MetLife 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Interest expense on these instruments is included in other expenses and was $11 million for each of the years ended December 31, 2003, 2002 and

2001.

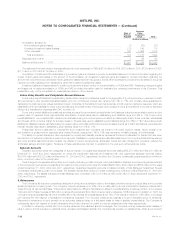

RGA Capital Trust I. In December 2001, a majority-owned subsidiary of the Company, Reinsurance Group of America Incorporated (‘‘RGA’’),

through its wholly-owned trust, RGA Capital Trust I (the ‘‘Trust’’), issued 4,500,000 Preferred Income Equity Redeemable Securities (‘‘PIERS’’) Units. Each

PIERS unit consists of (i) a preferred security issued by the Trust, having a stated liquidation amount of $50 per unit, representing an undivided beneficial

ownership interest in the assets of the Trust, which consist solely of junior subordinated debentures issued by RGA which have a principal amount at

maturity of $50 and a stated maturity of March 18, 2051, and (ii) a warrant to purchase, at any time prior to December 15, 2050, 1.2508 shares of RGA

stock at an exercise price of $50. The fair market value of the warrant on the issuance date was $14.87 and is detachable from the preferred security.

RGA fully and unconditionally guarantees, on a subordinated basis, the obligations of the Trust under the preferred securities. The preferred securities and

subordinated debentures were issued at a discount (original issue discount) to the face or liquidation value of $14.87 per security. The securities will

accrete to their $50 face/liquidation value over the life of the security on a level yield basis. The weighted average effective interest rate on the preferred

securities and the subordinated debentures is 8.25% per annum. Capital securities outstanding were $158 million, net of unamortized discount of

$67 million, at both December 31, 2003 and 2002.

9. September 11, 2001 Tragedies

On September 11, 2001, terrorist attacks occurred in New York, Washington, D.C. and Pennsylvania (the ‘‘tragedies’’) triggering a significant loss of

life and property, which had an adverse impact on certain of the Company’s businesses. The Company’s original estimate of the total insurance losses

related to the tragedies, which was recorded in the third quarter of 2001, was $208 million, net of income taxes of $117 million. As of December 31,

2003 and 2002, the Company’s remaining liability for unpaid and future claims associated with the tragedies was $9 million and $47 million, respectively,

principally related to disability coverages. This estimate has been and will continue to be subject to revision in subsequent periods, as claims are received

from insureds and processed. Any revision to the estimate of losses in subsequent periods will affect net income in such periods.

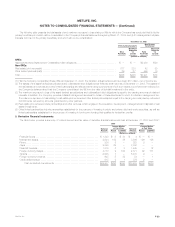

10. Business Realignment Initiatives

During the fourth quarter of 2001, the Company implemented several business realignment initiatives, which resulted from a strategic review of

operations and an ongoing commitment to reduce expenses. The impact of these actions on a segment basis were charges of $399 million in

Institutional, $97 million in Individual and $3 million in Auto & Home. The liability at December 31, 2003 and 2002 was $27 million and $40 million, in the

Institutional segment and $9 million and $18 million, in the Individual segment, respectively. The remaining liability is due to certain contractual obligations.

11. Income Taxes

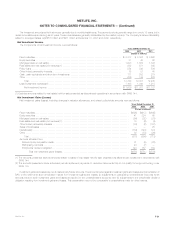

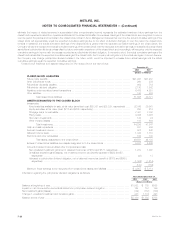

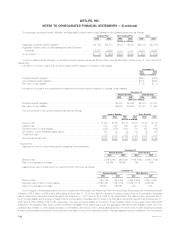

The provision for income taxes for continuing operations was as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Current:

Federal************************************************************************************** $363 $ 803 $ (67)

State and local ******************************************************************************* 22 (17) (4)

Foreign************************************************************************************** 47 31 15

432 817 (56)

Deferred:

Federal************************************************************************************** 240 (332) 247

State and local ******************************************************************************* 27 16 12

Foreign************************************************************************************** (12) 1 1

255 (315) 260

Provision for income taxes************************************************************************ $687 $ 502 $204

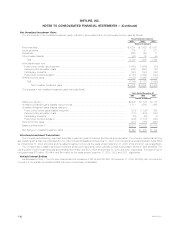

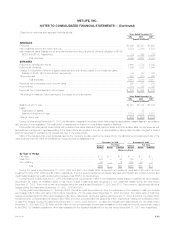

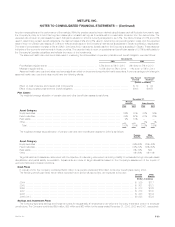

Reconciliations of the income tax provision at the U.S. statutory rate to the provision for income taxes as reported for continuing operations were as

follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Tax provision at U.S. statutory rate*************************************************************** $ 920 $572 $200

Tax effect of:

Tax exempt investment income**************************************************************** (118) (87) (82)

State and local income taxes ***************************************************************** 44 20 6

Foreign operations net of foreign income taxes **************************************************** (81) (1) 4

Prior year taxes***************************************************************************** (26) (7) 38

Sales of businesses************************************************************************* —— 5

Other, net ********************************************************************************* (52) 5 33

Provision for income taxes********************************************************************** $ 687 $502 $204

MetLife, Inc. F-31