MetLife 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

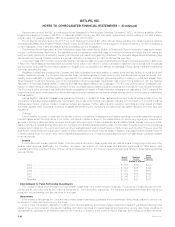

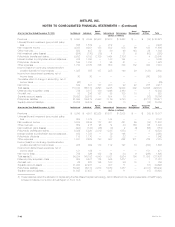

Auto & Asset Corporate

At or for the Year Ended December 31, 2003 Institutional Individual Home International Reinsurance Management & Other Total

(Dollars in millions)

Premiums *********************************** $ 9,093 $ 4,344 $2,908 $1,678 $ 2,668 $ — $ (18) $ 20,673

Universal life and investment-type product policy

fees ************************************** 635 1,589 — 272 — — — 2,496

Net investment income ************************ 4,038 6,201 158 502 473 66 198 11,636

Other revenues******************************* 592 407 32 80 49 143 39 1,342

Net investment gains (losses) ******************* (204) (130) (15) 4 31 9 (53) (358)

Policyholder benefits and claims***************** 9,932 5,183 2,139 1,454 2,136 — 4 20,848

Interest credited to policyholder account balances** 915 1,793 — 143 184 — — 3,035

Policyholder dividends ************************* 198 1,700 1 55 21 — — 1,975

Other expenses ****************************** 1,784 2,880 756 659 740 182 300 7,301

Income (loss) from continuing operations before

provision (benefit) for income taxes ************ 1,325 855 187 225 140 36 (138) 2,630

Income from discontinued operations, net of

income taxes ****************************** 30 30 — — — — 240 300

Cumulative effect of change in accounting, net of

income taxes ****************************** (26) — — — — — — (26)

Net income ********************************** 849 601 157 208 92 22 288 2,217

Total assets********************************** 113,743 165,774 4,698 9,935 12,833 302 19,556 326,841

Deferred policy acquisition costs **************** 739 8,817 180 1,046 2,160 — 1 12,943

Goodwill, net********************************* 59 206 157 85 100 18 3 628

Separate account assets ********************** 35,632 39,619 — 504 13 — (12) 75,756

Policyholder liabilities ************************** 61,599 100,278 2,943 7,179 9,783 — (2,211) 179,571

Separate account liabilities ********************* 35,632 39,619 — 504 13 — (12) 75,756

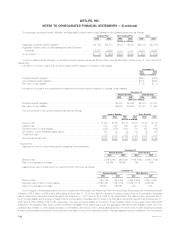

Auto & Asset Corporate

At or for the Year Ended December 31, 2002 Institutional Individual Home International Reinsurance Management & Other Total

(Dollars in millions)

Premiums *********************************** $ 8,245 $ 4,507 $2,828 $1,511 $ 2,005 $ — $ (19) $ 19,077

Universal life and investment-type product policy

fees ************************************** 624 1,379 — 144 — — — 2,147

Net investment income ************************ 3,918 6,244 177 461 421 59 (19) 11,261

Other revenues******************************* 609 418 26 14 43 166 56 1,332

Net investment gains (losses) ******************* (494) (144) (46) (9) 2 (4) (56) (751)

Policyholder benefits and claims***************** 9,339 5,220 2,019 1,388 1,554 — 3 19,523

Interest credited to policyholder account balances** 932 1,793 — 79 146 — — 2,950

Policyholder dividends ************************* 115 1,770 — 35 22 — — 1,942

Other expenses ****************************** 1,531 2,629 793 507 622 211 722 7,015

Income (loss) from continuing operations before

provision (benefit) for income taxes ************ 985 992 173 112 127 10 (763) 1,636

Income from discontinued operations, net of

income taxes ****************************** 121 199 — — — — 151 471

Net income (loss) ***************************** 759 826 132 84 84 6 (286) 1,605

Total assets(1)******************************** 98,234 145,152 4,540 8,301 9,924 190 11,085 277,426

Deferred policy acquisition costs **************** 608 8,521 175 945 1,477 — 1 11,727

Goodwill, net********************************* 62 223 155 193 96 18 3 750

Separate account assets ********************** 31,935 27,457 — 307 11 — (17) 59,693

Policyholder liabilities ************************** 55,497 95,813 2,673 5,883 7,387 — (2,011) 165,242

Separate account liabilities ********************* 31,935 27,457 — 307 11 — (17) 59,693

(1) These balances reflect the allocation of capital using the Risk-Based Capital methodology, which differs from the original presentation of GAAP equity

included in MetLife, Inc.’s 2002 Annual Report on Form 10-K.

MetLife, Inc.

F-46