MetLife 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

remarketing, the debenture owners received $21 million ($0.03 per diluted common share) in excess of the carrying value of the capital securities. This

excess was recorded by the Company as a charge to additional paid-in capital and, for the purpose of calculating earnings per share, is subtracted from

net income to arrive at net income available to common shareholders.

On May 15, 2003, the purchase contracts associated with the units were settled. In exchange for $1,006 million, the Company issued 2.97 shares

of MetLife, Inc. common stock per purchase contract, or approximately 59.8 million shares of treasury stock. The excess of the Company’s cost of the

treasury stock ($1,662 million) over the contract price of the stock issued to the purchase contract holders ($1,006 million) was $656 million, which was

recorded as a direct reduction to retained earnings.

Interest expense on the capital securities is included in other expenses and was $10 million, $81 million and $81 million for the years ended

December 31, 2003, 2002 and 2001, respectively.

Liquidity and Capital Resources

The Holding Company

Capital

Restrictions and Limitations on Bank Holding Companies and Financial Holding Companies — Capital. MetLife, Inc. and its insured depository

institution subsidiary, MetLife Bank, N.A. (‘‘MetLife Bank’’), a national bank, are subject to risk-based and leverage capital guidelines issued by the federal

banking regulatory agencies for banks and financial holding companies. The federal banking regulatory agencies are required by law to take specific

prompt corrective actions with respect to institutions that do not meet minimum capital standards. At December 31, 2003, MetLife, Inc. and MetLife Bank

were in compliance with the aforementioned guidelines.

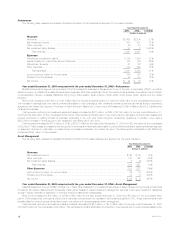

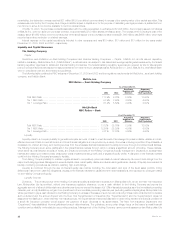

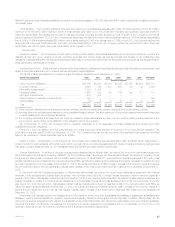

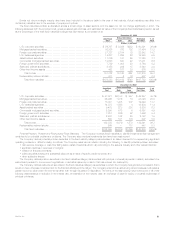

The following table contains the RBC ratios as of December 31, 2003 and 2002 and the regulatory requirements for MetLife Inc., as a bank holding

company, and MetLife Bank:

MetLife, Inc.

RBC Ratios — Bank Holding Company

As of December 31,

Regulatory Regulatory

Requirements Requirements

2003 2002 Minimum ‘‘Well Capitalized’’

Total RBC Ratio ************************************************* 11.19% 9.75% 8.00% 10.00%

Tier 1 RBC Ratio ************************************************ 9.19% 7.93% 4.00% 6.00%

Tier 1 Leverage Ratio ******************************************** 6.12% 5.59% 4.00% 5.00%

MetLife Bank

RBC Ratios — Bank

As of December 31,

Regulatory Regulatory

Requirements Requirements

2003 2002 Minimum ‘‘Well Capitalized’’

Total RBC Ratio ************************************************* 13.12% 25.75% 8.00% 10.00%

Tier 1 RBC Ratio ************************************************ 12.50% 25.39% 4.00% 6.00%

Tier 1 Leverage Ratio ******************************************** 8.81% 18.33% 4.00% 5.00%

Liquidity

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. It is managed to preserve stable, reliable and cost-

effective sources of cash to meet all current and future financial obligations and is provided by a variety of sources, including a portfolio of liquid assets, a

diversified mix of short and long-term funding sources from the wholesale financial markets and the ability to borrow through committed credit facilities.

The Holding Company is an active participant in the global financial markets through which it obtains a significant amount of funding. These markets,

which serve as cost-effective sources of funds, are critical components of the Holding Company’s liquidity management. Decisions to access these

markets are based upon relative costs, prospective views of balance sheet growth, and a targeted liquidity profile. A disruption in the financial markets

could limit the Holding Company’s access to liquidity.

The Holding Company’s ability to maintain regular access to competitively priced wholesale funds is fostered by its current debt ratings from the

major credit rating agencies. Management views its capital ratios, credit quality, stable and diverse earnings streams, diversity of liquidity sources and its

liquidity monitoring procedures as critical to retaining high credit ratings.

Liquidity is monitored through the use of internal liquidity risk metrics, including the composition and level of the liquid asset portfolio, timing

differences in short-term cash flow obligations, access to the financial markets for capital and term-debt transactions, and exposure to contingent draws

on the Holding Company’s liquidity.

Liquidity Sources

Dividends. The primary source of the Holding Company’s liquidity is dividends it receives from Metropolitan Life. Under the New York Insurance

Law, Metropolitan Life is permitted, without prior insurance regulatory clearance, to pay a cash dividend to the Holding Company as long as the

aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its statutory surplus as of the immediately preceding

calendar year; and (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding realized capital gains). Metropolitan Life

will be permitted to pay a cash dividend to the Holding Company in excess of the lesser of such two amounts only if it files notice of its intention to declare

such a dividend and the amount thereof with the New York Superintendent of Insurance (the ‘‘Superintendent’’) and the Superintendent does not

disapprove the distribution. Under the New York Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of

a stock life insurance company would support the payment of such dividends to its stockholders. The New York Insurance Department (the

‘‘Department’’) has established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial

condition and profitability under statutory accounting practices. Management of the Holding Company cannot provide assurance that Metropolitan Life

MetLife, Inc.

22