of liquid assets that it holds. Liquid assets include

cash, cash equivalents, short-term investments and marketable fixed maturity and equity securities. Liquid assets exclude assets relating to securities

lending and dollar roll activities. At December 31, 2003 and 2002, the Holding Company had $1,320 million and $846 million in liquid assets,

respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short and long-term instruments, including repurchase agreements,

commercial paper, medium and long-term debt, capital securities and stockholders’ equity. The diversification of the Holding Company’s funding sources

enhances funding flexibility and limits dependence on any one source of funds, and generally lowers the cost of funds.

At December 31, 2003 and 2002, the Holding Company had $106 million and $249 million of short-term debt outstanding, and $3.96 billion and

$3.27 billion in long-term debt outstanding, respectively.

The Holding Company filed a $5.0 billion shelf registration statement with the U.S. Securities and Exchange Commission (‘‘SEC’’), which became

effective on March 4, 2004. The shelf registration will permit the registration and issuance of a wide range of debt and equity securities, including

preferred securities of a subsidiary trust guaranteed by MetLife Inc., as described more fully therein. Approximately $44 million of registered but unissued

securities remaining from the Company’s 2001 $4.0 billion shelf registration statement has been carried over to this shelf registration.

The Holding Company issued and remarketed senior debt and debentures in the amount of $3.96 billion under the 2001 $4.0 billion shelf

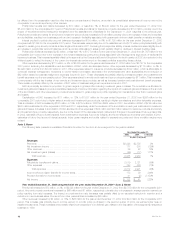

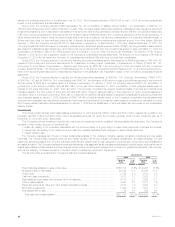

registration statement. The following table summarizes the Holding Company’s senior debt issuances:

Interest

Issue Date Principal Rate Maturity

(Dollars in millions)

November 2003************************************************************** $500 5.00% 2013

November 2003************************************************************** $200 5.88% 2033

December 2002 ************************************************************* $400 5.38% 2012

December 2002 ************************************************************* $600 6.50% 2032

November 2001************************************************************** $500 5.25% 2006

November 2001************************************************************** $750 6.13% 2011

In addition, in February 2003, the Holding Company remarketed $1,006 million aggregate principal amount of debentures previously issued in

connection with the issuance of equity security units. See ‘‘— MetLife Capital Trust I.’’

Other sources of the Holding Company’s liquidity include programs for short and long-term borrowing, as needed, arranged through Metropolitan

Life.

Credit Facilities. The Holding Company maintains a committed and unsecured credit facility, which expires in 2005, for approximately $1.25 billion

which it shares with Metropolitan Life and MetLife Funding, Inc. (‘‘MetLife Funding’’). In April 2003, Metropolitan Life and MetLife Funding replaced an

expiring $1 billion five-year credit facility with a $1 billion 364-day credit facility and the Holding Company was added as a borrower. Drawdowns under

these facilities bear interest at varying rates stated in the agreements. These facilities are primarily used for general corporate purposes and as back-up

lines of credit for the borrowers’ commercial paper programs. At December 31, 2003, neither the Holding Company, Metropolitan Life nor MetLife

Funding had drawn against these credit facilities.

Liquidity Uses

The primary uses of liquidity of the Holding Company include cash dividends on common stock, service on debt, capital contributions to

subsidiaries, payment of general operating expenses and the repurchase of the Holding Company’s common stock.

Dividends. On October 21, 2003, the Holding Company’s Board of Directors approved an annual dividend for 2003 of $0.23 per share. The

dividend was paid on December 15, 2003 to shareholders of record on November 7, 2003. The 2003 dividend represents an increase of $0.02 per

share from the 2002 annual dividend of $0.21 per share. Future dividend decisions will be determined by the Holding Company’s Board of Directors after

taking into consideration factors such as the Holding Company’s current earnings, expected medium and long-term earnings, financial condition,

regulatory capital position, and applicable governmental regulations and policies.

Capital Contributions to Subsidiaries. During the years ended December 31, 2003 and 2002, the Holding Company contributed an aggregate of

$239 million and $500 million to various subsidiaries, respectively.

Share Repurchase. On February 19, 2002, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase program.

This program began after the completion of the March 28, 2001 and June 27, 2000 repurchase programs, each of which authorized the repurchase of

MetLife, Inc. 23