MetLife 2003 Annual Report Download - page 18

Download and view the complete annual report

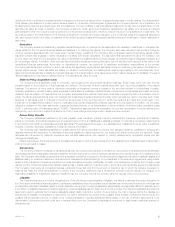

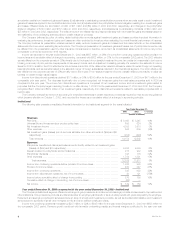

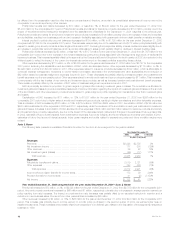

Please find page 18 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Policyholder benefits and claims increased by $1,069 million, or 6%, to $19,523 million for the year ended December 31, 2002 from $18,454 million

for the comparable 2001 period. This variance is attributable to increases in the International, Institutional and Reinsurance segments, partially offset by a

decrease in the Auto & Home segment. A $699 million increase in International is primarily due to the acquisition of Hidalgo, the acquisitions in Chile and

Brazil, the aforementioned sale of an annuity contract, the restructuring of a Canadian pension contract and business growth in South Korea, Mexico

(excluding Hidalgo) and Taiwan. An increase in Institutional of $415 million is commensurate with the growth in premiums as discussed above, largely

offset by the establishment of a liability in 2001 related to the September 11, 2001 tragedies and the 2001 fourth quarter business realignment initiatives.

An increase in Reinsurance of $70 million is commensurate with the growth in premiums discussed above. These increases were partially offset by a

decrease of $102 million in the Auto & Home segment. The variance in Auto & Home is largely due to improved claim frequency resulting from milder

winter weather, lower catastrophe levels and fewer personal umbrella claims, partially offset by an increase in current year bodily injury and no-fault

severities and costs associated with the processing of the New York assigned risk business.

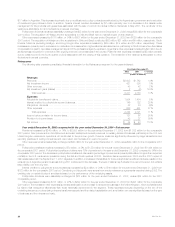

Interest credited to policyholder account balances decreased by $134 million, or 4%, to $2,950 million for the year ended December 31, 2002 from

$3,084 million for the comparable 2001 period. This variance is attributable to decreases in the Individual and Institutional segments, partially offset by

increases in the International and Reinsurance segments. A $105 million decrease in Individual is primarily due to the establishment in 2001 of a

policyholder liability with respect to certain group annuity contracts at New England Financial. Excluding this policyholder liability, interest credited expense

increased slightly in response to an increase in policyholder account balances, which is primarily attributable to sales growth despite declines in interest

crediting rates. An $81 million decrease in Institutional is primarily due to a decline in average crediting rates resulting from the current interest rate

environment. These variances are partially offset by a net increase of $28 million in International. This increase is principally due to the acquisition of

Hidalgo, partially offset by a reduction in the number of investment-type policies in-force in Argentina. In addition, a $24 million increase in Reinsurance is

primarily due to several new annuity reinsurance agreements executed during 2002.

Policyholder dividends decreased by $144 million, or 7%, to $1,942 million for the year ended December 31, 2002 from $2,086 million for the

comparable 2001 period. This variance is attributable to a decrease in the Institutional segment resulting from unfavorable mortality experience of several

large group clients. Institutional policyholder dividends vary from period to period based on participating contract experience, which is recorded in

policyholder benefits and claims.

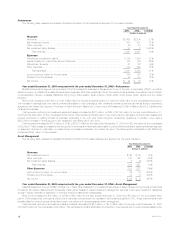

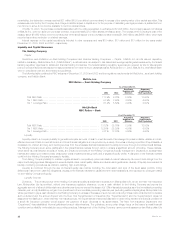

Other expenses decreased by $7 million, or less than 1%, to $7,015 million for the year ended December 31, 2002 from $7,022 million for the

comparable 2001 period. Excluding the capitalization and amortization of DAC, which are discussed below, other expenses increased by $68 million, or

1%, to $7,716 million in 2002 from $7,648 million in 2001. Excluding the capitalization and amortization of DAC and the change in accounting as

prescribed by Statement of Financial Accounting Standards (‘‘SFAS’’) No. 142, Goodwill and Other Intangible Assets, (‘‘SFAS 142’’), which eliminates the

amortization of goodwill and certain other intangibles, other expenses increased by $115 million. This variance is primarily attributable to increases in the

Reinsurance and International segments, as well as in Corporate & Other, partially offset by decreases in the Institutional, Individual and Asset

Management segments. A $209 million increase in Reinsurance is primarily attributable to increases in allowances paid, primarily driven by high-

allowance business in the United Kingdom along with strong growth in the U.S. and Asia/Pacific regions. An increase of $166 million in International

expenses is primarily due to the acquisition of Hidalgo, the acquisitions in Chile and Brazil, as well as business growth in South Korea, Mexico (excluding

Hidalgo), and Hong Kong. An increase in Corporate & Other of $65 million is primarily due to increases in legal and interest expenses. The 2002 period

includes a $266 million charge to increase the Company’s asbestos-related liability, expenses to cover costs associated with the resolution of federal

government investigations of General American’s former Medicare business and a reduction of a previously established liability related to the Company’s

sales practices class action settlement. The 2001 period includes a $250 million charge recorded in the fourth quarter of 2001 to cover costs associated

with the resolution of class action lawsuits and a regulatory inquiry pending against Metropolitan Life involving alleged race-conscious insurance

underwriting practices prior to 1973. The increase in interest expenses is primarily due to increases in long-term debt resulting from the issuance of

$1.25 billion and $1 billion of senior debt in November 2001 and December 2002, respectively, partially offset by a decrease in commercial paper in

2002. In addition, a decrease in the elimination of intersegment activity contributed to the variance. A decrease of $181 million in Institutional is due to

higher expenses resulting from the business realignment initiatives accrual in the fourth quarter 2001 (primarily the Company’s exit from the large market

401(k) business), $30 million of which was released into income in the fourth quarter of 2002. This decrease is partially offset by an increase in 2002

operational expenses for dental and disability and group insurance’s non-deferrable expenses commensurate with the aforementioned premium growth,

as well as higher pension and postretirement benefit expenses. A decrease of $105 million in Individual is due to continued expense management

initiatives, including reduced compensation-related expenses, a decline in business realignment expenses that were incurred in 2001 and reductions in

volume-related commission expenses in the broker/dealer and other subsidiaries. These declines are partially offset by higher pension and postretirement

benefit expenses and an increase in expenses stemming from sales growth in new annuity and investment-type products. In addition, a decrease of

$39 million in Asset Management is primarily due to the sale of Conning in July 2001.

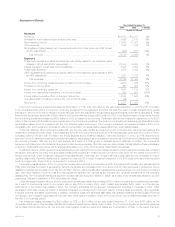

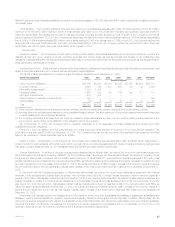

DAC is principally amortized in proportion to gross margins and profits, including investment gains or losses. The amortization is allocated to

investment gains and losses to provide consolidated statement of income information regarding the impact of investment gains and losses on the amount

of the amortization, and other expenses to provide amounts related to gross margins and profits originating from transactions other than investment gains

and losses.

Capitalization of DAC increased by $301 million, or 15%, to $2,340 million for the year ended December 31, 2002 from $2,039 million for the

comparable 2001 period. This variance is primarily due to increases in the Reinsurance, Individual, International and Institutional segments. A $125 million

increase in Reinsurance is commensurate with the increase in allowances paid. A $111 million increase in Individual is due to higher sales of annuity and

investment-type products, resulting in higher commissions and other deferrable expenses. A $51 million increase in International is primarily due to the

2002 acquisition of Hidalgo and overall business growth in South Korea, partially offset by a decrease in Argentina due to the reduction in business

caused by the overall economic environment. A $22 million increase in Institutional is primarily due to growth in sales commissions and fees for disability

products sold by Institutional. Total amortization of DAC increased by $206 million, or 14%, to $1,644 million in 2002 from $1,438 million in 2001.

Amortization of DAC of $1,639 million and $1,413 million are allocated to other expenses in 2002 and 2001, respectively, while the remainder of the

amortization in each period is allocated to investment gains and losses. The increase in amortization allocated to other expenses is attributable to

increases in the Individual, International and Reinsurance segments. An increase of $111 million in Individual is due to the impact of the depressed equity

markets and changes in the estimates of future gross profits. In 2002, estimates of future dividend scales, future maintenance expenses, future rider

margins, and future reinsurance recoveries were revised. In 2001, estimates of future fixed account interest spreads, future gross margins and profits

related to separate accounts and future mortality margins were revised. An increase in International of $64 million is primarily due to loss recognition in

Argentina as a result of the economic environment, primarily the devaluation of its currency. The remaining increase was due to new business in South

MetLife, Inc. 15