MetLife 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

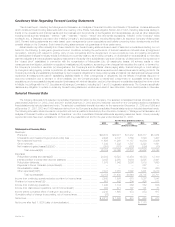

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For purposes of this discussion, the terms ‘‘MetLife’’ or the ‘‘Company’’ refers to MetLife, Inc., a Delaware corporation (the ‘‘Holding Company’’), and

its subsidiaries, including Metropolitan Life Insurance Company (‘‘Metropolitan Life’’). Following this summary is a discussion addressing the consolidated

results of operations and financial condition of the Company for the periods indicated. This discussion should be read in conjunction with the Company’s

consolidated financial statements included elsewhere herein.

Economic Capital

Beginning in 2003, the Company changed its methodology of allocating capital to its business segments from Risk-Based Capital (‘‘RBC’’) to

Economic Capital. Prior to 2003, the Company’s business segments’ allocated equity was primarily based on RBC, an internally developed formula

based on applying a multiple to the National Association of Insurance Commissioners Statutory Risk-Based Capital and included certain adjustments in

accordance with accounting principles generally accepted in the United States of America (‘‘GAAP’’). Economic Capital is an internally developed risk

capital model, the purpose of which is to measure the risk in the business and to provide a basis upon which capital is deployed. The Economic Capital

model accounts for the unique and specific nature of the risks inherent in MetLife’s businesses. This is in contrast to the standardized regulatory RBC

formula, which is not as refined in its risk calculations with respect to the nuances of the Company’s businesses.

The change in methodology is being applied prospectively. This change has and will continue to impact the level of net investment income and net

income of each of the Company’s business segments. A portion of net investment income is credited to the segments based on the level of allocated

equity. This change in methodology of allocating equity does not impact the Company’s consolidated net investment income or net income.

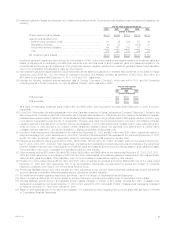

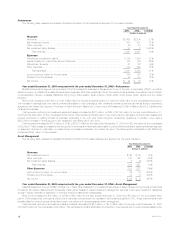

The following table presents actual and pro forma net investment income with respect to the Company’s segments for the years ended

December 31, 2002 and 2001. The amounts shown as pro forma reflect net investment income that would have been reported in these years had the

Company allocated capital based on Economic Capital rather than on the basis of RBC.

Net Investment Income

For the Years Ended December 31,

2002 2001

Actual Pro forma Actual Pro forma

(Dollars in millions)

Institutional************************************************************* $ 3,918 $ 3,980 $ 3,967 $ 4,040

Individual ************************************************************** 6,244 6,155 6,165 6,078

Auto & Home ********************************************************** 177 160 200 184

International ************************************************************ 461 424 267 251

Reinsurance *********************************************************** 421 382 390 354

Asset Management ***************************************************** 59 71 71 89

Corporate & Other ****************************************************** (19) 89 127 191

Total ************************************************************** $11,261 $11,261 $11,187 $11,187

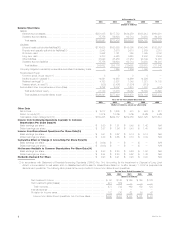

Acquisitions and Dispositions

In September 2003, a subsidiary of the Company, Reinsurance Group of America, Incorporated (‘‘RGA’’), announced a coinsurance agreement

under which it assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of North America. The transaction closed during

the fourth quarter of 2003 with an effective date retroactive to July 1, 2003. The transaction added approximately $278 billion of life reinsurance in-force,

$246 million of premium and $11 million of income before income tax expense, excluding minority interest expense, to the fourth quarter of 2003.

In June 2002, the Company acquired Aseguradora Hidalgo S.A. (‘‘Hidalgo’’), an insurance company based in Mexico with approximately $2.5 billion

in assets as of the date of acquisition. The Company’s existing Mexico subsidiary and Hidalgo now operate as a combined entity under the name MetLife

Mexico.

In November 2001, the Company acquired Compania de Seguros de Vida Santander S.A. and Compania de Reaseguros de Vida Soince Re S.A.,

wholly-owned subsidiaries of Santander Central Hispano in Chile. These acquisitions marked MetLife’s entrance into the Chilean insurance market.

In July 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica Financial

Corporation (‘‘GenAmerica’’) in 2000. Conning specialized in asset management for insurance company investment portfolios and investment research.

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies and make estimates and

assumptions that affect amounts reported in the consolidated financial statements. The critical accounting policies, estimates and related judgments

underlying the Company’s consolidated financial statements are summarized below. In applying these policies, management makes subjective and

complex judgments that frequently require estimates about matters that are inherently uncertain. Many of these policies, estimates and related judgments

are common in the insurance and financial services industries; others are specific to the Company’s businesses and operations.

Investments

The Company’s principal investments are in fixed maturities, mortgage loans and real estate, all of which are exposed to three primary sources of

investment risk: credit, interest rate and market valuation. The financial statement risks are those associated with the recognition of impairments and

income, as well as the determination of fair values. The assessment of whether impairments have occurred is based on management’s case-by-case

evaluation of the underlying reasons for the decline in fair value. Management considers a wide range of factors about the security issuer and uses its

best judgment in evaluating the cause of the decline in the estimated fair value of the security and in assessing the prospects for near-term recovery.

Inherent in management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its future earnings potential.

Considerations used by the Company in the impairment evaluation process include, but are not limited to: (i) the length of time and the extent to which the

market value has been below cost; (ii) the potential for impairments of securities when the issuer is experiencing significant financial difficulties; (iii) the

potential for impairments in an entire industry sector or sub-sector; (iv) the potential for impairments in certain economically depressed geographic

locations; (v) the potential for impairments of securities where the issuer, series of issuers or industry has suffered a catastrophic type of loss or has

exhausted natural resources; (vi) unfavorable changes in forecasted cash flows on asset-backed securities; and (vii) other subjective factors, including

concentrations and information obtained from regulators and rating agencies. In addition, the earnings on certain investments are dependent upon market

MetLife, Inc.

4