MetLife 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

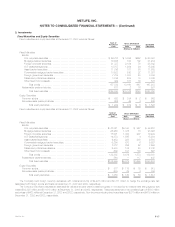

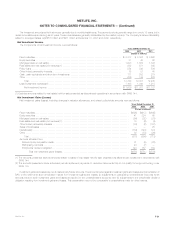

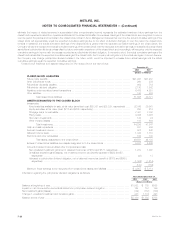

The following table presents the total assets of and maximum exposure to loss relating to VIEs for which the Company has concluded that (i) it is the

primary beneficiary and which will be consolidated in the Company’s financial statements beginning March 31, 2004, and (ii) it holds significant valuable

interests but it is not the primary beneficiary and which will not be consolidated:

December 31, 2003

Not Primary

Primary Beneficiary(1) Beneficiary

Maximum Maximum

Exposure Exposure

Total to Total to

Assets(2) Loss(3) Assets(2) Loss(3)

(Dollars in millions)

SPEs:

Asset-backed securitizations and Collateralized debt obligations ********************************** $ — $ — $2,400 $20

Non-SPEs:

Real estate joint ventures(4) **************************************************************** 617 238 42 59

Other limited partnerships(5) **************************************************************** 29 27 459 10

Total************************************************************************************ $646 $265 $2,901 $89

(1) Had the Company consolidated these VIEs at December 31, 2003, the transition adjustments would have been $10 million, net of income tax.

(2) The assets of the asset-backed securitizations and collateralized debt obligations are reflected at fair value as of December 31, 2003. The assets of

the real estate joint ventures and other limited partnerships are reflected at the carrying amounts at which such assets would have been reflected on

the Company’s balance sheet had the Company consolidated the VIE from the date of its initial investment in the entity.

(3) The maximum exposure to loss of the asset-backed securitizations and collateralized debt obligations is equal to the carrying amounts of retained

interests. In addition, the Company provides collateral management services for certain of these structures for which it collects a management fee.

The maximum exposure to loss relating to real estate joint ventures and other limited partnerships is equal to the carrying amounts plus any unfunded

commitments, reduced by amounts guaranteed by other partners.

(4) Real estate joint ventures include partnerships and other ventures, which engage in the acquisition, development, management and disposal of real

estate investments.

(5) Other limited partnerships include partnerships established for the purpose of investing in public and private debt and equity securities, as well as

limited partnerships established for the purpose of investing in low-income housing that qualifies for federal tax credits.

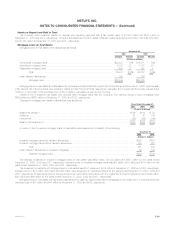

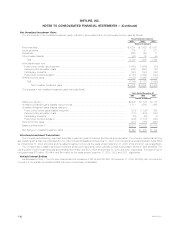

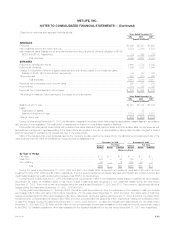

3. Derivative Financial Instruments

The table below provides a summary of notional amount and fair value of derivative financial instruments held at December 31, 2003 and 2002:

2003 2002

Current Market Current Market

or Fair Value or Fair Value

Notional Notional

Amount Assets Liabilities Amount Assets Liabilities

(Dollars in millions)

Financial futures ****************************************************** $ 1,348 $ 8 $ 30 $ 4 $ — $ —

Interest rate swaps **************************************************** 9,944 189 36 3,866 196 126

Floors *************************************************************** 325 5 — 325 9 —

Caps *************************************************************** 9,345 29 — 8,040 — —

Financial forwards ***************************************************** 1,310 2 3 1,945 — 12

Foreign currency swaps************************************************ 4,710 9 796 2,371 92 181

Options ************************************************************* 6,065 7 — 6,472 9 —

Foreign currency forwards ********************************************** 695 5 32 54 — 1

Credit default swaps ************************************************** 615 2 1 376 2 —

Total contractual commitments ************************************** $34,357 $256 $898 $23,453 $308 $320

MetLife, Inc. F-23