MetLife 2003 Annual Report Download - page 29

Download and view the complete annual report

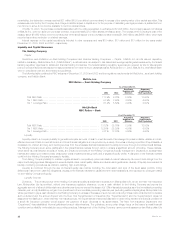

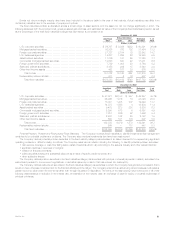

Please find page 29 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.General American has agreed to guarantee the obligations of its subsidiary, Paragon Life Insurance Company, and certain obligations of its former

subsidiaries, MetLife Investors Insurance Company (‘‘MetLife Investors’’), First MetLife Investors Insurance Company and MetLife Investors Insurance

Company of California. In addition, General American has entered into a contingent reinsurance agreement with MetLife Investors. Under this agreement,

in the event that MetLife Investors’ statutory capital and surplus is less than $10 million or total adjusted capital falls below 150% of the company action

level RBC, as defined by state insurance statutes, General American would assume as assumption reinsurance, subject to regulatory approvals and

required consents, all of MetLife Investors’ life insurance policies and annuity contract liabilities. At December 31, 2003, the capital and surplus of MetLife

Investors was in excess of the minimum capital and surplus amount referenced above, and its total adjusted capital was in excess of the most recent

referenced RBC-based amount calculated at December 31, 2003.

Management does not anticipate that these arrangements will place any significant demands upon the Company’s liquidity resources.

Litigation. Various litigation claims and assessments against the Company have arisen in the course of the Company’s business, including, but not

limited to, in connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities

and other federal and state authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable

insurance and other laws and regulations.

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses except with respect to certain matters. In some of the matters, very large and/or indeterminate amounts, including punitive and treble

damages, are sought. Although in light of these considerations, it is possible that an adverse outcome in certain cases could have a material adverse

effect upon the Company’s consolidated financial position, based on information currently known by the Company’s management, in its opinion, the

outcomes of such pending investigations and legal proceedings are not likely to have such an effect. However, given the large and/or indeterminate

amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome in certain matters could,

from time to time, have a material adverse effect on the Company’s consolidated net income or cash flows in particular quarterly or annual periods.

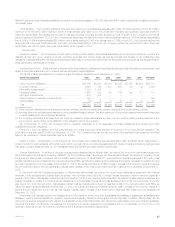

Based on management’s analysis of its expected cash inflows from operating activities, the dividends it receives from subsidiaries, including

Metropolitan Life, that are permitted to be paid without prior insurance regulatory approval and its portfolio of liquid assets and other anticipated cash

flows, management believes there will be sufficient liquidity to enable the Company to make payments on debt, make cash dividend payments on its

common stock, pay all operating expenses and meet its other obligations. The nature of the Company’s diverse product portfolio and customer base

lessen the likelihood that normal operations will result in any significant strain on liquidity.

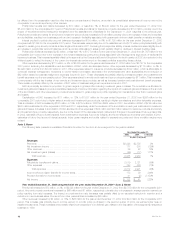

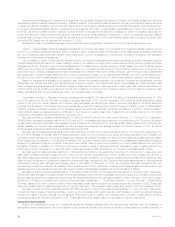

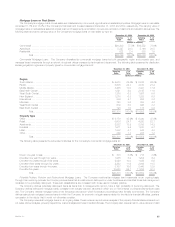

Consolidated cash flows. Net cash provided by operating activities was $7,363 million and $4,168 million for the years ended December 31, 2003

and 2002, respectively. The $3,195 million increase in operating cash flow in 2003 over the comparable 2002 period is primarily attributable to sales

growth in the group life, dental, disability and long-term care businesses, as well as higher sales in retirement and savings’ structured settlement

products. The acquisition of John Hancock’s group business also contributed to sales growth in the 2003 period. In addition, growth in MetLife Bank’s

customer deposits, accelerated prepayments of mortgage-backed securities that have been previously purchased at a premium, and an increase in

funds withheld related to reinsurance activity contributed to the increase in operating cash flows. These items were partially offset by the Company’s

contribution to its qualified defined benefit plans in December 2003.

Net cash provided by operating activities was $4,168 million and $4,258 million for the years ended December 31, 2002 and 2001, respectively.

The $90 million decrease in operating cash flow in 2002 over the 2001 comparable period is primarily due to a contribution by the Company to its defined

benefit pension plans and a decrease in recoverables due from reinsurance in December 2002. This was partially offset by sales growth in the group life,

dental, disability and long-term care businesses, the sale of a significant retirement and savings contract in the second quarter of 2002, as well as

additional sales of structured settlements and traditional annuity products.

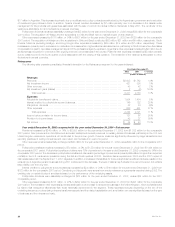

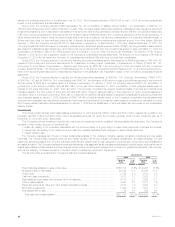

Net cash used in investing activities was $17,688 million and $16,213 million for the years ended December 31, 2003 and 2002, respectively. The

$1,475 million increase in net cash used in investing activities in 2003 over the comparable 2002 period is primarily attributable to an increase in the

purchase of fixed maturities and commercial mortgage loan origination, as well as an increase in the amount of securities lending cash collateral invested,

which resulted from an expansion of the program. In addition, the Company invested income generated from operations and cash raised through the

issuance of guaranteed investment contracts. These items were partially offset by lower income resulting from lower market rates and the June 2002

acquisition of Hidalgo. In addition, the 2003 period had less proceeds from sales of equity securities and real estate to use in investing activities. The

2002 period included proceeds from a significant sale of equity securities and cash generated by the Company’s real estate sales program.

Net cash used in investing activities was $16,213 million and $2,970 million for the years ended December 31, 2002 and 2001, respectively. Net

cash used in investing activities increased $13,243 million in 2002 over the comparable 2001 period, primarily due to an increase in the amount of

securities lending cash collateral invested in connection with the program. In addition, the Company invested income generated from operations, cash

raised through the issuance of guaranteed investment contracts and cash generated by the Company’s real estate sales program in various financial

instruments, including fixed maturities and mortgage loans on real estate. At December 31, 2001, the Company held cash equivalents that were

subsequently invested in bonds and U.S. treasury notes in the first quarter of 2002. Additionally, certain contractholders transferred investments from the

separate account to the general account. Net cash used in investing activities also increased due to the acquisition of Hidalgo.

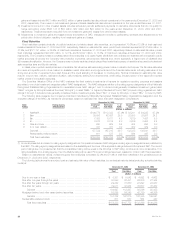

Net cash provided by financing activities was $11,735 million and $6,895 million for the years ended December 31, 2003 and 2002, respectively.

The $4,840 million increase in net cash provided by financing activities in 2003 over the comparable 2002 period is due to an increase in policyholder

account balances primarily from sales of annuity products, as well as additional short-term debt issued related to dollar roll activity. In 2003, the Company

received $1,006 million on the settlement of common stock purchase contracts (see ‘‘— The Holding Company — Liquidity Sources — Global Funding

Sources’’), issued $700 million of senior notes and had a decrease in cash used in the stock repurchase program as compared to 2002. These cash

flows were partially offset by additional repayments of long-term debt and a 10% increase in cash dividends per share in 2003 as compared to 2002.

Net cash provided by financing activities was $6,895 million and $2,751 million for the years ended December 31, 2002 and 2001, respectively.

The $4,144 million increase in financing activities in 2002 over the comparable 2001 period was due to an increase in policyholder account balances

primarily from sales of annuity products and the issuance of short-term debt. In addition, the Company had a decrease in cash used in the stock

repurchase program for 2002 as compared to 2001. These cash flows were partially offset by a decrease in long-term debt issued.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or

MetLife, Inc.

26